Business Laws of Singapore 2022

Singapore is well throughout the world as a business hub. Singapore is a desirable financial center due to the relatively low tax rate and significant government backing for businesses. More than 30,000 multinational enterprises have offices in the country.

The country’s legislation was created to attract international investment and foster a robust and open economic climate.

This section will cover the fundamental ideas that underpin the core legislative measures that all Singapore businesses must follow when doing operations in the market.

Filing Annual Return in Singapore

Each Singapore firm is required to file an annualised Return with the Accountancy and Commercial Regulatory Agency once a year. It provides vital corporate information such as the identities of the directors, secretaries, and investors, as well as the time on which the firm’s accounting records were completed. The Singapore Companies System is the principal law that governs this subject. A designated officer of the corporation submits the Annual Return. In most circumstances, this is handled on your behalf by your authorized filing agency.

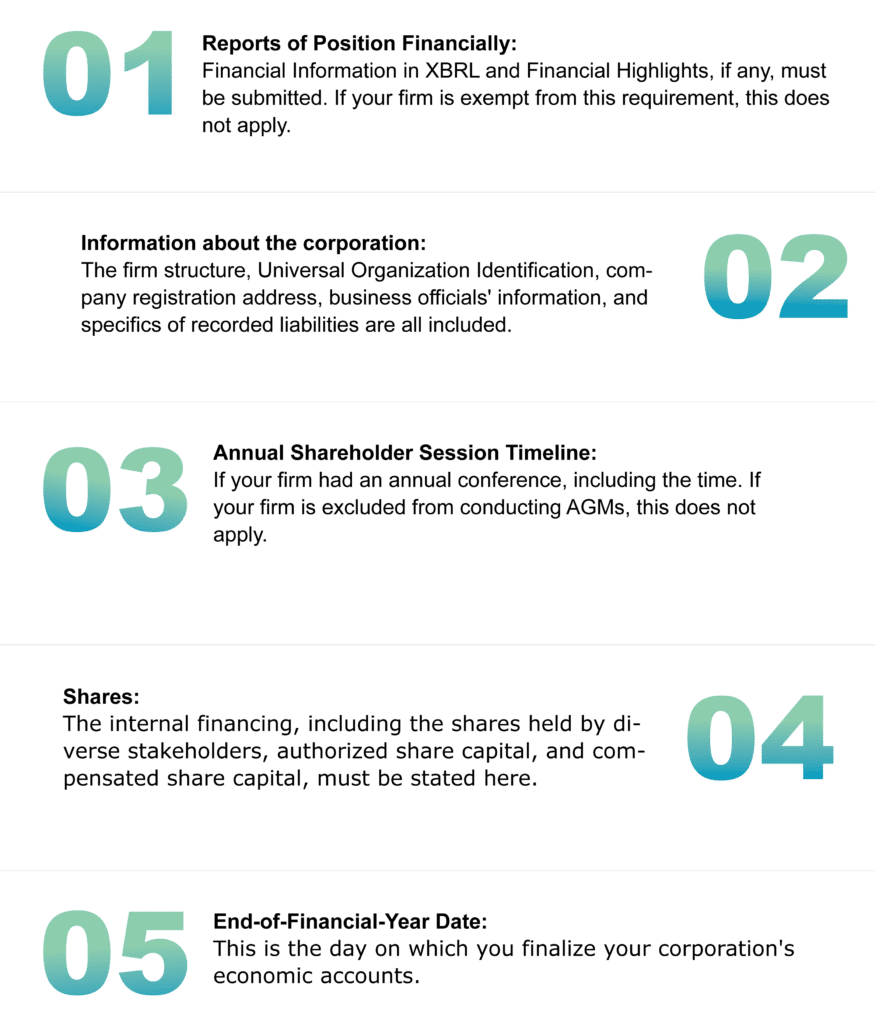

The details that businesses must include when completing their Annual Return are listed below:

- Reports of Position Financially: Financial Information in XBRL and Financial Highlights, if any, must be submitted. If your firm is exempt from this requirement, this does not apply.

- Information about the corporation: The firm structure, Universal Organization Identification, company registration address, business officials’ information, and specifics of recorded liabilities are all included.

- Annual Shareholder Session Timeline: If your firm had an annual conference, including the time. If your firm is excluded from conducting AGMs, this does not apply.

- Shares: The internal financing, including the shares held by diverse stakeholders, authorized share capital, and compensated share capital, must be stated here.

