Advantages Of Registering A Dutch Company

When it comes to establishing Dutch businesses, the Netherlands is regarded as one of the top locations. The advantages of registering a company in the Netherlands are numerous for an entrepreneur. One of the world’s most technologically advanced and innovative economies is that of the Netherlands. The Netherlands provides a strong corporate environment, a highly skilled workforce, and a top-notch infrastructure, including the biggest port in Europe.

In recent years, many entrepreneurs and investors have chosen to establish their corporations in the Netherlands due to the various advantages of registering a dutch company there.

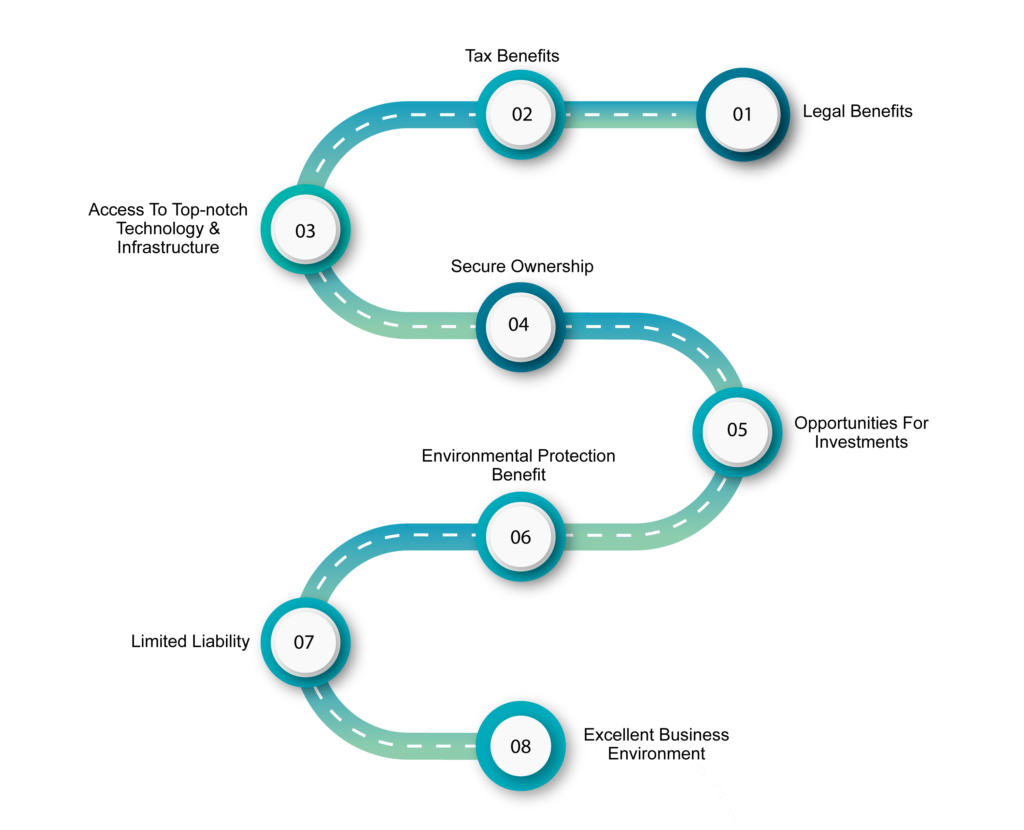

Advantages Of Registering A Dutch Company

The various advantages of registering a dutch company are as follows:

Legal Benefits

- One of the most important advantages of registering a Dutch company is the Netherlands’ legal benefits. There are numerous legal advantages to registering a company in the Netherlands. One of the advantages of registering a company in the Netherlands is the absence of anti-discrimination employment regulations.

- The Netherlands also has minimum pay rules and flexible working schedules. Additionally, small enterprises with fewer than five workers are exempt from the requirement to make social security contributions.

- The judicial system is one of the important advantages of registering a company in the Netherlands. The system includes several checks and balances, which makes the judicial system incredibly dependable, expert, and adaptable as well.

- Due to its stable governance and legal system, as well as its strong international ties, the Netherlands draws foreign businesses from all industries.

- Tax Benefits

Tax benefits are one of the most important advantages of registering a Dutch company. The Dutch government has made significant strides in terms of the tax benefits provided, particularly to foreign investors setting up businesses in the Netherlands. The Dutch tax system includes a number of tax incentives to foster invention and entrepreneurial operations, and the nation attracts many entrepreneurs due to its worldwide orientation. They are described as follows:

- Exemptions from taxes– One of the advantages of registering a company in the Netherlands is that the government has made a number of exemptions possible through tax exemptions.

The following exemptions are:

- Dutch companies are not required to pay taxes on dividends they earn under the participation scheme.

- Additionally, capital gains acquired following their sale under the same participation framework are exempt from paying taxes.

- Earnings from foreign subsidiaries are completely free of taxes.

