What Is A Variable Cost?

Variable cost is a constant value that causes price fluctuations as earnings and quantity supplied increase and decrease. Transaction fees and delivery charges are examples of variable costs. Young firms with greater monthly expenditures are not the same as those with heavy investment, such as housing and security, which do not alter with earnings and production. Organizations with strong overhead expenses must generate very little to maintain level, but their profitability is narrower than those with high maintenance costs.

Variable costs fluctuate depending according to how many items or operations are generated. The narrower the revenue percentage, the far more variable expenses there are. Aircraft, for example, have become less susceptible to rivalry because of their large operating expenses. To get started, they need to make a significant investment in hardware and other tangible objects.

As a very little amount of investment is necessary to initiate, firms with large marginal costs, such as the hospitality sector, which relies primarily on labour, are far more competitive.

Variable Cost Examples

Variable costs are incurred by every existing operation, although they fluctuate from one corporation to the next based on what it generates.

The basic variable cost includes:

- Charges are linked with a variety of expenditures required to generate a commodity or engage in an activity.

- Labour cost refers to the time spent on a single item of manufacturing or performing a job.

- If a firm’s workforce is compensated for revenue, incentives are paid.

- If you need electricity, freshwater, or fuel to make goods or services, you’ll need amenities.

- If goods are distributed to stores, factories, or consumers, shipment is required

- To manufacture one quantity of output or produce a product, primary tools are essential.

The following variable cost examples are:

Example 1:

A purchasing company must keep a modest facility and compensate contract workers. The average time spent varies according to the amount of business. For this company, delivery costs are a significant variable cost. The company employs a representative who is paid on commissions and receives an achievement incentive.

Example 2:

Johnny runs a European eatery that specialises in rice and noodles. These are the products that he sells. Johnny’s fixed expenses are his rental and taxes, which he must pay regardless of how many meals he delivers or not. Nevertheless, Johnny must also purchase kitchen supplies, pay his employees’ salaries, and pay his monthly utility bills.

All of these factors change based on the number of people who visit the diner, how many meals they purchase, and how frequently their facility is used. Furthermore, Johnny has officially unveiled a home delivery, and as a result, he must pay for vehicle costs maintenance, both of which are dependent on the size of call-in bookings. These are all his costs that vary.

Example 3:

A marketing consultant works on a variety of agreements, each with its own set of charges, she has a lot of overhead expenses. She has to pour money on one project. She also needs to fly to see the investor, and the taxi cost is an unpredictable price. She hires a secretary on an annual rate to support her, and this chargeable labour is a variable cost as well.

She needs to travel across the country for another assignment, and all of her airfare are variable costs. To accomplish her profession, she leases a portable office. She purchases windows apps tailored to the job and enrols in an online class and learn how to use them. She will have to raise cash to acquire the latest software and pay for the tuition, and the outstanding debt will be a variable cost.

Example 4:

A pet sitting service must travel to visit clients, and the cost of petrol for the corporate vehicle, as well as the number of miles driven, are both variable costs. Because her entrepreneurial smartphone is financial reward, it is a differential additional cost. Her employees are paid based on the time worked for service users, with workhours being a significant expense.

Example 5:

Michelle works as a designer and also provides professional services. She does not require a workplace because she works from home. She does, however, have a webpage where she offers her skills. She is required to pay for webpage maintenance regardless of how many appointments she delivers, thus it is a fixed cost for her. Michelle must visit several retailers and runway shows to assist her customers in selecting the greatest outfits. She also provides counselling over the telephone. The more customers she has, the higher her transportation and telephone charges get. These are the variable costs in Michelle’s situation.

