Stock of the Founder in a Singapore Company

Before you create a company with your co-founders, it is important to establish a strategy for allocating equity, to avoid misconceptions between you & your co-founder.

Each & every firm possesses a stock of their firm, which is partially divided or as per their means. However, this stock is considered as “founder’s stock”, it’s a stock that gives founders of companies the unique right to vote, control and distribute profits.

Stock of the founder in a Singapore company will be discussed with the potential pitfalls and benefits.

What is Founder's Stock?

The term “Founder’s Stock” is not legal. It simply refers to shares that were issued to early participants in the creation of the company. It could be the founders of the company, early directors, employees or anyone involved in the transformation of the idea into a business.

The difference between a founder’s stock and ordinary stock is that the founder’s stock can only be issued at the face value (i.e. The stock’s original cost, unlike stock that is sold on the secondary stock market.

The founder’s stock is essentially a low-priced stock that was issued to early founders. They have bought shares of the stock at a minimal price in return for a small cash payment or some initial assets (e.g. The business plan, hard or soft IPs, and other relevant information).

Let’s take an example:-

Let’s say you co-founded a company along with two other cofounders. Each co-founder invested USD$5,000 upfront and received a million shares. The company’s total value is USD$15,000, and all three founders own one-third. Each founder owns just USD$0.005 for each share.

Preference shares are usually issued to investors who have a longer-term. They typically pay a higher share price. They are also paid first in the event of a company going bankrupt or liquidating.

Ordinary shareholders won’t receive any money until creditors, bondholders and preferred shareholders have been paid. Prefer stock also has the advantage of paying fixed dividends. These are typically payable before common stockholders get dividends.

Read More: Strike Off Company in Singapore

Benefits of Owning Stock in Founders of Singapore Company

Attracting Skilled Talent

Many early workers will get stock in newly-incorporated businesses at an early stage. This is often in the form of restricted stock units or stock options. These workers want to get these shares when a company is not worth much and then reap the rewards when it succeeds.

Companies can offer leveraged compensation to the founder team by using their stock structure. This will encourage them and help you build a business. You can attract experienced people to your company by giving them a portion of the equity.

This will encourage them to stay with you as the business grows. Their potential compensation will increase the more successful the company becomes. Singapore’s workforce is consistently ranked among the most skilled, educated, and competitive in the world.

Read More: Singapore Work Culture

However, before you use your equity, it is important to carefully plan and structure your equity distribution. This will prevent the founder’s stock from being given out too cheaply and allow you to explore any legal issues that could affect your business or your employees.

Stock Value

In most cases, the founders share a significant amount of the company’s stock, which is often not worth much at first. Future potential is what makes a founder’s stock valuable. This is common for startups, as the company hasn’t yet started to do business and therefore has very little value.

Because the founder’s stock is a company’s original stock, it can yield the best returns on any future equity award in the form of capital gains.

Holders of the founder’s stock can make the most profit if a company is successful because they bought the stock at the lowest price. To ensure that you don’t lose hard-earned profits due to high taxes, it is important to have a forward-looking strategy.

Incorporating in Singapore is a good way to do this. There aren’t any taxes on dividends & asset gains. The founders of the company will not have to surrender a significant portion of their earnings to taxes when they sell their equity.

Opportunity to Buy Back

A founder’s stock usually includes a vesting program. This is a positive characteristic. This protects, the equity of the company and helps prevent other parties from taking control. It is common for founders to leave the company in the early years of a startup.

Vesting is the time period during which the founder’s stock becomes fully owned by the recipient. The vesting schedule gives the company’s equity to the recipient, but the recipient does not have any real ownership of the shares after the vesting period.

If the founder leaves the company prior to the stock being fully vested, the company or other founders have the right of buying back any unvested shares at nominal prices. The founders and investors often have a higher priority than the company.

These provisions can be used to control founder stock ownership and discourage founders from leaving the company’s early stages. Other founders of the company can keep their share of the stock. To avoid potential disputes, vesting provisions, as well as “buyback” rights, should be included in a written contract.

Possibilities of holding founder's stock

Priority

When it comes time to payouts, founders want as much as possible to be at the top of the queue. Their position in the payment queue will determine how much they will get in an exit.

Many founders are unaware that founder stockholders do not have the same priority as preferred stockholders when it comes to claiming a pay-out in the event of bankruptcy or liquidity.

The liquidation preference granted to preferred stockholders does not apply to the founder’s stock. This allows them to get some money back before common stockholders receive any pay-outs. These peculiarities can lead to founders owning very few shares of a failing company after a significant exit.

“Free Rider” Problem

It is quite common for founder stock to be divided equally among the partners. equitable allocation doesn’t necessarily mean equal allotment. The equity of founders should be distributed proportionally to their investment or ongoing role in the company.

Even if equity was originally allocated fairly, the “free rider” issue can arise when one founder stockholder is not contributing significantly to the company’s ongoing requirements and is not tending the company’s growth on a daily basis.

While other co-founders work hard and put in a lot, it may be that the other stockholders are not contributing as much. This can be a complicated matter if founder shares were not being earned fully by the recipient at the time of grant.

In this case, founder stock cannot be transferred, even if the founder quits or ceases contributing to the company. Free riders, in turn, are keen to stay in the company even if they don’t work hard enough.

