Singapore Company Registration

Are you looking to register your new company in Singapore or run existing company? . This article will lead you through the steps for Singapore company registration and will help you to get every details on how to incorporate, manage, run a company in Singapore.

How to Register your Company in Singapore?

- Learn and understand requirements for company registration in Singapore.

- Collect supporting papers and determine the corporate system

- Confirm the availability of the company name you are interested in

- Sign incorporation documents

- Create an new a bank account for the firm you have just created.

Table of Contents

Why register your company in Singapore?

Singapore is considered to be one of the top nations to conduct business because of its strong but welcoming investment and trade policies. Business owners have to register their company. The process of forming a company in Singapore is easy and cost-effective. Your Singapore business should be registered for a variety of reasons.

Strong economy

The country has experienced rapid growth and development. Singapore has a strong economy because it has used its resources wisely. This is why so many entrepreneurs have set up shop in Singapore.

Attractive taxation scheme

Singapore’s corporate tax rates range from 0% to 17%, which is very low compared to other developed countries.

Double Taxation Avoidance

Singapore has bilateral double tax avoidance treaties with over 50 nations. Double taxation avoidance agreements guarantee that transactions between Singapore and treaty countries don’t include double taxes.

Seamless Incorporation & Operation

Singapore Company Registration is straightforward. You don’t have to fill out complicated paperwork.

Pro-start-up environment

Singapore has adopted a number of tax incentives and in-kind assistance schemes to encourage growth and innovation.

World-class infrastructure

Singapore boasts a world-class infrastructure which is a boon to businesses. It has helped to increase productivity.

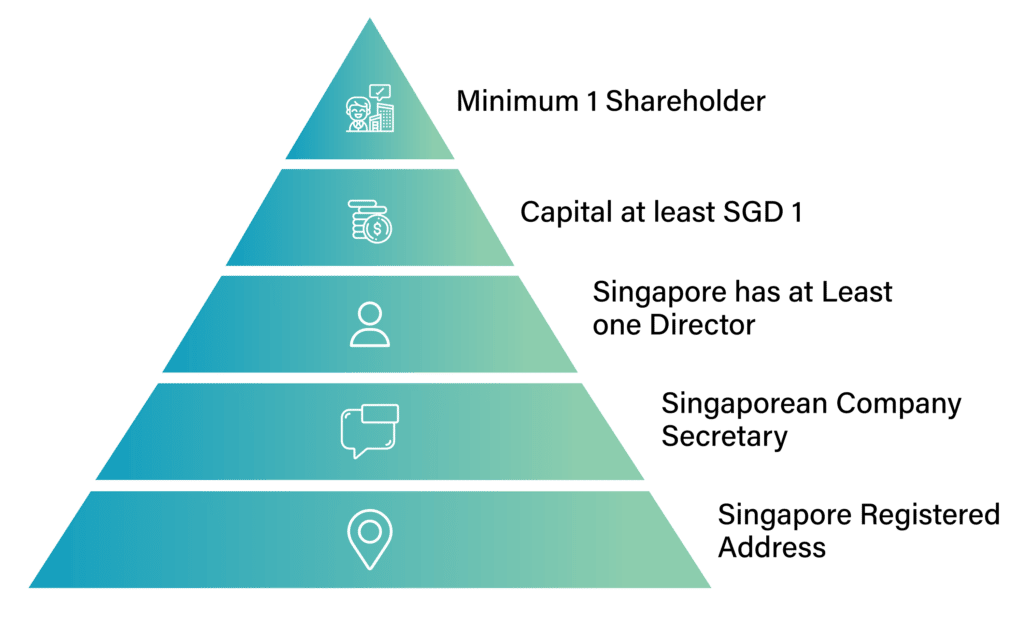

Eligibility criteria for Singapore company formation

- Minimum 1 shareholder

You need to have at least one shareholder in order to register your business in Singapore. .A stakeholder can be a person or another business. You can have multiple stakeholders.

- Capital at least SGD 1

With a capital of only 1 Singapore Dollar, you can begin your Singapore company.

- Singapore has at least one director

Directors of a Singapore firm can be both Singapore citizens and foreign citizens. However, there should be 1 Singapore citizen to be added as a Singapore Director into the BOD list.

