Setting Up a Branch Office in Singapore 2022

Foreign firms looking to do business in Singapore usually create a Singapore subsidiary or establish an office branch.

The majority of small and medium-sized businesses decide to establish a subsidiary company in Singapore to benefit from the more flexible and risk-free security that a subsidiary structure gives over branches.

So, before deciding to establish branches it is important to consider whether it is the appropriate arrangement for your business needs. However, this article will display all the essential information for setting up a branch office in Singapore.

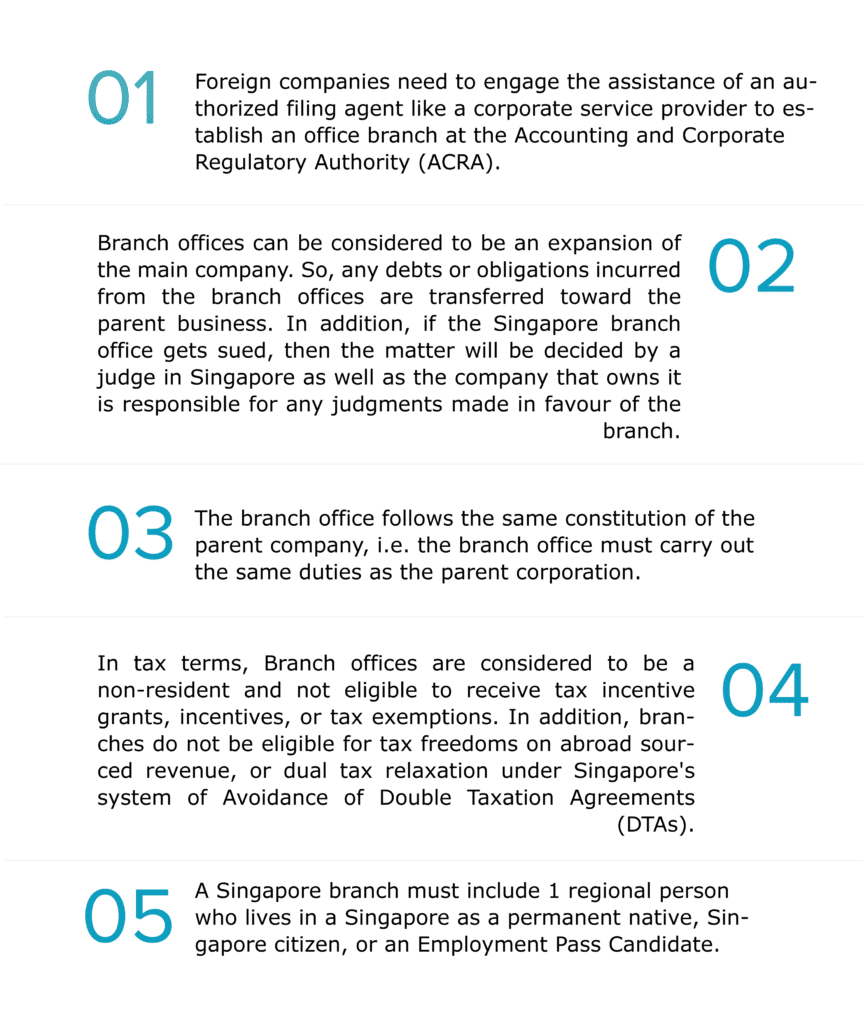

Key Facts Branch Office in Singapore

Down below, we have mentioned the key factor for the setting up of a branch office in Singapore.

- Foreign companies need to engage the assistance of an authorized filing agent like a corporate service provider to establish an office branch at the Accounting and Corporate Regulatory Authority (ACRA).

- Branch offices can be considered to be an expansion of the main company. So, any debts or obligations incurred from the branch offices are transferred toward the parent business. In addition, if the Singapore branch office gets sued, then the matter will be decided by a judge in Singapore as well as the company that owns it is responsible for any judgments made in favor of the branch.

- The branch office follows the same constitution of the parent company, i.e. the branch office must carry out the same duties as the parent corporation.

- In tax terms, Branch offices are considered to be a non-resident and not eligible to receive tax incentive grants, incentives, or tax exemptions. In addition, branches do not be eligible for tax freedoms on abroad sourced revenue, or dual tax relaxation under Singapore’s system of Avoidance of Double Taxation Agreements (DTAs).