- End-of-Financial-Year Date: This is the day on which you finalize your corporation’s economic accounts.

The paper must be certified by one of the firm’s directors or the officer of the company. The Financial Report must be filed within a month of the date and time of the Annual Meeting.

Filing Taxes

Having low taxation and a variety of tax benefits, Singapore boasts one of the most streamlined and business-friendly revenue regimes in the world. The major regulating legislation for corporation taxation in Singapore is the Inheritance Tax Act. The legislation establishes a solitary corporation tax structure. This implies that a sales revenue tax is the only charge on such revenue whereas payouts are tax-free to investors.

A corporation does not have to pay taxes on income or export opportunities that have already been taxed in another country. Thus, the major tax that a Singapore firm should submit is corporation tax, which is levied at a rate of 17% but is usually greatly reduced due to several tax benefits and exclusions available to Singapore-based businesses. Corporations in Singapore are required to submit corporation tax filings with IRAS, Singapore’s Federal Inland Revenue Authority, double a year. IRAS is the major governing body in Singapore that assesses and pays taxes.

The following are the proceedings:

Return on Income Earned

Companies must register a Corporate Tax Return with IRAS after finishing the ECI. The last date for traditional filing is November 30th, while the last date for e-filing is December 15th. The Income Tax Return calculates the amount of tax that must be submitted to the taxing authorities. Corporations must file tax returns for profit-sharing from the previous year in each given year.

Income Tax Returns are categorized into two categories:

- For eligible resident enterprises with yearly sales of up to S$5 million, Form C-S is a shorter form (just three pages). It includes a declaration statement outlining the company’s C-S eligibility, information on tax modifications, and banking information.

- If your business does not meet Form C-S, you must file Form C. You must include your annual financial performance, tax estimate, and necessary documentation when submitting Form C.

- Even if they are losing money, businesses must submit Form C-S or C. Companies that are defunct have no business activity, and have no income for the previous financial year are eligible for an income tax return filing waiver.

Chargeable Income Estimate (ECI)

For each financial year, all Singapore enterprises must file their Estimated Chargeable Income (ECI) within three months of the end of the financial year. After subtracting tax-allowable costs for the previous financial year, ECI is the company’s projected income. Companies must submit the ECI using an IRAS-provided ECI Form. A firm must report its income on the ECI Form in addition to mentioning the ECI. The term “revenue” refers to a company’s primary source of income, excluding factors like gain on the sale of fixed assets. Your investment income will be your principal source of revenue if your firm is an investment holding company.

Companies are excluded from disclosing their ECI under the legislation if they:

- The ECI is zero.

- The annual income is not more than S$1 million.

GST Registration

It is a wide-ranging taxation system that is charged on practically all goods and services supplied in Singapore, as well as on items imported. GST is also known as the Sales Tax in some jurisdictions. The main regulating legislation in Singapore for GST concerns is the Goods and Services Tax Act. The number of products and services you provide that are considered chargeable supply for GST purposes also known as taxable turnover determines your firm’s GST registration obligation.

If your firm’s taxed revenue is greater than S$1 million at the end of any financial year, you must apply for GST. If your yearly taxable turnover reaches this amount, you must verify it at the end of each financial year and register for GST. The GST Portal Calculator can help you figure out if your firm needs to register for GST. Businesses with sales below the aforementioned criteria are not forced to register, although they may do so willingly.

If you’ve concluded that you’re liable to GST or have voluntarily elected to apply, you must take the following steps:

Completing an e-Learning Training entails the following steps:

Only free registration necessitates this step. “Able to register for GST” and “Introduction to GST” are two e-Learning programs that a board member or GST return processor must finish. If the board has past management experience in other GST-registered firms or if the GST accountant is a Certified Tax Adviser or Qualified Tax Professional, you are not obligated to do so.

Send in your application:

You have the option of submitting a GST application. You will be asked to submit additional documentation after completing the online registration. Businesses who voluntarily register for GST are expected to use the GIRO system for GST transactions and reimbursements.

Receive notice of the registration’s date of issuance:

You will get a letter confirming your GST registration if your application is granted. The letter will include the following information:

- Your GST registration number is the number you must print on all invoices, credit notes, and receipts.

- The effective date of your GST registration Is the day you must start charging and collecting GST on taxable supplies. You must not charge or collect GST prior to the effective date of your GST registration.

Even though there are no GST activities during the appropriate accounting term, the GST-registered firms must digitally submit a GST F5 tax form with IRAS on a monthly or yearly basis. After submitting an F5 return, the GST must be deposited to IRAS within 30 days.