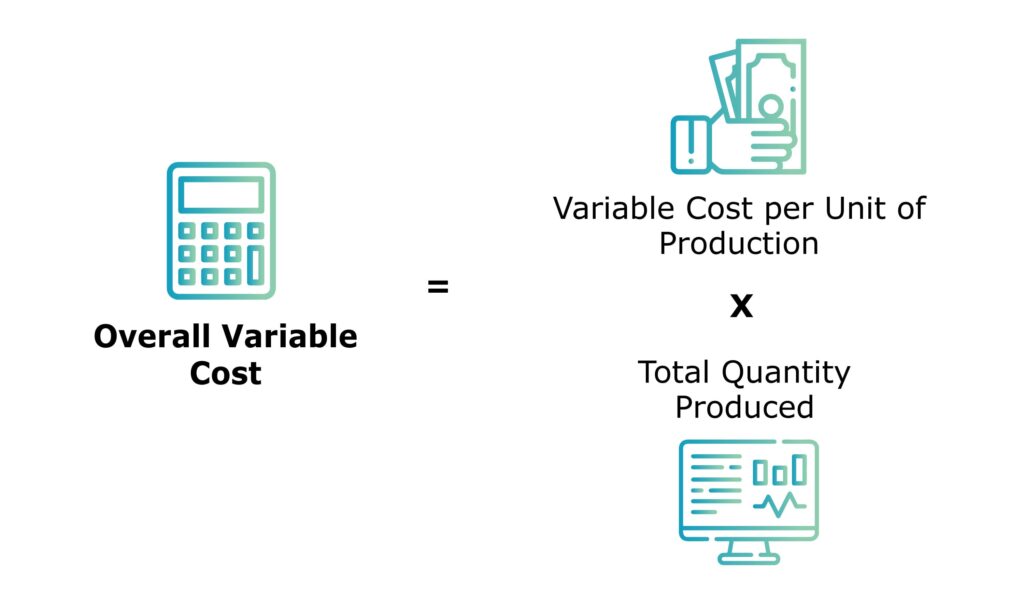

Variable Cost Formula

Overall Variable Cost = Variable Cost per Unit of Production x Total Quantity produced

How to calculate variable cost

Below you will find a step-by-step procedure on how to calculate variable cost:

- Calculate your overall expenditures over a specified timeframe. They can be calculated by deducting fixed expenses from overall costs for the period if they are undetermined.

- Estimate the amount of finished goods generated over a specified time period.

- Divide the changeable value by the number of products. This calculation will generate your contribution margin.

Difference Between Variable And Fixed Cost

The difference between variable and fixed cost, are as follows:

Variable Cost:

Variable costs are those that alter in response to changes in production. They are only payable when the components are manufactured. The variable cost per unit stays unchanged. It varies in response to variations in the production level. Wholesale Supply, Direct Employment, Direct Expenditure, Flexible Manufacturing Expense, Adjustable Marketing, and Allocation Operational costs are all part of it.

Fixed Cost:

Fixed cost refers to an expense that remains unchanged regardless of the volume generated. They are involved regardless of whether units are generated or not. Fixed cost per unit falls as the number of troops manufactured grows, and conversely, hence fixed cost per unit is inversely correlated to the amount of quantity manufactured.

Reasons To Be Aware Of The Variable Costs Of A Business

Variable costs are crucial to track because they reflect where a company’s money goes and if it is managed properly. If a firm wants to increase earnings, cutting costs is one of the ways to do it. Fixed expenditures are notoriously tough to cut: lower rent may necessitate relocation to a less expensive location with a smaller client base, and lower salary may result in poor work quality.

Whereas expenditures can be decreased through optimization. Some of the methods to reduce or minimize variable costs are: buying raw materials that are less expensive, partnering with organizations that offer cheaper transaction fees, outsourcing some services for lower prices, etc.

FAQ’s

No. The consumer surplus is the cost of measure of the total. In the entire cost of manufacturing, the cost of production will comprise both the costs. However, because fixed costs are fixed, the weight of fixed costs will decrease as manufacturing scales up.

Yes, they are also popularly known as ‘unit-level cost’.

Variable costs are expenses that fluctuate throughout time. Making a strategy might assist you in managing their unpredictability. Fixed expenses, such as automobile instalments, often remain constant over time, but expenditures alter. Variable expenses are less reliable, but they often provide more financial freedom.

Fixed expenses are those that are constant across a whole given time. Indirect expenses can rise or fall depending on the company’s output. Lease, tariffs, and health coverage are examples of fixed costs.