Australia Business Registration | 100% Online Incorporation

Are you a foreign investor looking to start a new business or expand your existing company in Australia?

If you are considering company formation in Australia, OnDemand International’s team of experts is here to provide you with complete support at every step of the way.

How Can OnDemand International Assist You?

- Australia Business Number: We can assist you in obtaining your ABN and ACN.

- Local Nominee Director: We can provide you with a local nominee director service.

- Registered Office Address: We offer a registered office address for your business in Australia.

- Document Notarization: Our services include expert assistance with the notarization of your documents.

- Annual Compliances & Taxation Filing: We provide comprehensive support for annual compliance and taxation filing.

We have helped more than 300

entrepreneurs establish their business presence in Australia

Why Register a Company in Australia?

As the world’s 6th-largest nation, Australia stands out as a premier destination for business registration, attracting significant interest from entrepreneurs worldwide.

As such, over 406,000 new enterprises were registered in the Australian market in 2023 alone. But what makes Australia an ideal location for business registration and expansion?

Here are some of the best reasons for registering your business in Australia:

Legal Protection

Setting up a company in Australia provides limited liability protection for the owners, meaning their personal assets are separate from the company’s assets.

Favorable Business Environment

The Australian government has a pro-business stance and has implemented policies to support the growth of companies, such as tax incentives and grants.

Taxation

Australia has a relatively low corporate tax rate and a system of tax incentives and concessions for small businesses.

Access to markets

Australia is a major trading nation with strong ties to Asia, Europe, and North America, making it an attractive location for businesses looking to expand internationally.

Access to the skilled workforce

Australia has a highly educated and skilled workforce, making it an attractive location for businesses in industries such as technology and professional services.

Good quality of life

Australia is known for its high standard of living and quality of life, which can be a factor in attracting and retaining top talent.

Eligibility Criteria for Australia Company Registration

| Process | Requirements |

| Shareholder | Minimum 1 |

| Foreign Director | Minimum 1 |

| Local Company Secretary | Mandatory |

| Local Registered Address | Mandatory (Virtual/Physical) |

To be eligible criteria for company formation in Australia, the company must:

- Director: The company must have a minimum of one director who is an Australian resident.

- Secretary: The firm must have at minimum one firm secretary who can be an Australian resident.

- Share Capital Requirement: There is no minimum share capital requirement for company registration in Australia.

- Registered office: The firm should have a registered office in Australia.

- Business name: The firm should also possess a unique name that is not already registered and does not closely resemble an existing company name.

- Not be disqualified from registering as a company.

- Not have an identical name to an occurring firm.

- Obey any additional rules outlined in the Corporations Act of 2001.

- If you are an entrepreneur looking to start a business in Australia as a foreigner, then you should know that the firm should be enrolled with the Australian Securities and Investments Commission (ASIC).

Our team of industry experts is here to guide you through the entire process and ensure everything is set up correctly.

