Company Registration In Cayman Islands

Before we jump straight to the details of company registration in Cayman Islands, let’s start with understanding the basics. The Cayman Islands used to exist as a colony in the British Empire, and later it changed to become a British Overseas Territory. The most common language spoken in the Cayman Islands is English, and that’s why the English Common law has always been mandatory for the judiciary.

The Cayman Islands are also known to be a tax haven because of having no income taxes, and the process to register an offshore company there is also easy. Foreign citizens and entrepreneurs choose to incorporate an offshore company in the Cayman Islands because of its tax benefits and privacy advantages.

Benefits of Registering a Company in the Cayman Islands

The corporate law of the Cayman Islands is enough to excite multinational businesses and skilled investors to establish a company in this nation. The reason for their eagerness is the great development and rapidly growing economy of the Cayman Islands.

But apart from this reason, several other points make company registration in Cayman Islands advantageous. So, without any further ado, let’s dive to find out the benefits:

1. Only One Director

According to corporate law in the Cayman Islands, only one shareholder and one director can be appointed in a firm. And, either the business structure or the same individual is responsible for the ownership and the directorship of the company. There is no requirement of any other director, shareholder, or officer.

2. No Shares Transfer Tax

Another benefit of company registration in Cayman Islands is that you do not need to fulfill any duty stamps or taxes after the firm sends shares to 3rd parties. But if the shares are somehow related to the investments in real estate, then you need to deal with the duty stamps and taxes.

3. Privacy

The next perk of company registration in Cayman Islands is that one doesn’t require to submit or file his/her papers with the government of the Cayman Islands. The personal documents include the official papers related to the business you wish to register. You can keep your documents with you. Another point that proves Cayman Islands privacy is that you don’t require meeting minutes or a shareholder meeting or even an annual audit. All in all, the firm records are kept private in the Cayman Islands.

4. Mergers Permitted

It is allowed to firms to form mergers with other firms. The ultimate merger can occur in either that firm or under any jurisdiction. Usually, the merging firms pick to stay in the Cayman Islands because of the several perks offered.

5. No Large Capital Needed

Several countries require you to submit a huge deposit in an escrow or a bank before the completion of the establishment. But when going for company registration in Cayman Islands, you do not have to worry about the capital requirement

6. Stability

The strong point of the Cayman Islands has always been the stability of its government and the nation’s rapidly growing economy because of a powerful banking structure, tourism, and offshore companies.

7. Quick Establishment

The establishment process takes only a single day, and the reason for that is the non-requirement of any permit from a regulatory body. Plus, their company registration and the yearly renewal fee are quite low when compared to that of other nations.

Business Entities Eligible For Company Registration in Cayman Islands

Several business entities can be incorporated in the Cayman Islands. Let’s take a glance at the formable entities:

1. Limited Partnership

The business structure needs 2 partners, limited and general. This entity is best for firms that work to provide official services to their customers. Amongst the 2 partners, one should be a native resident of the Cayman Islands. And lastly, the limited partner is only responsible for the portion of contribution he/she has made in the firm, and the general partner is completely responsible for the firm.

2. Offshore Company

To run a foreign organization, you should hire a director and a shareholder for your company. Yes, there is no requirement of capital for investment in this entity, but according to the guidelines, a registered office is mandatory. That’s why this type of business entity is best suited for conduit or trading firms.

3. Non-residential Company

Just like the offshore company, the non-residential firm also has similar requirements. Some of them are no minimum capital for investment, single shareholders and directors, and a mandatory registered office. Also, the firm should file and issue full details of the shareholders, directors, and the registrar’s capital annually.

Documents Required for Company Registration in Cayman Islands

There are some documents needed for you to successfully register a company in the Cayman Islands.

Documents that you will need are:

- Approval by CIMA – This kind of document is needed by firms that aim to work in the regulated business

- Memorandum of Corporation – This document includes the name of your firm, its objective, registered office, amount of capital invested, and the number of shares.

- Articles of Association – This is the official rulebook that empowers the internal supervision of the firm.