- A Singapore branch must include 1 regional person who lives in Singapore as a permanent native, Singapore citizen, or an Employment Pass Candidate.

Registration essentials for Setting up a Branch Office in Singapore

In order to setting up a branch office in Singapore, foreign firms need to engage the services of an approved filing agent, which is typically a corporate service provider. The following list provides the basic requirements for setting up a branch office in Singapore for registration purposes.

- Local representatives:- Branch offices are expected to possess at minimum 1 regional diplomat who is existing in Singapore. The representative from Singapore must be at minimum 18 years old. They can be either a Singapore citizen or a permanent resident of Singapore or Employment Pass holders.

- Address for registration in Singapore:– A branch office should include an enlisted regional address placed in Singapore. It is important to point out that the location must not be an address that is a PO box.

Documents Required for Setting up a Branch Office in Singapore

The necessary documents will be needed for setting up a branch office in Singapore:

- The name of an associated firm.

- Address of associated firm, which is situated outside of Singapore

- An official copy of the corporate certificate of incorporation for the associated firm.

- The certified version of the firm’s establishment

- A director’s listed of the associated company.

- The specifics of the authorized local representative

- Written consent from a representative of a local Singapore citizen who is to act as the representative local for the branch office

- A notice that contains the following details:

- the number for registration of a foreign company;

- the category of corporation executed by the foreign corporation; and

- how the lawful structure of the overseas corporation

- An image of the audited monetary reports

Registration Procedure for Setting up a Branch Office in Singapore

The registration method is consist of 2 steps: name approval as well as registration of the entity:

- Name Approval:- The branch office must be named the exact as the primary firm. In general, the name will be approved within one hour. It is important to note that the name should not be identical to an existing business located in Singapore.

- Entitle registration:- After all, documents are provided to the file agent, the branch office will get registered at ACRA. When the agent files all the required documents in order the registration process may take just 20 minutes.

Taxation of Branch Office in Singapore

Singapore has tax rates on the earnings of a branch office. If necessary the branch office must also be registered to collect the goods and services taxes (GST).

To be tax-efficient Branch offices are taxed as non-residents. Existing a non-resident branch office is a non-resident. The Singapore branch office is not able to profit from Singapore’s tax incentives, grants, or tax breaks.

Additionally, branches don’t have the right to tax exemption for certain foreign-sourced income, and they are not able to claim double tax relief from Singapore’s extensive system of Avoidance of Double Taxation Agreements (DTAs).