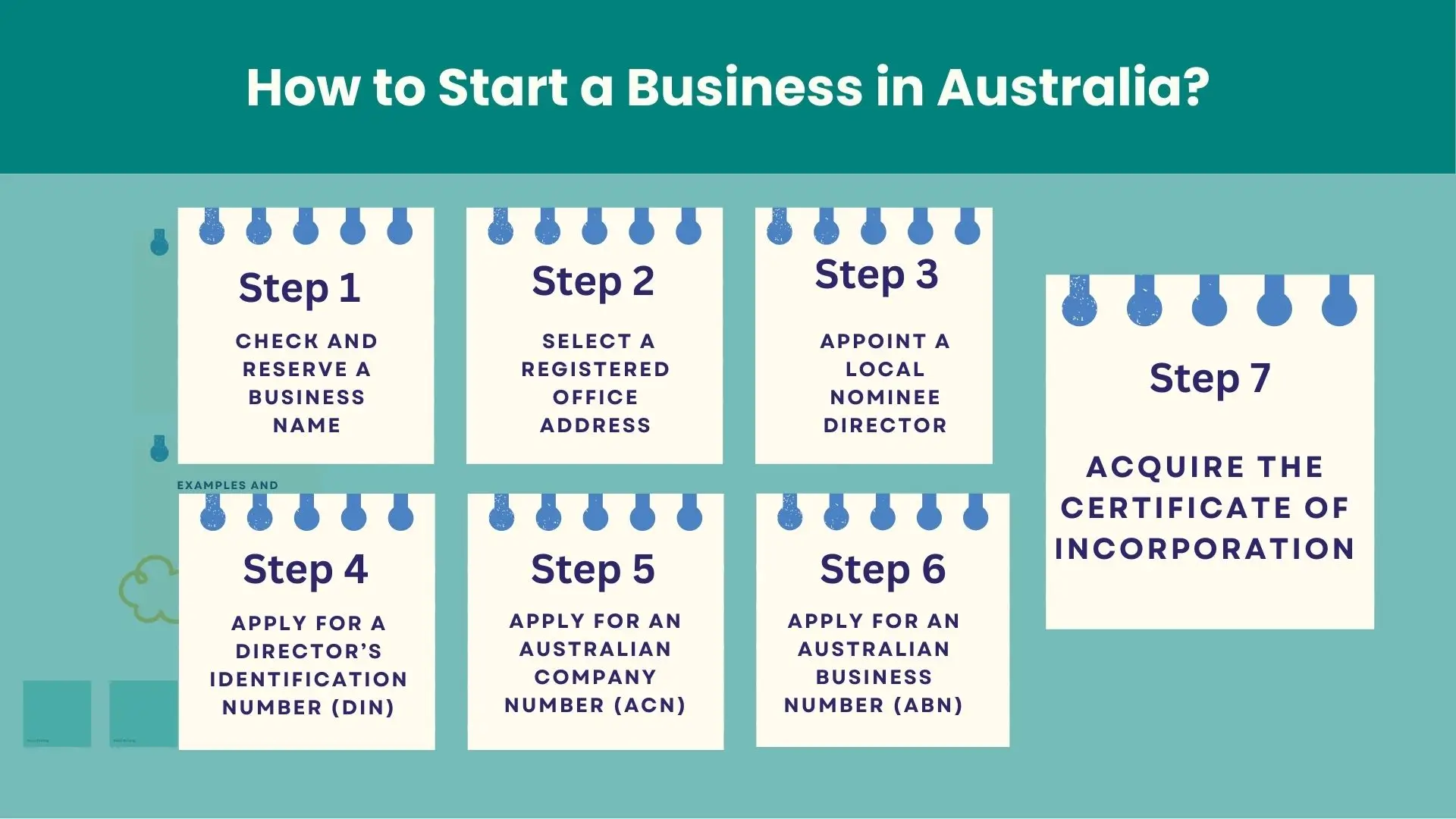

Procedure for Company Registration in Australia

Business registration in Australia typically involves the following steps:

1. Check and Reserve a Business Name

Before proceeding with Australia company formation, you need to select a unique name for your business which ought to be memorable and represent your brand. After choosing the name, conduct a name search to guarantee it is accessible to ensure no one else uses it. Our business experts can assist you with this phase.

2. Select a Registered Office Address

Every Australian company is required to have a registered office address. This is where all legal documents, notices, and government communications would be delivered. It could be a physical office or a virtual office, but it has to be within Australia.

3. Appoint a Local Nominee Director

If you’re a foreign business owner, Australian law requires you to appoint at least one local (Australian) director.

We offer professional local nominee director services in Australia to help you meet Australian business requirements.

4. Apply for a Director’s Identification Number (DIN)

The Australian government requires all company directors to acquire a Director’s Identification Number (DIN). This number helps identify directors and ensures transparency in the business world. It’s a simple process, and you can submit an application for it via the Australian Business Register.

5. Apply for an Australian Company Number (ACN)

The Australian Company Number (ACN) is a unique nine-digit identifier for your company. You’ll need this when registering your company with the Australian Securities and Investments Commission (ASIC). It’s an essential step in forming your company legally in Australia.

6. Apply for an Australian Business Number (ABN)

The Australian Business Number is a unique number that businesses in Australia use for tax and identification purposes. It is essential for conducting business, issuing invoices, and dealing with the Australian Taxation Office (ATO).

Our team of business professionals is here to guide you through the entire ABN application process with ease.

7. Acquire the Certificate of Incorporation

Once everything is in place, you’ll receive a Certificate of Incorporation from ASIC. This official documentation confirms that your firm is legally registered and ready to operate in Australia.

With OnDemand International, you can set up your business in Australia within 2 weeks. So speak with our business professionals to start your business journey in the Australian market today.

Documents Required for Company Registration in Australia

The documents required for Australian company formation vary depending on the type of company being registered and the state or territory in which it will be registered.

Generally, the additional documents that are expected to Starting a business in Australia includes:

- Complete Application Form

- ACN (Australian Company Number)

- Constitution or replaceable rules

- Notarized copies of the passports of the individual shareholders and directors

- Registered office address

- Shareholder details

- Any other relevant documentation as per the state or territory regulations.

Types of Business Entities for Company Registration in Australia

There are various types of entities in Australia that can be established when you think to registering a company in Australia including:

1. Proprietary Limited Company

The system that is nearest to that of a Limited Liability Company is the Proprietary Limited Company (“Pty Ltd”). It’s the most popular corporate structure in Australia and is among the most suitable companies for foreign investors who want to conduct business in the country.

The incorporation of the proprietary company requires at minimum one director who is resident (if you’re not a resident of Australia it is necessary to find a director or find an organization that provides nominee directors).

