Double Taxation Avoidance Agreements for Singapore Companies: Meaning, Claiming Tax Relief

If you’re a business owner who earns income from a Singapore incorporated business entity, not paying taxes twice – once in Singapore and once in your home country – should be a big concern for you.

To determine whether you’ll be taxed twice or not depends upon the tax resident status of your company. If your home country has a Double Taxation Avoidance (DTA) arrangement with Singapore, and most countries do, you can avoid being subject to this unfair cost.

This article will tell you everything you need to know about DTAs, whether your company’s country of residence has a DTA with Singapore, the process for availing DTA benefits, and more.

Double Taxation Meaning

- earn profits from trade between 2 countries,

- are employed in a country other than the one of which you are a citizen,

- or earn any other type of income from another country,

Why Do Countries Enter into DTAs?

As you can see, apart from being unfair on the entrepreneur, it could also cost him/her resources that help bring prices down. That is the reason why governments enter into DTAs – to lower business costs and encourage innovation.

- When tax outcomes are fixed, expenses can be predicted and planned for.

- Tax authorities in different countries are better able to demarcate their respective jurisdictions.

- International tax fraud can be dealt with better by fostering cooperation between governments.

- Business owners can claim relief if they’ve been unjustly taxed in one country in a legally valid manner.

What is a DTA?

A DTA or a Double Taxation Avoidance agreement is a treaty between the governments of 2 different countries that establishes the applicability of tax laws on certain types of income that involves transfer of money from one of the agreeing countries to the other.

Such treaties are meant to encourage businesses to trade freely between the 2 countries and encourage investment and innovation.

Tax outgo is a big concern for your operational cash flows and tends to impose legally binding business costs that take away from your global competitiveness.

What is DTA Singapore?

Singapore’s double taxation agreements apply to tax residents of the second country and Singapore.

Only income earned is considered for tax relief under DTA laws and not other duties such as those incurred on goods entering or leaving the country or manufacturing.

DTAs define a Permanent Establishment for tax purposes as an office, a branch, a place where management is exercised, workshops, warehouses, farms & plantations, a site where natural resources are drawn out, construction sites, project sites, or supervisory offices associated with the above.

A Permanent Establishment or PE would also include a place where one person acts on behalf of the business owner to:

- enter into contracts regularly,

- maintain an inventory of items to be delivered,

- or procure goods on order for businesses connected with the second person.

Eligibility for Availing Tax Relief Via Singapore DTAs

Nevertheless, Singapore’s tax treaties are fair and reciprocative. With most countries, you must satisfy the following conditions to be able to avail the benefits of a DTA:

- You’re a professional, specialist, or other individual earning income that arises in Singapore and tax resident in Singapore (present in Singapore or gainfully employed in Singapore.

- You’re a business whose effective place of ‘management and control’ is located within Singapore.

How to Claim the DTA Relief?

- You would need to file a Certificate of Residence if you are an individual earning income from a foreign country in that country.

- You would need to file a Certificate of Residence from Non-Residents to Singapore’s Inland Revenue Authority of Singapore (IRAS)

Incomes covered under Singapore DTAs

Singapore DTAs cover the following incomes

- Income from immovable property

- Business profits

- Shipping and air transport

- Associated enterprises

- Dividends

- Interest

- Royalties and fees for technical services

- Capital gains

- Artistes and sports-persons

- Salary and pension from government service

- Non-governmental pensions and annuities

- Students and trainees

- Teachers and researchers

- Income of government

- Other income

Methods of Relieving Double Taxation in Singapore

1. Tax Credit

A tax credit will be provided for the exotic tax suffered by a taxpayer for any holder’s trained tax committed on the related earnings. The percentage of tax value of owner’s assistance is generally prohibited to the worst of the paid/payable in the different house states.

Tax credit solace is normally pertained to as Double Tax Relief (“DTR”) in Singapore. The lawsuit for DTR should be earned while filing annual revenue tax returns (Form C) and should be exhibited in the corporation’s tax estimation for any holder.

2. Tax Exemption

- The increased corporate fee ratio (headline fee ratio) of the exotic country from which the dividend was earned is at least 15% for any individual.

- The foreign revenue had been subjected to price in the different nations from which they were obtained. The price at which the unfamiliar payment was taxed can be varied from the caption rate for payers.