- Singaporean Company Secretary

A Singapore company must appoint a company secretary, who is based in Singapore. The company secretary ensures compliance with company filings and regulatory obligations.

- Singapore Registered Address

A registered address must be provided for the company in Singapore. It can’t be a PO Box.

Documents needed for Singapore Company Registration

- Register your company in Singapore

- Completed KYC form (If you are engaging nominee director service).

- Memorandum of Association and Articles of Association

- Copies of passports for all directors/shareholders of the proposed new company

- All directors and shareholders must have proof of their residential address

- Bank statement / Bank reference letter

- Certificate of incumbency from parent company

- Profile of the client’s business in his country

Various types of business entities in Singapore

- Private Limited Company

The Private Limited Corporation (PLC) It is an option that allows the participation of up to 50 investors. It provides tax deductions as well as incentives which makes it the most sought-after option.

- Limited Liability Company

The an LLP is a flexible choice for business owners who want to create a partnership, but retain their legal identities distinct.

- Subsidiary Company

The subsidiary is an individual limited corporation with its own legal entity and is not affiliated with its parent corporation.

- Sole Proprietorship

If you are an sole proprietorship only one person is accountable on behalf of the firm’s capital as well as obligations.

- Branch Office

Foreign companies can open an office branch in Singapore and be non-residents. The branch office is an extension to the parent company and is an entity legal as a separate entity.

- Representative Office

A representative office is able to be established for a maximum period of three years, so it is an indefinite structure. Foreign firms are only allowed to study the Singapore market in this manner and are not permitted to offer products or services in order to earn money.

- Variable Capital Company

The VCC that was introduced in the early months of 2020, is an exciting financial vehicle that is a great investment for Singapore. The VCC is an anticipated vehicle to register due to its incredible versatility.

Steps for Singapore Company Registration

Step 1: ACRA Approves the Company Name

Step 2: Acquire all the papers you will be required to register your company in Singapore.

Step 3: Company Constitution

Step 4: File your application on the BizFile+ Portal

Step 5: Confirmation Of Incorporation

Step 6: Acquire company licenses & permissions

Step 7: Get Share Certificates

Step 8: First Board Resolution

Step 9: Annual Filings and Returns

Step 10: Corporate Secretary.

Step 11: Paid up Capital

Advantages of Singapore company registration

As there are numerous advantages of Singapore company registration, however, we’ve listed down some of the key advantages of it.

- The owners of the company

Shareholders own a company. They invest in it to get a return on their investment in dividends and growth in the company’s value.

- Vibrant Startup Ecosystem

Singapore is a city that was called as the World’s Freest Economy in 2020 and has been a consistent as a business hub for a variety of companies and startups.

Beginning an enterprise in Singapore provides an additional benefit from government assistance, making the process easier.

- Special Tax Benefits

While the high rates of corporation tax in other parts of the world may be an issue for some companies, Singapore has created an attractive tax structure for corporations with tax rates that range between 0% and 17 percent.

There are many other benefits aside from the tax rate for corporations that is low like:

- Tax-free dividends

- Capital gains are not tax-free.

- Tax credit pooling

- Tax credit for Unilateral

- Tax withholding reductions on income from foreign sources

Conclusion

Singapore is a great place for budding entrepreneurs to set up a business, due to its strong economy, strategic location and tax policies make it a great place to start a business.

Foreign nationals who want to a Singapore company registration must engage with a Corporate Service Provider who provides company registration in Singapore and deals with incorporation procedure.

Odint Consultancy will assist you in resolving all the legal and corporate producers.

FAQ’s

A Singpass is a government sustained digital login and designation system that authorizes you to transact with numerous regional authorities.

The government does not see a reason to permit home-based food companies because of the tiny amounts of food they offer according to Singapore’s Singapore Food Agency (SFA).

Setting up a corporation in Singapore with ACRA takes one day.

Only when a Singaporean company’s yearly revenue surpasses S$1 million are they required to register for GST.

In Singapore, only specific business operations are restricted and need a company license. Examples include legal services, employment agency services, and financial services. If you’re unsure, check with us so we can direct you.