Pty Ltd companies can be entirely owned by foreign investors and the capital for the first share is as low as $1.

2. Australian Public Companies (ASX)

The public companies of Australia tend to be founded by businessmen who wish to draw capital from a greater number of investors rather than Pty Ltd companies. The management team of these companies is usually independent of the business owners.

This type of entity follows the same incorporation procedure as the one for a Proprietary Limited Company, although you must have at least 3 directors (including two Australian resident directors) to be approved, along with a Company Secretary and Public officer to be tax-efficient.

3. Partnership

The partnerships in Australia are used most often for providing accounting and legal services to clients. Partnerships may be established with general partners that are either liable for the activities of the partnership or only accountable for their own contributions towards the association.

If you want to establish a partnership in Australia it is necessary to have at minimum 1 Australian resident partner. While a partnership doesn’t have to pay tax on the profits it makes, each of its partners must declare their portion of the profits in addition to paying their personal tax.

4. Australian Trust

Another common business structure for small-sized businesses in Australia is the Trust. Family-owned businesses usually utilize discretionary trusts. However, larger companies that have more than one person from the family member tend to utilize the unit (or fixed) trusts.

Trusts are not legal entities, and they do not charge tax on their own provided that all the trust’s earnings are given to its beneficiaries. The beneficiaries then become accountable for their own tax on the profits. Trusts are created by deeds and don’t have to be registered with authorities.

5. Australian Branch Office

To establish the Australian branch as part of an expansion strategy, foreign companies can sign up through ASIC along with the Australian Taxation Office. Branch offices are an option for companies who wish to establish a presence in Australia and would like to consolidate earnings from their home nation.

You’ll need to designate an agent in the local area who will accept notifications on behalf of your business and then create an address within the country. Branch offices are taxed in Australia for their Australian earnings and must annually submit financial reports to ASIC.

6. Representative Office

There’s also an Australian Representative Office and this type of business entity permits the conduct of only non-commercial and limited activities and is a popular option for companies looking to expand their reach internationally or conduct research and analysis prior to getting into the market.

It’s fairly simple and easy to establish a representative office in Australia, but it is more economical to establish the Branch or a different type of business to reduce time on the road.

