Cryptocurrency in Lithuania

Lithuania has created very acceptable conditions for launching a cryptocurrency program. Government, regulatory authorities and development of fintech startups. Lithuania has simplified the process of obtaining a license, which has had a positive impact on investment flows in the region.

Requirements for Applicants

Forming an LLC is the best way to get started in the crypto sector. The following are the fundamental rules for forming a limited liability company:

- Set aside €2,500 in cash.

- At least one partner capable of combining the roles of director, shareholder, and compliance manager (subject to relevant experience).

Remote registration is also an option. It is suggested that compliance functions be outsourced.

Registration of a Legal Entity in Lituania

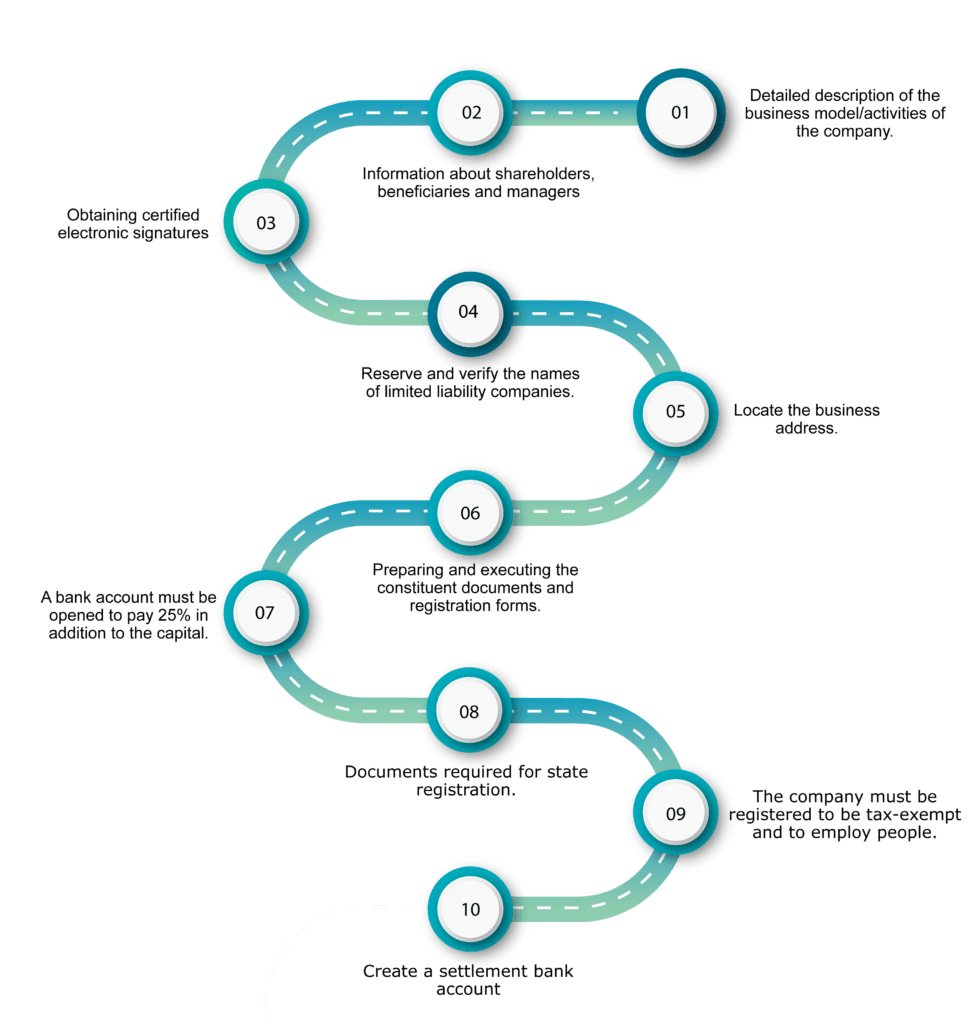

The procedure for starting a crypto business in Lithuania is simple and consists of the following steps:

- Detailed description of the business model/activities of the company.

- Information about shareholders, beneficiaries and managers

- Obtaining certified electronic signatures.

- Reserve and verify the names of limited liability companies.

- Locate the business address.

- Preparing and executing the constituent documents and registration forms.

- A bank account must be opened to pay 25% in addition to the capital.

