Establish a Special Purpose Vehicle Company In Singapore

If you are figuring out the process of a Special Purpose Vehicle (SPV) for your new firm in Singapore. Though this post is for you, make sure to be with us until the end.

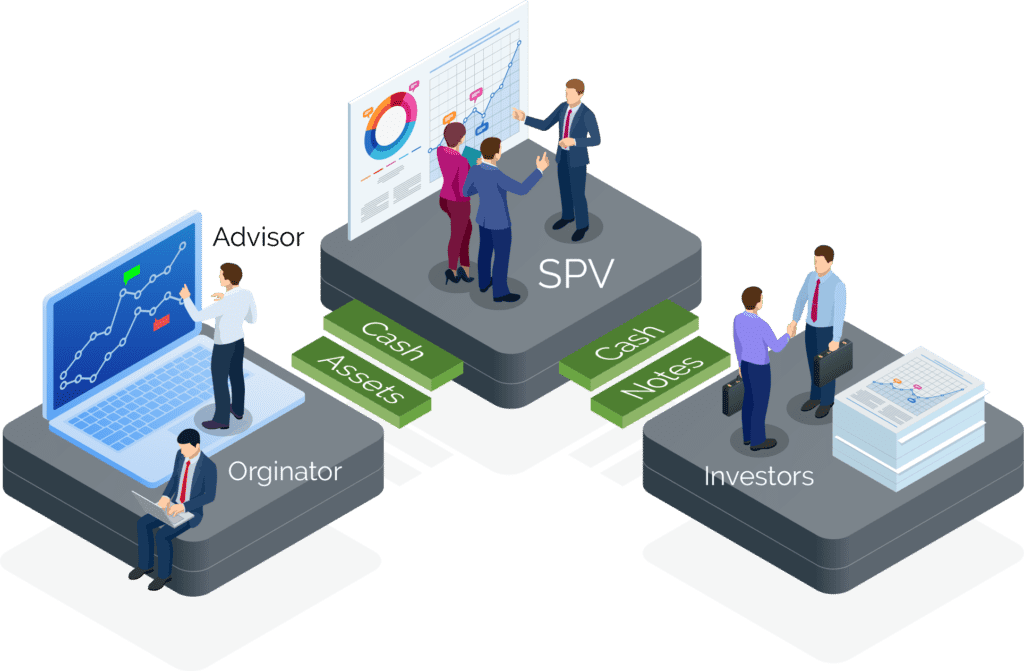

The Special Purpose Vehicle (SPV) — sometimes known as a Special Purpose Entity (or SPE) is a tool for corporate structuring which allows an organization to manage risk or separate it to secure financing and achieve other important business objectives. SPVs are typically utilized to accomplish a specific project or business goal.

Eventually, having an SPV will assist you in your firm growth directly and this article will give you more information about the entire process of setting up your SPV company in Singapore & how to start one, so without any further ado, let’s dive into it.

What is a Special Purpose Vehicle?

The Special Purpose Vehicle (SVPV) is an entity made for an enumeration of a particular, a certain purpose by the investors or firms, usually for a specific period of time. This could include the financing of certain business transactions, risk-free isolating of a project as well as mergers & gains, and more.

The SPV is generally an affiliated subsidiary of the original company but is an entity that is legal in its own right, it has its financial statements. The subsidiary company is shielded from financial risk that is ascribed to the parent company.

The legal status of an independent entity separates its liabilities and assets from the parent company. Particularly the case of the SPV structure can make its obligations secure for creditors even if the parent company is bankrupt.

If it is properly collateralized SPV will therefore be able to have significantly better credit ratings than its parent company and receive more favorable financing conditions.

In certain situations, the SPV can be established as a holding company. In this instance, the equity of subsidiary companies contributes to the creditworthiness of the SPV however, the liabilities of any subsidiary aren’t transferred to the SPV. This is the reason why the term SPV could be correlated to Bankruptcy Remote Entity (BRE).

Who Should Set up an SPV Company

An SPV is a good choice in a wide range of circumstances. Certain of these are discussed below.

1. Startup Companies

Historically, SPE was usually utilized in the form of investment funds. Eventually, in past few years, the SPE is becoming more & more prominent in Singapore for startups.