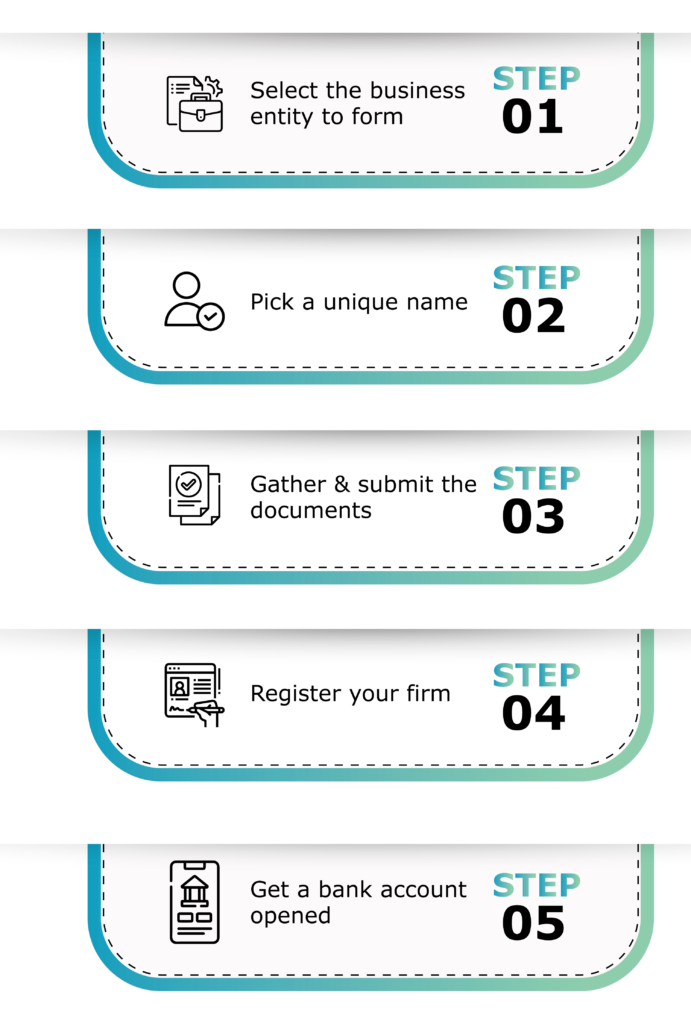

The process to Register Your Company in the Cayman Islands (Step-by-Step)

Step 1: Select the business entity to form

The first step of company registration in Cayman Islands comprises selecting a business entity.

Step 2: Pick a unique name

The owners or partners of the company work to pick a unique name for their firm in this step. The Companies Registry will then pass or reject their chosen names. It is to be ensured that the names are unique and not picked by any other existing firm.

Step 3: Gather & submit the documents

Prepare and then submit all the required documents in the 3rd step of company registration in Cayman Islands.

Step 4: Register your firm

You will have to register your firm with the General Registry of the Cayman Islands.

Step 5: Get a bank account opened

This is a post-establishment step, and in this, you need to open a corporate bank account, and also fulfill any registration that is left.

Tax System in the Cayman Islands

Amongst all the famous tax havens existing in the world, the Cayman Islands tops the list. Usually, most of the nations have a corporate tax, but the Cayman Islands don’t. This makes it the most ideal location for foreign businesses to form their business entities or save up their revenue from getting taxed.

Apart from freedom from corporate tax, this nation also doesn’t put any kind of direct tax on its residents. No kinds of property tax, income tax, payroll tax, withholding tax, and even no capital gains. That’s why the Cayman Islands are said to be tax neutral. By avoiding getting revenue from taxes, they get it from fees earned by work permits, tourism, import duties, or financial transactions.

Conclusion

Now that you have reached the end of this article, you must have understood that company registration in Cayman Islands is super beneficial and offers a lot of perks. There are economic advantages like cheap registration fees, quick establishment, stability, flexibility, etc.

Not to forget, you get privacy as an advantage by registering a company in the Cayman Islands. Because there is no record of the firm or shareholder filed with the official authorities, no one from the public can get access to the registers of shareholders or directors.

ODINT Consulting is experienced enough to help you through the whole process of company registration in Cayman Islands. Our skilled experts know how to guide our clients and leave them with a successful outcome. So, if you are looking for a place where you can kickstart your company registration in Cayman Islands, consider ODINT Consulting, and contact us today!

FAQ’s

You have an option of forming an offshore company, a non-residential company, and a limited partnership firm, when looking to register a company in the Cayman Islands.

Holding corporations in the Cayman Islands can join with other corporations, allowing the business to operate in any country.