- Dutch corporations established as investment funds may potentially profit from reduced taxes or even no taxes if they meet specific requirements.

- Tax deductions– One of the advantages of registering a Dutch Company is that entrepreneurs who establish corporations in the Netherlands may be eligible for a number of tax deductions that might last for three or five years after the company’s operations began. A few of them are:

- deduction for self-employment taxes

- exemption from paying profits for certain qualified businesses

- the general tax and labor incentives

- startup deduction or exemptions.

- In order to prevent double taxation, the Netherlands has established a vast network of agreements. As a result, businesses can take advantage of lower withholding tax rates on interest, royalties, and dividends distributed to local businesses, as well as the country’s minimal tax on capital gains through shares selling.

- One of the most often used tax-related benefits is the participation exemption. This tax law excludes tax-holding organizations that control at least 5% of a subsidiary in the event of a dividend transfer.

- Access To Top-notch Technology & Infrastructure

- The Netherlands also enjoys a top-notch infrastructure supported by cutting-edge technology and ongoing innovation, which proves to be one of the most important advantages of registering a company in the Netherlands.

- The Netherlands does exceptionally well in areas that are important for transformation readiness, such as infrastructure facilities and telecommunication technologies.

- Due to the port and airport’s direct access to one of Europe’s best rail networks, it provides quick access to major places, including Paris, London, and Brussels.

- The availability of several technological and infrastructure facilities in the nation makes it simple to transfer commodities and services into and out of Europe.

- Secure Ownership

- Due to the Netherlands’ participation in the World Intellectual Property Organization as well as the World Trade Organization’s Treaty on Trade-Related Elements of Intellectual Property Laws, Dutch companies can take advantage of a worldwide framework that safeguards rights to intellectual property.

- The best course of action for an entrepreneur who is looking to invest and safeguard their assets legally is to submit them through a Dutch corporation to Dutch jurisdiction, which recognizes the importance of protecting property rights inside the Netherlands, the EU, and internationally.

- Opportunities For Investments

- Another one of the advantages of registering a Dutch company in the Netherlands is that it serves as a gateway to Europe and the global economy.

- The Netherlands’ advantageous geographical location serves as an ideal point of entry into the European marketplaces with exposure to foreign trade and consumer markets. It takes merely 24 hours to access 95% of Europe’s most profitable marketplaces.

- These circumstances make it advantageous for business owners to start a Dutch company. Additionally, it also expands investment opportunities as more and more foreign investors make investments in the Netherlands due to the favorable scenarios.

- The Netherlands signed the most bilateral investment and double taxation treaties, which puts them in a strong position to conduct business overseas with a high level of assurance and economic gains.

- Environmental Protection Benefit

- There are numerous environmental advantages to registering a Dutch company in the Netherlands, such as waste management.

- A business can deliver its waste to recycling facilities in the Netherlands rather than other nations or landfills if it establishes a local branch there.

- Additionally, this will aid in preventing the damaging effects of landfill gas on the ecosystem.

- Limited Liability

- One of the advantages of registering a company in the Netherlands is limited liability. The shareholders do not personally owe the debts of the corporation.

- The liabilities are constrained to the capital they have invested in the company.

- Excellent Business Environment

- The Netherlands is home to numerous globally renowned multinational corporations because of the country’s extremely steady political and economic business environment.

- The Netherlands is the ideal base for safeguarding business interests and other valuable assets while also maximizing its present tax condition.

- The Dutch economy is quite transparent and focused on the global market since the Dutch government’s primary goal is to completely remove all impediments to the free flow of goods, services, and capital across international borders.

- A large network of tax treaties, specific provisions for extremely competent experts, and frequent clarity ahead of tax law interpretation are only a few factors that support international corporations’ growth in the Netherlands.

Conclusion

The Netherlands has a lot of advantages of registering a Dutch company. The World Economic Forum has named the Netherlands as the fifth-most inventive and competing nation worldwide, while Forbes Magazine has placed it as the third-best nation globally for doing business.

The Netherlands also provides a wealth of tax advantages, a secure business climate, a prime location, and access to world-class infrastructure and technological facilities. These rankings and other variables demonstrate the advantages of registering a company in the Netherlands.

If you wish to register for a Dutch company, you can get in touch with Odint Consultancy. You will be guided throughout the process by our skilled professionals.

FAQ’s

The Netherlands is ranked third best in the world for doing business by Forbes Magazine and the fifth most inventive and competitive nation overall by the World Economic Forum. The Netherlands also offers a multitude of tax benefits, a safe corporate environment, a premium location, and access to cutting-edge technology infrastructure. These rankings and other factors illustrate the reason that an entrepreneur would choose to register their company in the Netherlands.

The advantages of registering a Dutch company are:

- Legal Benefits

- Tax Benefits

- Access To Top-notch Technology & Infrastructure

- Secure Ownership

- Opportunities For Investments

- Ecosystem Protection Benefit

- Limited Liability

- Outstanding Business Environment