It is because startups require money that they can get faster and more securely via an SPV. Utilizing the Singapore SPV to start the startup has numerous advantages:

- An SPV could provide a platform for investors to invest money into equity and also receive equity shares in companies that are starting;

- Through an SPV investors can establish syndicates that allow substantial amounts of money may be invested and reinvested in an enterprise;

- With the same SPV, The startup will have to manage only one company rather than many investors.

- The company could attract more investors who would like to invest in the project via an SPV.

2. Better Financing Terms

If a business raises money by allowing investors from the individual investor to purchase shares, it will likely have to deal with the worries of each new shareholder regarding how the company is run which could take a long time and could be difficult to handle.

An SPV could allow the business to steer clear of this problem and connect with just one new investor (the SPV company), instead of many investors. The investors are a part of the SPV and then are invested in the company.

This is a crucial aspect for entrepreneurs of a startup if the decision-making process is based on the use of expertise that investors don’t have (e.g. medical or engineering companies). The directors of such companies want to minimize the influence of investors who aren’t adequately well-informed

3. Risk Segregation

A Singapore SPV can give investors the possibility to invest money in just one project, thus disaggregating its risk.

Additionally, when a company structures its SPV so that it is structured in a way that the SPV includes its assets that investors have an access right to, the investors will have the assurance of knowing that the investment they make is secured through tangible collateral.

Typically, investors of the company might not be able to recover assets should the company become insolvent because different stakeholders (e.g. banking institutions or employees) could have a previous claim to the assets.

Investors who invested funds in a properly constructed SPV might be able to assert a claim against the assets of the SPV even if the company that is associated with them goes into bankruptcy. This extra protection could provide more incentive to potential investors as well as allow the SPV to access money at a lower cost and with better terms.

Additionally, risk mitigation is another reason to create an SPV. Organizations that manage parent companies can legally block high-risk assets with an SPV and safeguard parents from the possibility of the SPV becoming bankrupt.

4. Asset Transfer

SPVs may facilitate the easier transfer of assets. For instance, permissions to use assets (such as a power plant) aren’t easy and sometimes impossible to transfer.

But permits are stored by an SPV as a subsidiary which is the sole owner of all the assets and permits, thus eliminating the requirement to transfer permits. If a sale must be completed, it is possible to sell the SPV in a self-contained, single package.

5. Securitization by Banks or Insurance Companies

They often establish SPVs due to their ease of management of securitized assets. For example, a financial institution might decide to offer mortgage-backed securities whose payment is made through an array of loans.

To safeguard that the owner of mortgage-backed insurances is granted the first-priority rights to get the payments for the loans & the loans need to be legally differentiated from other deficits of the bank.

This is accomplished by forming the SPV and then transferring these loans onto it by transferring them from the bank.

6. Reduction of Regulatory Burden

With the creation of SPVs onerous rules can be evaded. For instance, laws that require owners of specific assets to register or be established in particular jurisdictions could be avoided by establishing an SPV within the appropriate location.

This type of SPV could then be able to hold the relevant assets, without needing to transfer all activities of the parent company to the jurisdiction in which it is located.

7. Companies Wishing to Protect Intellectual Property

SPVs are a great way to safeguard intellectual property when it may be insecure. For instance, a new subsidiary could be established to control IP which will block the existing licensees of the parent firm from gaining access to the IP by way of prior licensing agreements.

This isn’t an exhaustive list of the various structures and functions in which the SPV may be employed. The SPV is an extremely flexible tool that can be adapted and created to meet your specific needs.

SPV Regulations in Singapore

In the majority of instances, a Singapore SPV is formed into a Private Limited Company, so the laws applicable to this kind of company will apply to the SPV.

If you are opening SPVs in Singapore, it is essential to follow the following laws and regulations: SPV in Singapore The rules and laws that apply to it are to be adhered to:

- The Companies Act governs all corporate entities, including the Private Limited Company. Private Limited Company;

- The Banking Actis also relevant when an SPV will be utilized by banks to facilitate financial transactions

- The Securities & Futures Act regulates the issuance of securities, which is a typical financial instrument used in SPVs. The law will apply for instance to startups for fundraising that utilize an SPV to issue securities.