This could be a problem for your company. You should talk to your corporate services provider about possible solutions (such as issuing equity).

Retaining control

You will need to raise funds and distribute equity if you want to see your company grow. Founders tend to be reluctant to relinquish the power they have worked so hard for. It is possible for founders to retain all of their stock and maintain complete control of the company.

Read More: Crowdfunding in Singapore

But, preserving equity in the company because you fear losing control may be a short-sighted decision. You have a few strategies that you can use to keep your company in control. Even if they only own a small portion of the business, founders can still control it.

Stockholder agreements or other contractual arrangements may stipulate that the decision-making power is given to the appropriate persons regardless of who owns it. You should therefore consider reallocating founder shares using a method that maximizes your control shares.

One important thing to remember about shared ownership is that the company’s value increases so does one’s share. It is better to own just 1% of a billion dollar company than 100% of small businesses.

Bill Gates holds just 1.3% of Microsoft shares, which is worth around U$16billion. This made him one of the most successful people in the world.

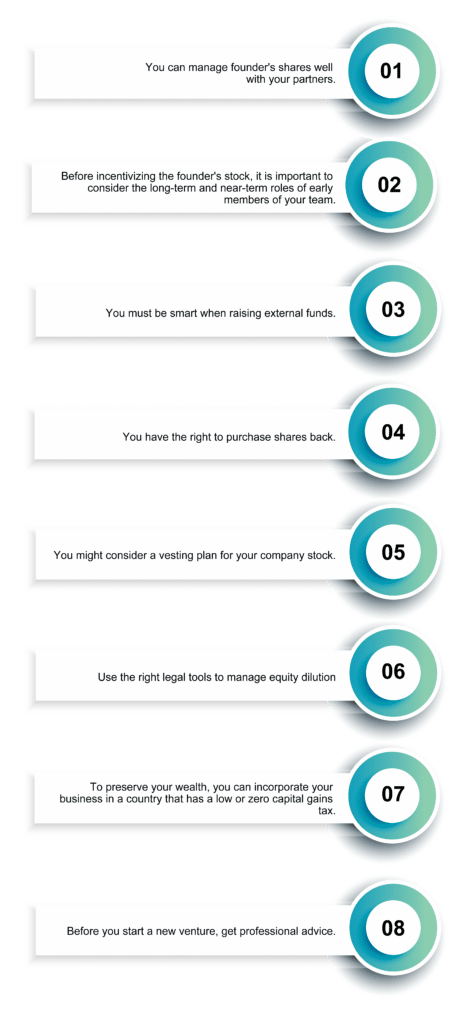

Keys to Managing the Stock of Founders in a New Business

Entrepreneurs often face difficulties managing founder stock. This should be addressed at the very beginning of company incorporation. These tips can help founders save time, money, frustration, and effort.

- You can manage founder’s shares well with your partners.

- Before incentivizing the founder’s stock, it is important to consider the long-term and near-term roles of early members of your team.

- You must be smart when raising external funds.

- You have the right to purchase shares back.

- You might consider a vesting plan for your company stock.

- Use the right legal tools to manage equity dilution

- To preserve your wealth, you can incorporate your business in a country that has a low or zero capital gains tax.

- Before you start a new venture, get professional advice.

Tax considerations

Consider future tax implications to determine if dispensing founder stock is beneficial for the company. Many startups pay founders almost entirely in stock. This arrangement provides tax benefits.

Rather than paying founders higher salaries, the payments are subject to ordinary income taxes. Profits from founders’ stock sales or purchases are considered personal investments and are therefore subject to lower tax rates in most countries.

This is not always the case. In certain circumstances (e.g. option exercise), equity in the USA can be considered income ordinary. Any appreciation in founder’s stock is considered a deferred capital loss. This is because the stock’s value increases are not taxed immediately as ordinary income, but will be treated as capital gains when it is sold.

A loan against the stock can be a great way to get value from it. This is a tax-efficient strategy because no tax is due on the loan amount. However, the interest can be considered an expense. This approach has been used by Jeff Bezos and Elon Musk. This approach might be suitable for your company. Talk to your corporate services provider.

Capital gains are not subject to tax in Singapore. If the founders keep their stock until they die, their heirs are free to sell the stock and not pay any tax on accrued gains. If properly planned, this effectively means that the founder’s gain in Singapore is exempt from tax.

Conclusion

The founder’s stock is a form of compensation for their hard work and dedication. A founder’s stock is a great way to solve many problems that arise in newly formed companies. It is important to be cautious as there are some potential pitfalls.

Knowing the unique features of founder stock and its tax implications can help founders avoid headaches later on.

If you still have any queries related to the Founder’s Stock in a Singapore Company, we are ODINT Consultancy, here to help you out in each & every step of yours.

FAQ’s

Initial founders hold 100% of the equity in their startup. However, they eventually give away most of their equity to co-founders and investors.

Share capital amount around PLN 50,000 is necessary to form a company, and it is also crucial to have NIP or REGON also including the register of VAT payment.

Founding founders who receive early stock are exempt from tax due to its low value. It would be more tax-exempt if the stock is appreciated after the founders have received it.

CEIDG is a business book of entries with info on self-employed entrepreneurs. Any sole trader must register in CEIDG.

Founding founders who receive early stock are exempt from tax due to its low value. It would be more tax-exempt if the stock is appreciated after the founders have received it.