Employment Act In Singapore

The Labour Law is the major Singapore statute that determines the conditions of employment agreements that firm contracts with its employees (EA). It establishes a minimum standard for the terms and conditions under which a business must hire employees. Your business must adhere to the EA’s applicable duties to employers and offer conditions that are no less favorable than those set by the EA. If a condition in the employment agreement is less advantageous to the employee than the EA, that clause will be deemed null and void, and the EA’s applicable element will be implemented instead.

Organizations who are unfamiliar with this clause may inadvertently sign contracts that put them in danger. For example, a corporation may agree to pay an employee a high wage in return for another restricted condition in the contract, but that clause would be null and unenforceable in the event of a disagreement. Individuals who are hired by a contract of employment, which is an agreement in which one group decides to employ another as an employee and the other party agrees to accept the work, are protected by the EA. Both domestic and international employees are covered by the statute. The Employment of Foreign Manpower Act, which establishes an employer’s additional responsibilities and obligations for employing foreigners, applies to foreign employees who have a work permit.

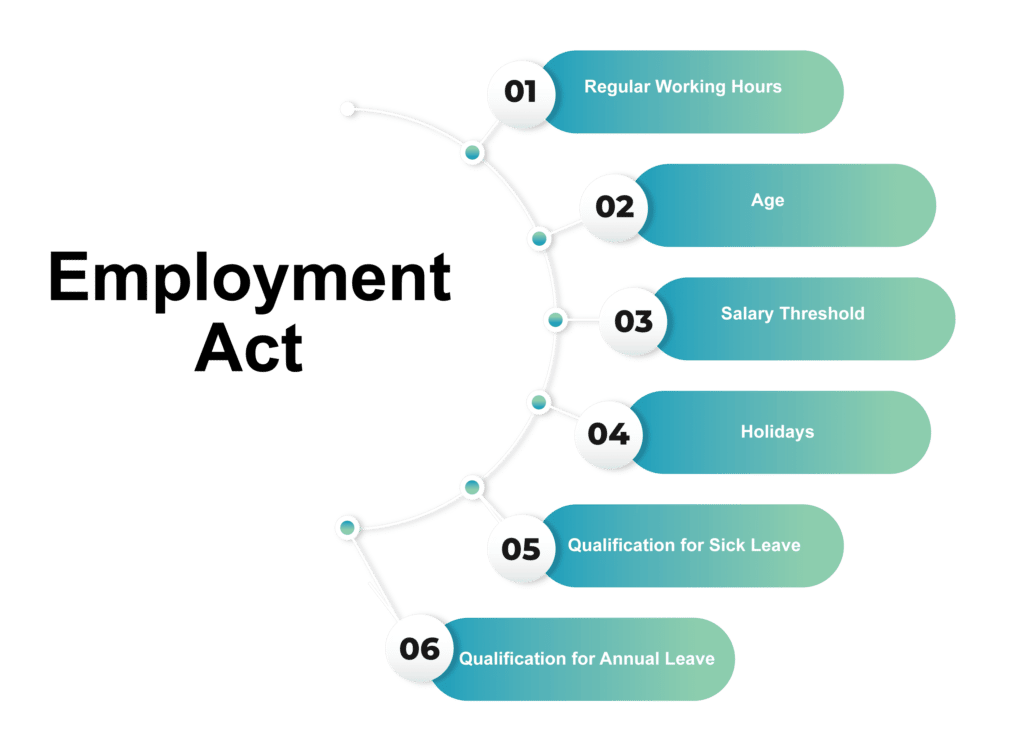

Your employer must respect the following minimal worker protections for individuals protected by the EA:

Regular Working Hours:

The preceding guidelines are applicable to common work agreements. Occupational working time cannot exceed 9 hours per day or 44 hours per week for a business week of up to 5 days. Your workers’ work schedule may be up to 8 hours per day or 44 hours per week if they work more than 5 days per week. Compensation must be paid for any time spent working outside of the scheduled work hours. Such payment can be made within 2 weeks after the remuneration period starts to end.

Age:

In Singapore, you must be at least 17 years old to work. Employing children and young people aged 13 to 16 years is legal, however, there are limitations on the kind of jobs that children and young people can do. The retiring age in the United States is 62 years old.

Salary Threshold:

Workers are not measured by the amount of wage under the legislation. Salaries are established by the parameters of the employer-employee agreement.

