How Much Does It Cost to Start a Business in Spain?

It is important to understand and do an appropriate Research and Assessment about any country’s economic ecosystem. Spain does come with an abundance of natural and man-made resources but it is safer to continue and set foot as a vigilant entrepreneur.

Initially, most entrepreneurs consider starting a business as self-employed (autonomo) or setting up a Limited Company (Sociedad Limitada) since these are the most popular alternatives.

In the past, many business entrepreneurs began as self-employed, but then later moved on to limited companies. The reason behind this was the high price of the initial start of an SL as well as the accounting expenses that are associated with SL.

In this article, we will be discussing more in-depth the various costs of starting a business in Spain as a foreign citizen. We will discuss the various factors that affect the cost to start a business in Spain.

Cost To Start a Business in Spain as a Sole Proprietor

The cost to start a business in Spain as a sole proprietor or freelancer is the least expensive and easiest company structure that you can set up in Spain.

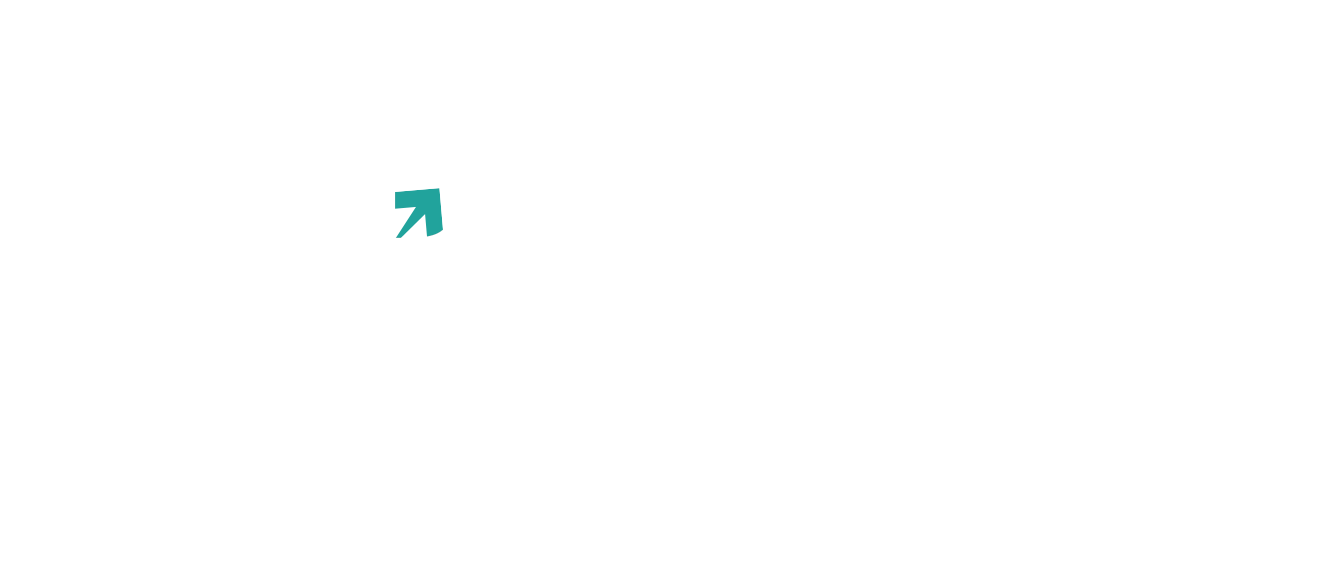

The only things you’ll have to cover are:

- Your work visa or business permit (if required)

- Materials and tools used in your trade

- A commercial premises or office (if applicable)

- A professional association membership (if applicable)

- Accounting assistance if you’d need assistance with making your tax return personal