Tax deductions for any Individual – Section 13(7A) of the Singapore Income Tax Act

Tariff rates for citizens and individuals in Singapore, all uncommon revenue amassed in Singapore will be protected from tax if the Comptroller is comfortable that the tax privilege is useful to the selves.

3. Tax Sparing Credit

Under a DTA, tax credit is generally accessible in the nation of housing only if the earnings have been taxed in the nation of base. Tax sparing prestige is a particular aspect of credit whereby the country of housing concedes to give a credit of the tax which would have been spent in the country of source but was not, i.e., “spared”, under different laws in that nation to facilitate financial improvement.

The tax limiting credit prerequisite is usually found in DTAs between a country which requests tax reasons to persuade foreign investment and a developing country which is money exporting. The value is given by the capital-exporting nation under its ordinances to stimulate investments.

4. Diminished Tax Rate

Under this aspect of relief, income is taxed at a lower rate and is favorable to the following grades of income: interest, earnings, and revenues from global shipping and by air carriers.

5. Relaxation by Deduction

Here, household tax is correlated on the distant earnings after subtracting foreign tax withstood. Singapore does not enable a deduction of foreign income tax. However Singapore reduces your tax outgo. Thereafter, it taxes the percentage of foreign income you earn (i.e. net of foreign tax) in the Singapore region.

6. Unilateral Tax Credit

If you are a Singapore tax citizen obtaining the next foreign revenue from nations which Singapore has yet to assume an Escape of Double Taxation Agreement (DTA), you can get a unilateral tax credit for the foreign prices paid on such income under Section 50A of the Singapore Income Tax Act.

Income originated from any experienced, consultancy and other employment provided in any province outside Singapore;

Dividends; or Profits arisen by an overseas branch of a Singapore resident company.

Singapore gives you a tax credit under Section 50A if you earn foreign sourced royalty from a non-treaty country, provided the royalty is not:

acquired rapidly and indirectly by an individual citizen in Singapore or a permanent organization in Singapore; or is deductible against any Singapore-originated earnings.

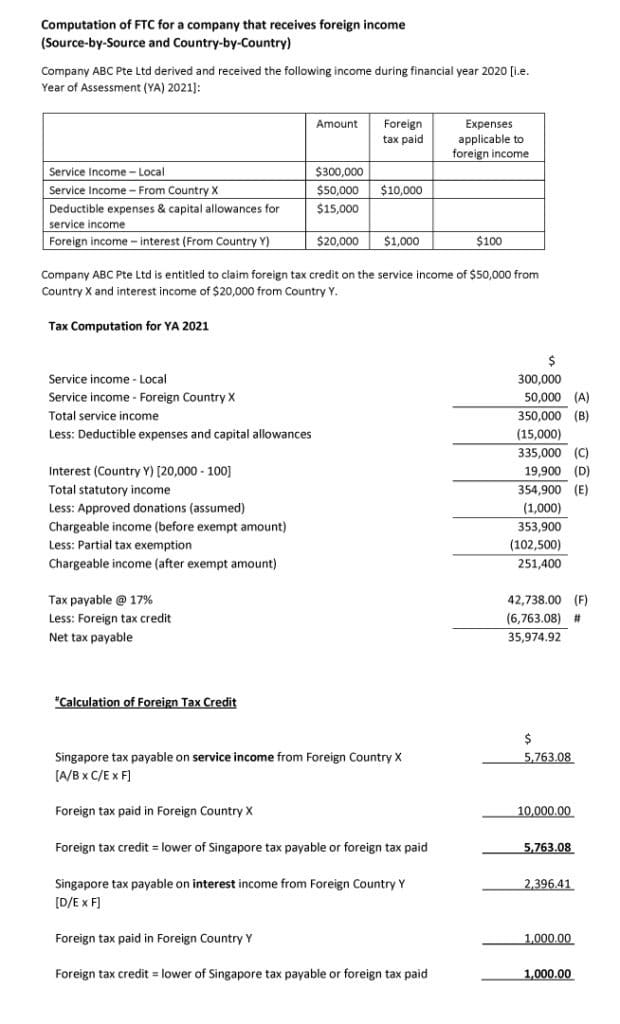

Example of Double Taxation Relief Calculation

Tax Reliefs on Types of Income with Reference to India

1. Business Profits

As per the DTA, the benefits of an enterprise are available just in the state where the business activities are done. If a Singapore-based business has a long-lasting establishment in another country, the benefits owing to the super durable establishment will be taxed uniquely in the other country.

