Introduction

Singapore is located in Asia and is one of the world’s fastest-growing economies, making it an ideal hub for enterprises wishing to expand their operations in Asia.

Ranked second on the Ease of Doing Business index, Singapore offers an unparalleled environment for entrepreneurs seeking to expand in Asia, combining profitability with simplicity in company registration.

What sets Singapore apart is its pro-business climate, supported by competitive corporate tax rates, efficient incorporation processes, and an extensive network of double taxation agreements. Entrepreneurs benefit from a stable economy, transparent regulations, and a flourishing ecosystem that helps both new and existing companies.

Through this article, we will cover the procedure for Singapore company formation. Furthermore, we will discuss eligibility, taxation structure, and the advantages of company incorporation in Singapore.

Why register a company in Singapore?

Here are some of the reasons that you should consider company registration in Singapore:

1. Strong and Stable Economy

Singapore boasts a high-income economy with a reputation for macroeconomic stability, making it an ideal launchpad for startups and global businesses.

2. Attractive Taxation Scheme

Corporate income tax is capped at 17%, with new startups enjoying exemptions. No capital gains tax applies.

3. Double Taxation Avoidance Agreements (DTAAs)

Singapore has signed DTAAs with over 50 countries, eliminating the burden of double taxation on cross-border transactions.

Read More: Singapore Double Taxation Avoidance Agreement

4. Easy Incorporation Process

With professional assistance, the entire company registration process can be completed digitally in as little as 7-15 working days.

5. Supportive Startup Ecosystem

Numerous government grants, tax incentives, and business-friendly regulations are available to encourage innovation and growth.

6. World-Class Infrastructure

Advanced transportation, internet, and digital services make Singapore a global trade and innovation hub.

How to Register a Business in Singapore?

Are you planning to start your company in Singapore? Singapore is one of the easiest places in the world to set up and run a business, but you must follow the proper steps to register your company legally and smoothly.

Below is a complete guide on how to register a business in Singapore:

Step 1: Choose and Reserve a Company Name in Singapore

The first step to register a business in Singapore is picking a suitable name. Your company name has to be:

- Unique and not similar to existing companies

- Easy to read and meaningful

- Free from offensive or vulgar words

How to reserve a name?

A minimum of three names must be submitted to verify with the Accounting and Corporate Regulatory Authority (ACRA) if a business name is available. Upon approval and availability, the business name will be reserved for 60 days from the date of application.

Note: If you register through OnDemand International, our team will help you select a compliant name and handle the reservation process for you.

Step 2: Decide on the corporate structure

The next step to incorporate a company in Singapore involves deciding the form of business you wish to incorporate. To register a company in Singapore, you have the option of setting up a Private Limited Company, a Sole proprietorship, or any other form of business.

A private limited company in Singapore is the most commonly used business structure. Our experts can help you register your Pte Ltd company in Singapore within a week.

Step 3: Prepare the necessary documents

The third step for company incorporation in Singapore is to prepare the appropriate papers to establish a company in Singapore, such as articles and memorandum of association, business address information, stockholder information, and so on.

With OnDemand International, we guide you through KYC, collect all required documents, and ensure they comply with ACRA regulations.

Step 4: Proceed with business registration

We will assist you with the procedure for company registration in Singapore by submitting a business registration application to ACRA and uploading the required documentation via the Bizfile+ platform.

We can expedite the business registration process for you. With us, you don’t need to be physically present to incorporate your company. We will help you register your company in Singapore remotely from any part of the world.

Step 5: Acquire a Certificate of Incorporation

We will promptly collect your incorporation documentation, including the company profile and certificate of incorporation after your firm has been registered in Singapore. Afterward, we will deliver the documents to you.

The certificate of incorporation will include the business’s name, establishment date, and an identification number called the Unique Identification Number (UEN).

The business’s profile includes information about the firm, including its name, registration number, formation date, primary business activities, and other details.

Step 6: Obtain licenses and permits

Once the company has been incorporated, it will have to obtain different business licenses and certificates to engage in business activities.