- Service for Merchants for those who sell items on the internet

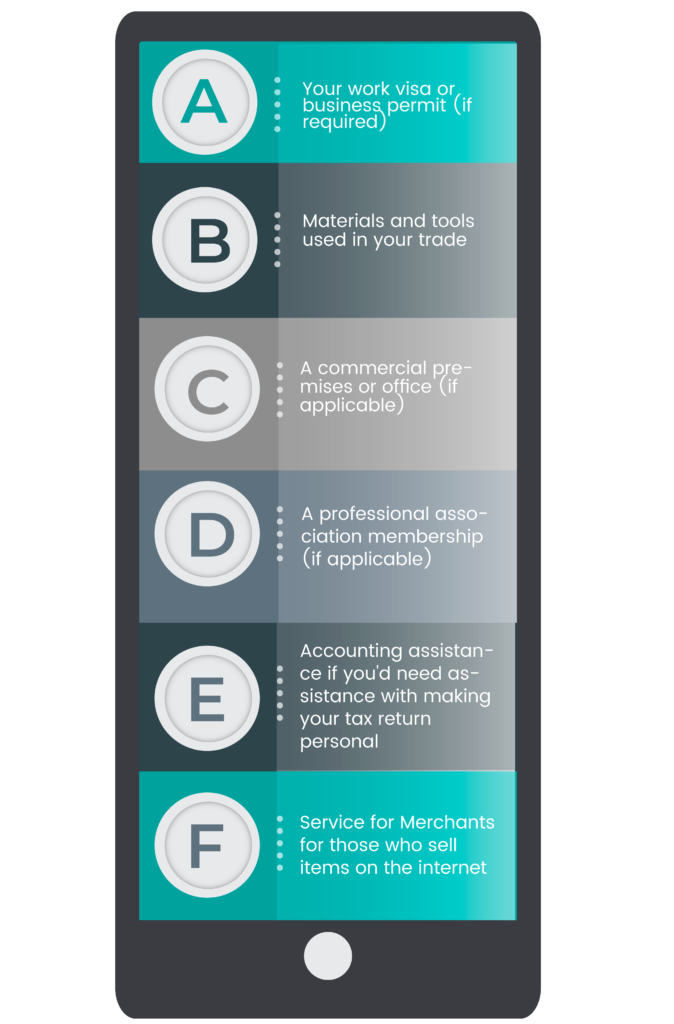

Once you have registered as a self-employed (or sole trader), you’ll be responsible for the following:

- Tax on personal income

- VAT (IVA) an additional 21% you’ll be able to add to every invoice.

- Social Security contributions

- Insurance

- Professional association charges

Self-Employed Worker Visas

If you’re a non-EU citizen, you’ll require an employment visa for self-employment work and to start performing business in Spain. EU citizens are welcome to arrive with an application for NIE right away.

Self-employed persons are required to prove that they possess the necessary qualifications and cash to launch their businesses. A self-employed permit is just more than EUR200, however, the visa is valid for one year.

Cost To Start a Business in Spain as a Limited Company

Limited liability is the most commonly used type of business entity in Spain. However, the cost to start a business in Spain as an LLC requires at least several shares in the firm, which is EUR3000, and an additional EUR1,500 – EUR2,000 for various notary fees, certificates as well as legal fees, and trademarks.

Even though this is higher than incorporating a business as a sole proprietor in Spain in the form of an autonomous is aware that:

- Sole Proprietors are personally accountable for the company’s debts which could result in being unable to access their assets.

- The initial capital expenditure required by limited companies may be used to purchase business assets, which means it’s not “money lost.”

Full-Fledge Cost to Start a Business in Spain

If your work requires creating a business this is significantly more expensive than working as a sole proprietor. You can expect the following cost for starting a business in Spain as a foreigner or citizen.

Minimum set-up capital

A minimum investment of EUR 3,000 of capital is needed, but it is a given that you will get the money back if you decide to dissolve the business.

Statutes of the company and deeds

It is among the crucial aspects of establishing an organization that the deeds and statutes define the route for the business and define what you are allowed and not permitted to do.

Consult a lawyer for advice

A payment of EUR200 shall be made to draft the company’s stature and title deeds of the company This is money well spent according to our own experiences!

Notary fees

The constitution is signed by the company in a notary public. You should expect to pay about EUR600 for this service, but higher if the documents are long and complex.