Holidays:

According to the Employment Act, your employees are entitled to 11 paid gazetted public holidays every year. If an employee is compelled to work on a public holiday, you should compensate them with an extra day’s salary or another day off in return. If a designated break falls on a regular rest day, the next working day is a paid vacation.

Qualification for Sick Leave:

If your employee works for your firm for at least 3 months, he or she is eligible for both paid clinic sick leave and paid hospital absence. If an employee has told or attempted to tell the employer within 48 hours of the departure, the employee has the right to paid medical sick leave and paid hospitalization leave. An employer may need a qualified doctor licensed under the Medical Registration Act or the Dental Registration Act to certify an individual unfit for service.

Qualification for Annual Leave:

Your employee shall be entitled to a yearly break if he or she has served you for at least three months. The amount of yearly leaves an employee is entitled to be determined by the number of years they have worked for the organization.

PDPA & GDPR

All Singapore businesses are required to safeguard the Personal Data (PD) of their customers, workers, and any other persons whose data they process. The Privacy Data Security Act and the General Data Security Regulation are the two main legislation that applies to Singapore businesses in this field.

PDPA:

The Personal Data Protection Act (PDPA) controls Singaporean enterprises’ collection, use, and protection of personal information. The act’s main goal is to ensure:

- Individuals’ privacy and ownership rights are respected in the processing of all personal data.

- Organizations only use this information for legitimate business purposes. The PDPA protects private information, which is defined as any knowledge about an entity that may be recognized from that data, or from that data and additional information to which the organization has or may have access, whether true or not.

The following forms of PD are addressed:

- Name in detail

- Foreign Identification Card or Registration Identity Card number

- Pictures or camera footage of a person

- Contact information for private use

- Analysis of DNA

- The number on the visa

- Fingerprint

- Photograph of Iris

- An individual personal voice is recorded.

Organization contact details, such as name, title, phone number, address, and email, are not recognized by PD. To conform with PDPA, your organization should follow the appropriate steps:

- Make a Data Security Commissioner appointment

- Notify customers about the reasons for gathering personal data and obtain their agreement to process it

- When consumers inquire about their personal data, answer.

- Confirm that customers’ PD is accurate and that it can be corrected

- Protect the PD owned by your company

- Remove any PD that is no longer mandatory

- Take all reasonable steps where data can be protected when it is sent internationally

- Suppliers of PD services should be closely monitored.

- Before utilizing a cell phone number, check the Do Not Call Registry.

- Actively convey your information security policies, procedures, and processes to clients and workers.

GDPR:

GDPR is a European Union data security and protection legislation. The text has cross-border ramifications, which means it also extends to businesses that are not based in an EU country. The GDPR applies to firms based beyond the EU that acquire or handle the personal data of EU citizens. As a result, if your Singapore firm gathers and handles the personal data of customers, workers, or other EU citizens, you must adhere to GDPR standards.

The GDPR protects the main forms of personal details:

- Name, address, and ID numbers are the most basic elements of a person’s identification.

- Position or motion data, IP address, cookie data, and RFID tags are all examples of web data.

- Data on healthcare and genetics

- Genetic information

- Data about race or ethnicity

- Views on politics

- Gender or sexuality preference

- Information on a person’s work productivity

- Statistics about the economy

- Individual interests and values

- Other personal characteristics such as dependability, behavioral habits, and so on.

To become GDPR compliant, your firm should take the following steps:

- Put your data protection act into action.

- Put in place security precautions

- When collaborating with other firms, keep PD safe.

- Activities encourage the processing of documents

- Carry out a risk assessment for data security.

- Try reporting any PD infractions.

- A Data Protection Director should be appointed.

- Ensuring that your confidentiality is respected.

- Have a valid legitimate justification for information processing.

Contract Law

In Singapore, no one statute governs all collaborative agreements. The guidelines are mostly based on the English contractual legal system. Much of Singapore’s commercial contracts are still based on predecessors, or rules established by judges. Specific legislation, on the other hand, impact various areas of contract law.

An overview of some of Singapore’s contractual legislation’s important ideas follows.

Capacity to Execute Agreements:

An agreement is enforceable at law only if the participants have the legal power to do so. An understanding with a juvenile, a person of inferior intelligence, or someone who is drunk may not be effective. If such persons did not comprehend what they were consenting to, they are regarded as incapable of fulfilling their commitments. Because firms are defined in law as individuals with the given jurisdiction to engage in contracts, a contract with a company is virtually always valid.