Depending on your business activity, we will apply for various business licenses and permissions after verifying the requirements with the relevant government agencies.

Step 7: Register for GST

Your business has to register for GST in Singapore if your yearly revenues are more than SGD 1 million.

When a firm’s taxable revenue during the previous year exceeded S$1 million or when it anticipated exceeding S$1 million in taxable revenue in the following twelve months, it is mandated to register and collect GST.

On your behalf, we shall submit an application to the Inland Revenue Authority of Singapore (IRAS) for GST registration.

Step 8: Open a business bank account

After the firm has been established, you can establish a business bank account in Singapore. Major local and international banks in Singapore include DBS Bank, OCBC Bank, UOB, HSBC and Standard Chartered.

Note: Many banks allow foreign directors to open remote accounts. With OnDemand International, we shortlist the best bank for your business needs and assist you through the entire process.

Documents Required for Company Registration Singapore

1. Company Constitution- A company’s constitution in Singapore outlines the essential principles by which the corporation would be governed. It establishes the corporation’s goals and describes the rights, obligations, authority, and tasks delegated to the company, its board of directors, and its shareholders.

It contains information like:

- Business name

- An overview of business operations

- About the share capital and issued shares

- Details of the shareholders and directors

- Information about the corporate secretary

- Details of the registered address

2. Memorandum of Association

3. Articles of Association

4. Foreigners are required to produce copies of their passports and documentation of their residential addresses.

5. Completed KYC form (If you are engaging for nominee director service).

6. Bank statement / Bank reference letter

We will compile all necessary documentation and submit it to ACRA on behalf of your company.

Eligibility Criteria for Company Formation in Singapore

| Criteria | Requirements |

| Paid Up Capital | Minimum SGD 1 |

| Shareholder | Minimum 1 |

| Foreign Director | Minimum 1 |

| Local Director | Mandatory |

| Local Company Secretary | Mandatory |

| Local Registered Address | Mandatory (Virtual/Physical) |

| Preferable Type of Company | PTE Limited |

Minimum 1 shareholder

For Singapore company registration, you must have at least one shareholder. A stakeholder can be an individual or another business. A private limited corporation in Singapore can have up to fifty shareholders.

Note: Singapore allows 100% foreign ownership, as such, 100% of the corporation may be owned by a foreign national.

Minimum Paid-up Capital is SGD 1

Minimum paid-up capital of only 1 Singapore Dollar you can incorporate a company in Singapore.

Singapore has at least one director

At least one director who is a Singapore resident, to be entitled to the post of business director, a candidate should be at least 18 years old. A corporate director is in charge of overseeing the business affairs and determining the business’s strategic course.

In the case you do not have a Singaporean director, you can use our service for appointing a nominee director in Singapore.

Singaporean Company Secretary

A Singapore company must appoint a company secretary, who is a Singapore resident. The company secretary ensures compliance with company filings and regulatory obligations.

If you establish your business in Singapore with us, we’ll appoint an experienced company secretary for your company.

Singapore Registered Address

A registered address must be provided for the company in Singapore. It can’t be a PO Box.

When you incorporate your business with us, we’ll designate our address as the registered address for your business.

Auditor

You must choose an auditor within three months of your Singapore company formation, except if the pertinent parts of the Companies Act exclude your business from audit requirements.

Opening A Corporate Bank Account In Singapore

Singapore businesses have a wide range of options for opening corporate bank accounts. The majority of banks in Singapore offer enticing options like international money transfers, online banking, card payments, and trade finance.

Before selecting a business bank for your Singapore company, there are a number of things to take into consideration, including service charges, interest rates, accessibility to customer service, data security, the efficiency and scope of financial support, and a number of other things.

All banking organizations in Singapore are governed centrally by the Monetary Authority of Singapore (MAS), which is Singapore’s central bank.

With your Singapore company, you can receive & send hassle-free payments globally.

Registering a business with us will make it easier for you to open a bank account as we will complete the whole process electronically.