- Documents required for state registration.

- The company must be registered to be tax-exempt and to employ people.

- Create a settlement bank account

Basic Documents and Details

To start a business and obtain a crypto licence in Lithuania, applicants must submit:

a CV/summary of experience and training for all participants in the crypto-related project;

information confirming the directors’ credibility; and

a document detailing financials and histories.

documentation of an arrest conviction for owners, board members, owners, last beneficiary, and AML officers.

Please contact experts for specific advice on required documents.

The procedures must be followed

The term “compliant” for a holding crypto license company in Lithuania refers to:

- The formulation of policies and requirements and policies, including:

- different types of risk-related transactions and the modes of execution

- high-risk trades and the methods of their execution

- due diligence;

- Implementation of security measures within the company:

- the collection and storage of data;

- compliance with the obligations of notification when required by laws.

- The checks conducted are conducted by the people involved in order to determine if each person.

- an entity against which international sanctions were imposed;

- Person who is politically exposed;

- Residing in a state with lax anti-money laundering laws and measures;

- An entity that was that was previously suspected of laundering money and financing of terrorists.

A compliance officer, among other things is required to:

- Organise the collection and analysis of transactions that are suspicious;

- Submit reports to the appropriate regulator on a regular basis;

- Notify the supervisory authority in cases of suspicious transactions

- More details about the intricacies of compliance in your particular case can be obtained from the experts.

After receiving a cryptocurrency license the holder can conduct these kinds of transactions:

- Exchange fiat for virtual currency, and reverse the process;

- exchange operations that require the involvement of various types of cryptocurrency;

- Virtual currency storage;

- The storage of fiat currency for an agreed-upon time to make the next purchase with this fiat currency;

- Transfers between wallets that are carried out using cryptos.

Taxation

It is implemented through the broad provisions within the law. Profits from corporate operations are taxed 15 percent. Withholding tax is 15% assessed on dividends with a gross value. The specifics depend on how the transaction and the type of asset that are involved. Our experts are glad to help you and provide the specifics

Review of any applicable laws

The regulations are defined by what kind of crypto asset is that is involved. Transactions that involve assets that do not grant an opportunity to exercise voting or gain, however, are connected to the access to a product or service and are subject to general laws of civil law. Asset transactions that grant the right to vote and profit or are employed in payment transactions are subject to securities regulations as well as collective investment schemes along with banking regulations. Every transaction, no matter its nature is subject to regulations against money laundering.

Regulations of crypto licenses in Lithuania

The businesses that operate in the market for cryptocurrency have to comply with these rules:

- All customers have to go through an identification and verification process;

- Records and the analysis of customer data records and accounting of customer data should be maintained;

- An officer is required to ensure compliance with the Anti-Money Laundering Policy (AML Policy); and

- Reporting in an FCIS of Lithuania (Financial Crime Investigation Service) is required.

Conclusion

Obtaining a cryptocurrency exchange certificate in Lithuania is a great option for anyone looking to legally operate within the European Union. Lithuania does not have complicated requirements for applicants and tries to create simple and acceptable working conditions for cryptocurrency business. Work permits enable you to attract more clients while building your business in a friendly manner and avoiding legal issues.

If you still have questions regarding cryptocurrency exchange license in Lithuania. So we are Odint Consultancy. We are available here to solve your queries.

FAQ’s

The Lithuanian Financial Crime Investigation Service (FCIS) supervises crypto-related activities. firms in Lithuania

Yes Non-residents of Lithuania might be legitimate owners of the Lithuanian crypto-related company, but it is important to keep in mind that residents who are not from Lithuania must provide the required documents, which includes a proof that there is no criminal record in the country where they reside.

An account with an financial institution that is that is registered within Lithuania (one among the Lithuanian banks or the Electronic Money Institution registered in Lithuania) is required to be established by a company that has applied for the crypto license. The authorized capital of the company must be transferred into this account.

Crypto licenses in Lithuania are valid for an indefinite time.

It is possible to pay the capital charter for a cryptocurrency business by making a transfer from the owner’s account to the company’s account at one of the banking institutions in Lithuania or the Electronic Money Institution registered in Lithuania.

The money contributed may be used to fund the commercial activities of your company’s crypto once when the Registry center in Lithuania confirms the payment of the capital of the charter company.