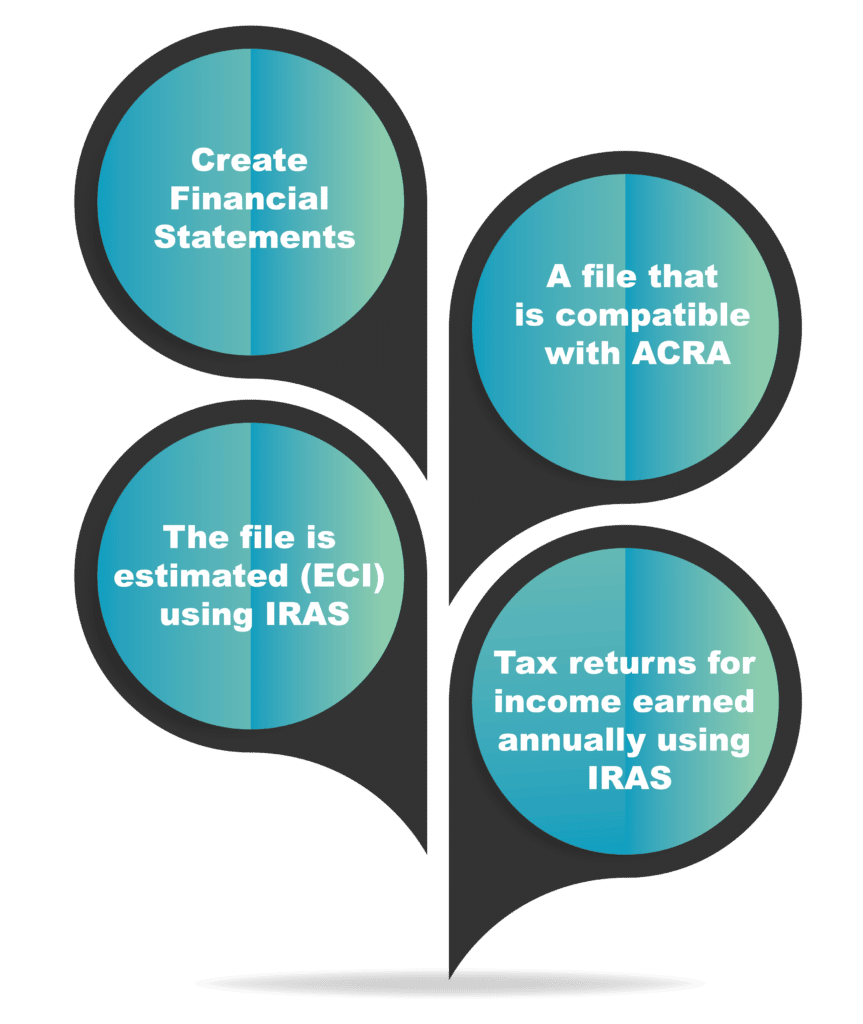

Filing Requirements for Branch office in Singapore

Department offices are expected to meet the laws for filing annually as set by ACRA and the tax authority of Singapore called IRAS. Failure to adhere could result in fines or penalties. The filing requirements for the annual year of the Singapore Branch office are as the following:

- Create Financial Statements:- In accordance with Singapore Firm law branches must create a monetary report using Singapore Financial Reporting Standards (FRS). FRS almost matches International Financial Reporting Standards (IFRS).

- A file that is compatible with ACRA:- Singapore branch offices must submit their financial statements audited for audit to ACRA within 60 calendar days from the annual general meeting.

- The file is estimated (ECI) using IRAS:- Within three months of the financial year’s closing date, A Singapore branch office must report its income and ECI using the IRAS. ECI refers to the amount generated by the branch, fewer items like capital gains or disposals of assets fixed.

- Tax returns for income earned annually using IRAS:- An Singapore branch office must prepare an annual income tax return through the IRAS. Singapore utilizes a previous year’s base to calculate tax.

Taxes are calculated by calculating the earnings of the preceding year. Branch offices must complete income tax filings using IRAS on or before November 30 for filing on paper or before December 15 for filing electronically.

Branch Office vs Subsidiary Company

In order to incorporate into Singapore, foreign firms typically decide for setting up a branch office in Singapore or a subsidiary company.

A branch office in foreign companies is not required to have an office director in the local area or secretary of the company. However, branches have some disadvantages to be considered

- A branch office isn’t an entity legal in its own right, it is merely one of its parent companies. Thus, the obligations and obligations that the office has been passed directly to the parent business.

- Being a non-resident for tax purposes, branch offices are not able to profit from Singapore’s lavish tax incentives grant as well as exemptions.

- A branch office follows the same corporate constitution as the parent company, and consequently is required to perform the same functions as the parent company.

In contrast, a Singapore subsidiary offers greater flexibility and protection against liability from foreign-owned companies who want to establish a presence in Singapore:

- A legal entity distinct from the parent company A Singapore subsidiary’s liabilities and debts doesn’t extend to the parent company in foreign countries.

- Singapore affiliates are tax residents in Singapore and are eligible in Singapore for incentives to pay taxes, tax exemptions, as well as grants that are available in Singapore.

- A Singapore subsidiary is governed by its constitution for the company which gives it the right to engage in other business activities that are not those of the parent company.

Conclusion

Setting up a branch office in Singapore is not difficult since it can be set up in a matter of 1-2 days. The parent firm is accountable for all financial obligations and debts. Foreigners can establish business in Singapore and there are no limitations on the hiring of foreign workers.

If you’re still having a query regarding setting up a branch office in Singapore or any other question, we are ODINT Consultancy. We’re here to assist you at each step of your way.

FAQ’s

A branch office is not able to contract legally The foreign company is the one engaging the contract and thus is responsible for the entire activities in the branches.

A branch is essentially an office located at a different location that acts in the same way as the main office. It is not a distinct legal entity which is why the parent company has the responsibility for the branch office.

This is the name of a corporate entity that is incorporated under the Companies Act of 2013 and can carry out any of the following: making, selling, offering services, etc.

The branch office can be described as an office, which is different than the main office where business operations are carried out. The majority of branch offices are smaller divisions that cover different aspects of the business including marketing, human resources, and accounting.

Singapore tax is levied on the earnings of a branch office. If required, a branch office must also be registered to collect goods and service taxes (GST). To be tax-efficient branch offices are deemed, non-residents.