Additionally, you won’t need to travel to Singapore to open a bank account, which will save you time.

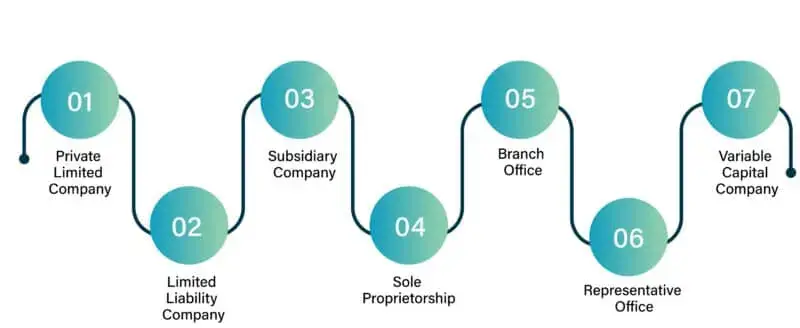

Types of Business Entities for Company Registration in Singapore

Here are the various kinds of businesses available for Singapore company incorporation:

1. Private Limited Company

ThePrivate Limited Company in Singapore is an option in which up to 50 investors can participate. It offers both tax deductions and incentives, making it the most popular alternative.

The majority of businesses incorporate as private limited companies for the following reasons:

- A private limited corporation has a distinct legal identity from its stockholders and directors, enabling it to sign contracts and file and respond to lawsuits under its name.

- By selling shares, it is simple to change ownership of the business.

2. Limited Liability Company

The Limited Liability Company is a flexible choice for business owners who want to create a partnership but retain their legal identities distinctly.

Advantages of a limited liability company:

- Provides limited liability.

- A limited liability company is regarded as a separate legal entity.

Disadvantages of a limited liability company:

- The biggest disadvantage of an LLC is the substantial amount of compliance obligations.

3. Subsidiary Company

A subsidiary company is a parent corporation associate that has its own legal entity. The subsidiary is overseen by its board of directors. A subsidiary’s operations may be comparable or distinct from those of its parent firm. It must include at least one Singaporean local representative.

Advantages of a subsidiary company:

- Because the subsidiary is a distinct legal entity, the parent company is shielded from its obligations.

- An overseas business may own all of the stock in the subsidiary.

4. Sole Proprietorship

A sole proprietorship is a type of business that is managed by just one person. In this case, there is only one owner, and the business is not a distinct legal entity. All debts and obligations associated with the business are the responsibility of the proprietor alone.

Advantages of a Sole Proprietorship:

- Easy and quick to set up.

- The sole proprietor will receive all of the company’s profits.

Disadvantages of a Sole Proprietorship:

- A sole proprietor has unlimited liability.

- A sole proprietorship doesn’t have a perpetual existence

5. Branch Office

Foreign companies can open a branch office in Singapore and be non-residents. The branch office is an extension of the parent company and is not a separate entity. A branch office must have a minimum of one Singaporean local representative.

Advantages of a Branch Office:

- The branch office’s operations are entirely under the authority of the foreign corporation.

- Singapore provides a range of tax benefits for branch offices.

Disadvantages of a Branch Office:

- The branch office’s obligations are shared by the parent firm because it is not a separate legal entity.

- A branch office is only permitted to conduct the same kind of operations as an overseas corporation.

6. Representative Office

A representative office can be formed for a maximum of three years, making it an endless organization. Foreign enterprises are only permitted to study the Singapore market in this fashion; they are not permitted to offer products or services for profit.

Advantages of Representative Office:

- Compared to other forms of legal organization, a representative office has affordable operational expenses.

- A representative office can help a foreign business build its reputation and create its presence in Singapore.

Disadvantages of Representative Office:

- A representative office is not allowed to carry on operations, sign agreements, transport goods, provide services

- An RO is only intended to be used for promotional purposes or research on markets.

7. Variable Capital Company

The VCC is an exciting financial vehicle that is a great investment for Singapore. The VCC is an anticipated vehicle to register due to its incredible versatility.