2. Interest, Royalty, and Dividend

The DATA indicates the rates appropriate on account of pay from interest, sovereignties, profit, and dividends, the tax rates in the DATA are lower than the predominant tax rates in the nations that are gatherings to the understanding.

3. Interest

Without the settlement, the retention tax rate in Singapore for any interest paid to non-occupants is 15% while in India the rate goes from 5 – 20% (contingent upon the sort of interest) in addition to overcharge and cess. Under the DTA the tax on interest is as per the following:

- 10% of the gross sum, in case of interest, is paid on the loan which is conceded by a bank continuing financial business or any such monetary organization.

- 15% of the gross sum in any remaining cases.

4. Royalty

Without the settlement, the retention tax rate in Singapore for any sovereignties paid to non-inhabitants is 10% while in India the retention tax rate for any royalty paid to non-occupants is 10% in addition to overcharge and cess. Under the DTA, the tax rate for sovereignties is 10-15% relying upon the sort of royalty paid to non-occupants.

5. Dividends

Preceding April 1, 2020, India didn’t demand any retention tax for dividends. Nonetheless, the organization delivering dividends bears a profit dissemination tax (DDT) of 15% (in addition to overcharge and cess) while delivering the profit to its shareholders. The beneficiary investor is absolved from delivering any tax on profit. Hence, in India, the shareholders today deliver no tax on dividends except for when the organization settles a tax.

From April 1, 2020, India has nullified the DDT and the dividends will be taxed in the beneficiary’s hands. All things considered, India has presented a profit retaining tax. The rate will be 10% for dividends paid to shareholders in India and 20% whenever paid to unfamiliar financial backers (the India-Singapore DTA decreases this rate to 10 or 15% as portrayed beneath).

Read more : Dividend Declarations Explained

In Singapore, profit circulations by an organization are sans tax. Furthermore, the beneficiary investor is likewise excluded from tax on profit pay.

The India-Singapore DTA states that profit pay is taxed in the beneficiary’s condition of the home as follows:

- 10% if the beneficiary organization holds at least 25% of the portions of the organization delivering profit and

- 15% in any remaining cases.

The presentation of the new profit tax system by India sets out exceptional freedom for generous tax reserve funds by making a Singapore organization an investor of an Indian organization. This can be exceptionally useful to both unfamiliar and Indian shareholders. For addition to this, see our blog entry Singapore benefits from India’s new profit tax strategy.

6. Capital Gains

Article 13 of The DTA constrains the nation in which capital gains are responsible for tax payments. Another significant aspect of the India-Singapore DTA is the regulation of the advantages of sentences that were submitted in the policy signed between the governments in 2005.

7. Limitation of Benefits Clause

In 2005, the India-Singapore DTA was changed. The change gives that any capital acquired that emerges on the offer of property or offers are taxable just in the nation where the investors reside. This amendment proves useful to Singapore since the nation doesn’t require any tax on capital increases. For example, if a resident of Singapore sells portions of an Indian organization, it will be excluded from capital increases tax both in India and Singapore. This is an exceptionally huge tax advantage of the DATA that is intended to support interest in India from Singapore registered businesses and organizations.

However, to keep away from the abuse of this exception particularly by third-country inhabitants who set up holding organizations in Singapore to profit from the capital additions exclusion, the arrangement added a “Limit of Benefits (LOB)” provision. Under this provision, a Singapore incorporated organization won’t be qualified for the exclusion from capital increases if the sole motivation behind the foundation of the organization was to profit from this advantage. Furthermore, organizations that have insignificant business tasks in Singapore, with no congruence in business exercises won’t be qualified for this advantage. Because of the LOB provision, the arrangement isn’t material to shell organizations.1.

Singapore’s Tax Treaty Network

All the existing terms inferred by Singapore since 1965 to duration are categorised as mentioned:

- Detailed – These consensuses normally encompass all varieties of dividend.

- Limited – These authorizations enclose only payment from ferrying and/or other carriers.

- Treaties which have been guaranteed but not ratified – These are either extensive authorizations or restricted unions which do not have the terms turned into law yet.