Accounting fees

The following responsibilities will typically be performed by an accountant for a monthly payment:

- Filing Business Tax Returns

- Preservation of records required by law

- Filing annual accounting reports

Company Costs for registering

Also, you must create a company with the Registro Mercantile, and it is priced at around EUR250.

License for commercial premises

If your business plans to establish premises and you want to open it, you’ll need an opening license.

The price varies based on the local council, however in Malaga for instance the price range is between EUR400 to EUR800. Expect to pay about EUR500 for the permit for opening a shop or office.

Other costs for setting-up

Like those who set up as self-employed in Spain When you set up an organization, there are certain procedures that you can complete yourself. You can also hire someone else to complete these for you.

The requirements are:

- The company tax declaration and getting the tax number of the company (CIF to Spanish) – estimate at minimum EUR100 in this.

- Registering your company with the tax office, and receiving an electronic certificate You should expect to pay a minimum amount of EUR50 to avail of these services.

How to Cover the Cost to Start a Business in Spain?

Ideally, you’ll have a sum of an extra EUR100,000 under your mattress to cover the costs of starting your own business in Spain. In the real world, businesses usually start by borrowing money.

To figure out how much you’ll need it’s crucial to add up your business expenses during the initial few months to ensure that you’ve got enough cash coming in to pay for your expenses, and then begin paying back your loan.

It is also crucial to consider the length of time each expense will last. For instance, a 20-30 year investment in real estate is a good idea if you plan to keep it open for that for a long time. In contrast, it is not advisable to take out a 20-year loan to fund the development of something that will become out of date in the next year and does not have much economic value.

To keep their monthly costs at a minimum, businesses typically rent commercial or business premises offices, instead of investing in real property. This is a smart choice when you’re beginning to get started.

These are the most popular methods of financing a new venture in Spain:

Bank Loan

The majority of banks in Spain lend businesses about 50,000 euros for the time span of 2 to 7 years at fixed rates of interest ranging from 10% and 6%.

Credit Company Loan

If you’re either a freelancer or a sole proprietor you might be able to get a sole-trader credit from a credit institution with less paperwork than a standard business loan.

Family Loan

The borrowing of money from relatives is a common practice in Spain. However, it is important to be aware of how this loan might impact your relationships if you are unable to repay the loan. Consider making a legal agreement for the loan, and then making sure that you secure the loan using some of the personal belongings you own.

Investors

Registered businesses can raise money by promoting their business concept to investors. For this, you’ll require a robust business plan that is well-constructed and a thorough market study. A lot of investors are more comfortable investing when you have a solid client base and a successful track history.

Shareholders

The initial investment to begin your own business can be made by a variety of individuals rather than one. Based on the number of shareholders your company has, each shareholder could contribute to the company with a portion of its capital, with the ownership share divided according to.

Conclusion

While starting a business, entrepreneurs often face significant expenses. Therefore, having knowledge about the costs involved can help entrepreneurs estimate the average amount they may require when forming a company in Spain. This information can further assist entrepreneurs in determining whether their budget can sustain the long-term growth of their firm in Spain. If you’re considering setting up an LLC, you might expect to pay a minimum of 1000 euros for the administrative costs for your start-up in addition to your taxes. However, you may be required to pay additional fees for gathering documents, opening a bank account, and so on.

Get expert assistance with the cost to start a business in Spain from our specialists from Odint Consulting. Our specialists will provide you with the necessary details and help you set up your firm in Spain. Contact us today.

FAQ’s

Anyone who wishes to form a limited company in Spain will need to deposit an amount of at least Euros 3000 in a Spanish banking account.

The process generally takes approximately 4-6 weeks once shareholders have received the NIE and to be a shareholder, each shareholder will require an identification number from a foreign country (NIE).

The standard CIT tax rate for Spain is 25%. Other tax rates are also possible following the kind of business that is taxed, as well as the kind of business. Resident businesses are taxed on their worldwide earnings

Incorporating your own business in Spain can take about three months if you conduct this independently. It is necessary to be present physically, negotiate with the notary personally and fill out a variety of legal documents.