Singapore court, like that of other widely accepted nations, states that an agreement may only be established if it has the following components:

- Offer: One of the sides has promised to do or fails to act a certain development is expected.

- Consideration: This indicates that in compensation for the stated action or nonaction in the offer, something of value must be given. A significant investment of cash or energy, a commitment to supply a product, a decision not to do something, or reliance on the committee are all instances of this. Gratitude is the value that allures the sides to enter into an agreement. A contract is distinguished from a gift by the presence of value. A gift is an unsolicited transfer of ownership from one person to another with no expectation of receiving something that is of worth in exchange. Failing to uphold through on a promise to bring a present is not enforceable as a specific contract since there is no remuneration for the agreement.

- Acknowledgment: The offer must be accepted. Acceptance can take the shape of words, acts, or performances, depending on the contract. Electronic offers and acceptances between parties have become more common in recent years. In general, the conditions of the offer must be reflected in the acceptance. If not, the agreement is viewed as a counterproposal and the proposal is rejected.

Competition Act

In the course of business operations, all Singapore enterprises must adhere to economic competition legislation. By restricting anti-competitive behavior by any firm, this field of law fosters and strives to sustain competition in the marketplace. Transparent, flexible marketplaces come from a competitive industry, with productivity improvements, creativity, and greater value and service. Competition law is the other term for antitrust law. The Competition Act is the primary legislation that governs this area in Singapore.

The statute prevents firms from engaging in the three major core actions in an effort to enhance competitive balance among buyers and sellers:

In any sector of the world the behaviour that contributes to the exploitation of a commanding position:

The following are some instances of actions that might be deemed as exploitation of a dominating position:

- Having the opposing party sign the agreement with extra responsibilities that have nothing to do with the deal’s issue.

- Customer bias is used to minimize energy, marketplaces, and technological growth.

- Rivals are being preyed upon.

- Using different terms to comparable transactions with other traders puts them at a disadvantage compared.

Contracts in Singapore with the goal of preventing, restricting, or distorting the competitive market:

Contracts, agreements, or coordinated activities including the following are regarded to have a negative effect on the market and are thus ethically wrong:

Contracts, agreements, or coordinated activities including the following are regarded to have a negative effect on the market and are thus ethically wrong:

- Establishing buying or selling rates, as well as any other terms of trade.

- Manufacturing, marketing, technical development, and capital are all limited or controlled in some way.

- Markets or supply bases that are shared.

- Contract manipulation or coercive proposing are two methods of rigging bids.

Fusions or acquisitions that might lead to a significant reduction in competitiveness in any international markets for products and services:

The legislation prohibits acquisition opportunities that lead to a significant decrease in competitiveness in any of the products or services sectors. Some combinations, therefore, are exempt from these constraints. These transactions include those that have been accepted by regulatory agencies, are subject to the exclusive jurisdiction of any supervisory agency, or are part of individual behaviors defined by law, such as services of overall economic interest that lead to financial efficiency improvements that greatly exceed their adverse effects, and so on.

If there are valid causes to detect a violation of competition regulations, the Commission has broad surveillance capabilities. It may advise the Minister of Business and Commerce to issue block exception directives. Exemption orders may be issued in the case of a certain type of contract that is expected to improve productivity or promote technical and economic growth.

Conclusion

We believe that this tutorial on major Singapore business rules will help you conduct your Singapore-incorporated firm in a way that is compliant with all Singapore authorities. Odint Consultancy can assist you with the registration of a prospective Singapore business as well as other activities relating to its establishment and management. We may also serve as your protracted conformance specialist, ensuring that your company follows all of Singapore’s corporation and tax laws.

FAQ’s

Employer-employee interactions are influenced by business legislation, and conversely. Firms, for example, are required to obey government standards on how they treat their workers and how they hire.

Business law is a part of the law dealing with the preservation of liberties and rights, the maintenance of order, dispute settlement, and the formation of laws for enterprises and their relationships with government organizations and individuals.

Occupation laws are on the books not primarily to protect individuals, but also to aid in the development of a healthy and long-term business. In addition to engaging in unlawful behavior and putting your organization in danger, refusing to follow them can have a negative effect on your financial line.

The distinction between contract law and commercial law is that the former controls how companies are governed and managed, whilst the latter encompasses a variety of business-related practice areas of employment, tax, contractual, and transactional law.

The Singapore Competition Law is the government entity responsible for implementing the Competition Act. Before another party agrees on a proposal, it might be withdrawn at any time. Overtime must be paid at least 1.5 times the monthly basic wage by employers.