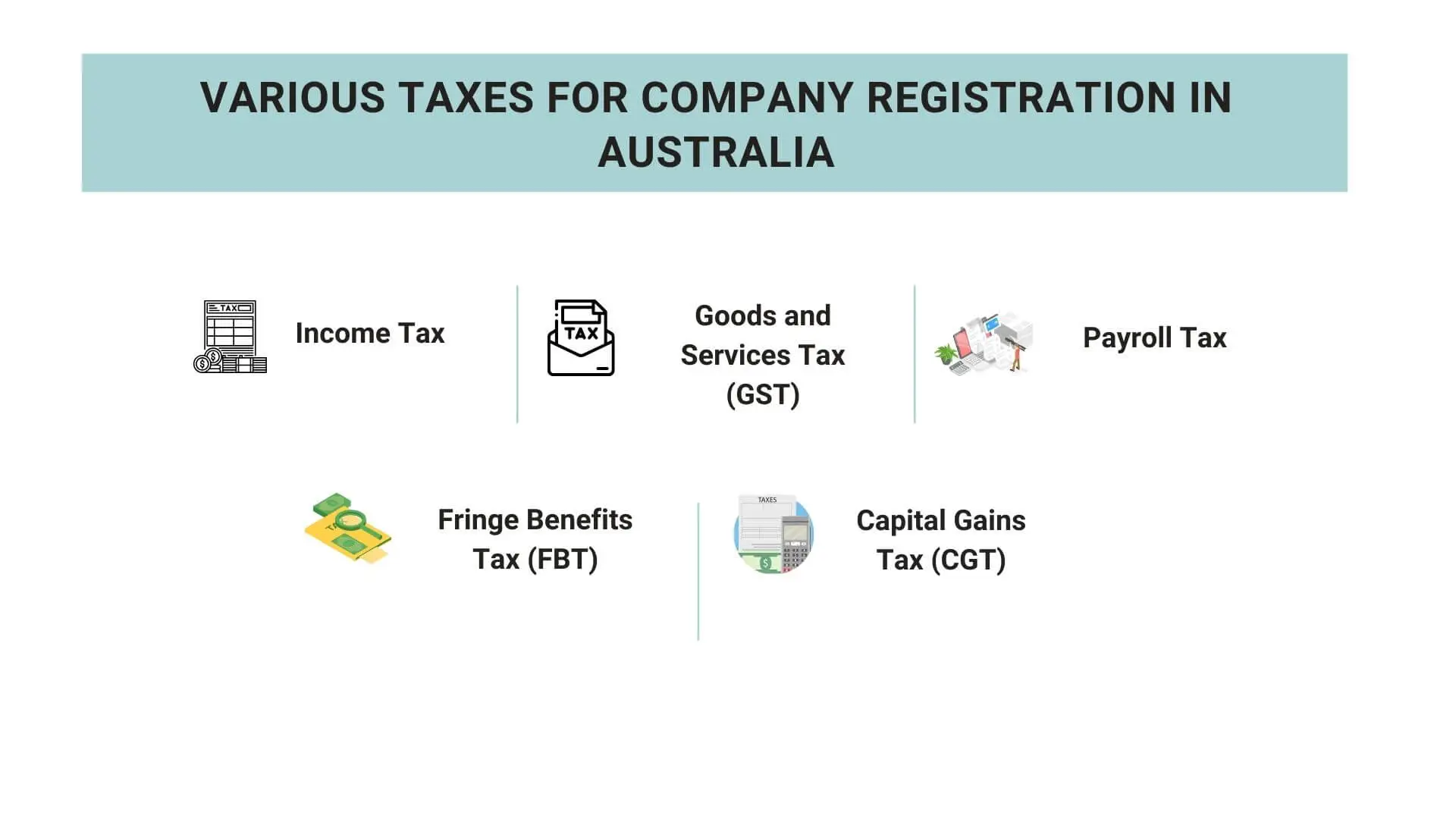

Various Taxes for Company Registration in Australia

When you think to register a company in Australia, there are several taxes that may apply, including:

- Income Tax: All firms are required to pay income tax on their earnings at the corporate tax rate, which is currently 30%, with the exception of “small or medium business” organisations, which are subjected to a lower tax rate of 25%.

- Goods and Services Tax (GST): Companies with a GST turnover of more than $75,000 are required to register for GST in Australia and are charged GST on their sales. GST is a tax that is imposed by the federal govt at a rate of 10% and the proceeds are given to the state govts.

- Payroll Tax: Companies with a payroll above a certain threshold (varies by state) are required to pay payroll tax on their employee’s salaries and wages.

- Fringe Benefits Tax (FBT): Employers may be required to pay FBT on certain non-cash benefits given to workers, such as firm cars or low-interest loans. The FBT is levied at 47%.

- Capital Gains Tax (CGT): Companies may be required to pay CGT on any capital gains made from the sale of assets. It’s important to consult with a tax professional to understand the specific tax obligations of your company.

Cost of Company Formation in Australia

The cost to register a company in Australia can vary relying on the kind of firm and the services used to register it. The Australian Securities and Investments Commission (ASIC) charges a fee for registering a company.

Along with their there are numerous other expenses you need to take into account while considering company registration Australia, such as legal fees for drafting the constitution, or company name search fees, fees associated with acquiring the Australian Business Number, Australian Company Number, virtual office space and numerous other services.

Contact our business formation experts if you wish to register your company in the growing Australian economy.

Advantages of Australia Company Registration

There are several advantages to setting up a company in Australia, including:

- As a distinct formal entity, a firm offers its shareholders limited liability, meaning they are only accountable for the firm’s debts to the importance of their investment.

- Companies in Australia are eligible for a range of tax concessions, including a lower corporate tax rate and access to tax offsets.

- Having a registered company can enhance the credibility of a business, making it more attractive to customers, suppliers, and investors.

- Companies can be structured in a variety of ways, offering flexibility for different types of business models and ownership structures.

- Registered companies can access capital through equity and debt financing, which can be beneficial for growth and expansion.

- Shares of companies can be bought and sold more easily than ownership in other business structures, which makes transferring ownership of a business more efficient.

Conclusion

Australia is one of the best destinations to do business globally. In the year 2020, Australia ranked 14th among more than 190 nations, according to the Doing Business Report that was conducted by the World Bank Group.

However, there are a number of benefits for foreign companies looking for company registration in Australia, such as access to a large market, a well-developed infrastructure, and a skilled workforce.

If you want to open a company in Australia, then you can get in touch with our business experts from OnDemand International. Our experts will assist you in easily setting up your business and can help you with other related aspects of business registration.

FAQ’s

A non-resident can establish a business in Australia but they can’t start it by themselves.

The most well-known type of business in Australia is one that is a private limited corporation (Pty Limited). The filing as a restricted business is that if the business is insolvent the shareholders’ sole liability is the value of their shares in the company.

The registration form for companies typically takes about 15 minutes to fill out. Once completed, the company is usually registered in a matter of 1-2 minutes. The only exception to this is the case where ASIC requires a manual review of the name of your business.

To qualify for an Australian business visa, you have to make your expression of Interest (EOI) through SkillSelect and be then invited to accept an application.

The cost for registering companies is between $443 to $538 according to the type of business that you want to register. Find the most current list of fees for companies on the external website on the ASIC website.