- The Revenue Tax Act applies to all companies that operate in Singapore. It is important to note however that SPVs are subject to somewhat different tax and accounting regulations compared to other Singapore businesses.

- It is the Bankruptcy Act rules that apply to the termination of an SPV.

Steps for Creating an SPV in Singapore

Step 1. Establish the proper business structure

The first step is to must be aware of the reasons that you wish to establish the SPV. This will establish the required business structure.

For instance, it is possible that your SPV could be a subsidiary corporation that is owned by the original entity for purposes of fundraising or it could be a holding company that controls various businesses, which plan to combine, for example.

Step 2. Add your SPV(s)

After you have developed a strategy for your business’s structure you can begin incorporating the SPV or one of them by the structure you have. An SPV is usually organized in Singapore as it is a Private Limited Company (a company) -which is an entity in which shareholders’ liability is capped through the cost of shares.

Your SPV is a corporation, that could be owned by a minimum of 1 and up to 50 shareholders. These could be natural persons or corporate entities, foreign or local. The complete listing of registration requirements as well as information about the procedure for incorporation within our guide about Singapore Company Registration requirements.

In the course of SPV’s procedure for incorporation through Singapore’s Accounting and Regulatory Authority of Singapore, You must draft the corporate constitution. The constitution of a company is a document that outlines the rules for a business’s activities and defines its mission.

Alongside the normal rules and regulations contained in Private Limited Companies’ constitutions and constitutions, the constitution of an SPV must contain the organization that SPV is part of the SPV’s activities and its specific goals.

The objects will likely be decided through a meeting with all parties involved and should be tied to the strategy that was agreed upon in the deal.

In contrast to ordinary businesses in which the clause describing the object generally identifies the type of business the firm wants to pursue, as well as the intent of the company’s receipt and distribution of profits those of an SPV typically outlines the specific purpose and function of the SPV within the corporate structure

Additionally, if the company is formed for a specific purpose and a specific duration the constitution of the company must be able to reflect the specific operating period and outline the appropriate winding-up procedure.

In addition to the requirements for incorporating a business, there are no additional regulatory requirements that must be met in the process of establishing an SPV.

Accounting and Tax Considerations for an SPV

Taxes

When your SPV is registered as a corporation and is assessed at the rate of corporate taxes of 17% for its taxable earnings, in addition to tax incentives for qualified businesses.

One of the tax regulations that apply for Singapore Special Purpose Vehicles is those relating to the Goods and Services Tax.

In some cases, qualifying SPVs are exempted from GST. For instance, Real Estate Investment Trusts (“S-REITs”) which are listed on the Singapore Exchange (SGX) and their SPVs can be granted an exemption from GST to claim GST paid in business costs.

SPV could have to settle stamp duty to facilitate the execution of documents relating to property and shares. Singapore SPVs could also be affected by withholding tax on royalties and interest when they are paid to non-residents.

Accounting

SPVs must comply with the regular year-long filing requirement in the same manner as Singapore private limited companies.

But there are certain specific situations. For instance, if the SPV is created by a Singapore firm that is listed on the SGX the business may be required to include the liabilities and assets of its SPV within its financial statements even though they are distinct entities.

This consolidating of the financials can be required if the business meets all of the following criteria:

- It controls the SPV

- It is subject to variable returns arising from its participation in the SPV

- It has the ability to utilize the SPV to influence its returns.

Conclusion

A Special Purpose Vehicle is a favored business tool, which is often employed internationally and is even used in Singapore. An SPV can be utilized to protect Intellectual property in mergers and acquisitions as well as for various other business-related purposes.

If you’re interested in incorporating your Singapore SPV, we are OnDemand Consultation, here to help you out in each & every step of yours.

FAQ’s

SPVs are often used in specific structured finance applications like asset securitization joint ventures or property transactions, or even to separate the operations of a parent company from its assets or risk.

No. Special purpose vehicles are subject to their assets, obligations, and liabilities that are not owned by the parent company.

The Special Purpose Car costs $2110 to put together.

Benefits of the use of the Specific Purpose vehicle (SPV) to purchase a property

- Profits from taxation.

- Tax relief for mortgage interest.

- Maximize your retirement savings.

- Increase your portfolio of properties.

- Credibility and risk reduction.