If you are looking to register your business under GST, then you need to know every aspect of it. As per the rules laid by the Indian GST council, that is a must for every organization who is having yearly turnover of more than 40 lakh, which has to register its business under normal tax commodity.

The people living in the North-eastern side of India, who have an annual turnover necessity is Rs 10lk, need to get their GST registration done.

What exactly is GST registration?

GST registration is the process through which a taxpayer files for GST. When a corporation has to register its business under GST, a 15 digits unique registration number is provided to them. However, it is recognized as GSTIN, I.e. ( Goods and Services Tax Identification Number ).

GST registration is done via the online GST portal ( website). However, you need to submit the required document for the registration of GST. Every business or individual must have their GST number.

It is an illegal offense to run a business without having a GST register and to avoid such mishandling, government has severe penalties for non-registration.

So, to avoid such penalties or getting into any trouble, I’ll be briefing you on complete details about the GST Registration process. So, without any further ado let’s get started.

Why GST?

The Indian Goods and Services Tax (GST) was introduced as a statute in 2017 to rectify two of the biggest criticisms of indirect taxation prevalent before then. These rectifications were the cascading effect of tax and the multiplicity of taxes – from excise and customs duties to VAT(Value Added Tax) and octroi. Further, these taxes differed from state to state, thus making production, sale, and transport of goods very complicated and difficult.

More than 82% of the total number of countries in the world use some form of the GST. The GST unifies tax rates for goods and services sold within the country. The system also makes it easier to pay all taxes online at the place where the final goods are sold for consumption (a destination-based tax).

Why GST?

The Indian Goods and Services Tax (GST) was introduced as a statute in 2017 to rectify two of the biggest criticisms of indirect taxation prevalent before then. These rectifications were the cascading effect of tax and the multiplicity of taxes – from excise and customs duties to VAT(Value Added Tax) and octroi. Further, these taxes differed from state to state, thus making production, sale, and transport of goods very complicated and difficult.

More than 82% of the total number of countries in the world use some form of the GST. The GST unifies tax rates for goods and services sold within the country. The system also makes it easier to pay all taxes online at the place where the final goods are sold for consumption (a destination-based tax).

Who is eligible for GST registration?

GST Registration is imposed on the following people & various businesses;

- Non-Resident Taxable Person & General Taxable Person

- Individuals subject to the reverse charge mechanism

- Any e-commerce aggregator

- Firms with an annual turnover of Rs.40 lakh or more. Although, this price differs in different states, like 10lk in Uttarakhand, HP, J&K & North-East states of India.

- Multiple custom distributors and delivery agents

- A person who sells things via an e-commerce store.

- A person who offers database authorization and online data, being apart from India to an individual who’s living in India.

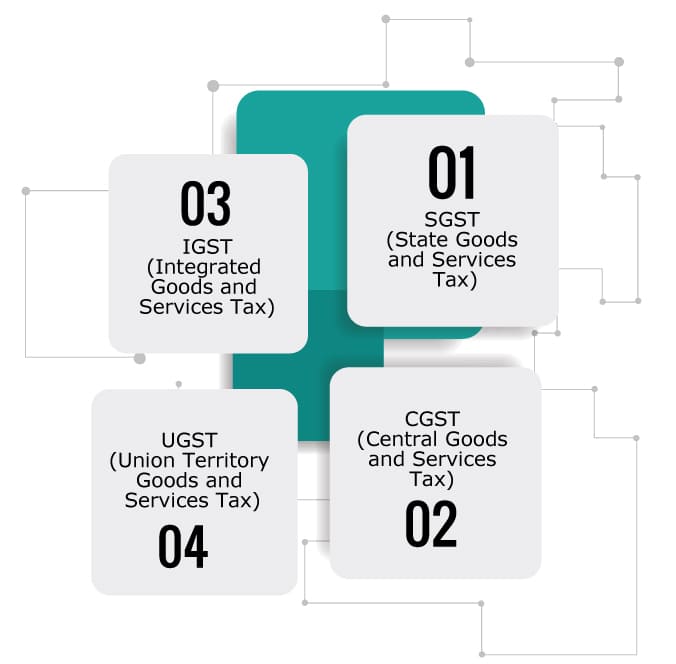

Types of GST Levied in India

For the purposes of distribution of levies between federal forms of government, GST has been classified into the following types:

● SGST (State Goods and Services Tax): The state government charges this tax on intra-state goods and services. Although the revenues are collected by the State Authorities where the transaction is questioned.

● CGST (Central Goods and Services Tax): The CGST is charged on the intra-state transaction of goods and services, and it is imposed by the central government. Other concerned authorities are also responsible for collecting this revenue.

● IGST (Integrated Goods and Services Tax): In this type of tax, charges are imposed on interstate transactions of goods and services and also applied on imports and exports of services. Also, both state and Central governments share the revenue collected through this IGST.

● UGST (Union Territory Goods and Services Tax): The UGST is imposed by the union territory body and charged on all transactions carried out in Indian union territory. It is similar to payment rules on the GST platform.

The State or Union Territory within which the final consumer resides, collects and distributes this tax between itself and the Union Government.

Types of GST Registration

GST Acts have several ways of Registration. It is mainly divided into 4 different parts, which are based on your type of firm or as an individual, so choose the type which fits you.

- Normal Taxpayer

Most types of business in India fall into this group. To be a formal taxpayer, you don’t have to do any kind of deposits, as there are no such limits for this type of taxpayer in this category. Normally such types of taxpayers are small firms & Individual people of India.

- Casual Taxable Person

Whosoever wishes to open a stall or a seasonal business can enroll for the casual taxable type. To register for the GST, you need to deposit a handsome amount that is equal to the GST liability. Registration is only credible for the 3 months & can be renewed.

- Taxpayer’s Composition

To be in this category you need to fill out the form under GST Composition Scheme. Also, you have to deposit a flat in this type of GST registration. Although, there is no availability of Input Tax Credit.

- Non-Resident Taxable Individual

This type of tax is imposed on these people/businesses who stay abroad or do business in India. To register for the Non-Resident tax under GST, you need to deposit a handsome amount that is equal to the GST liability.

However, this type of registration is only credible for the 3 months & can be renewed before the time expiration date to continue the services.

How to Obtain the GST Registration Process Online

To obtain the GST Registration process online, we have listed down the step-by-step process to ease your work.

Step 1: Visit the GST site, I.e. https://www.gst.gov.in.

Step 2: Now get into the ‘Taxpayers’ menu & tap on to ‘Register Now’ link/button.

Step 3: Tap onto the ‘New Registration.’

Step 4: Fill out the necessary information;

- You will see a drop-down menu, I.e. ‘I am an option, simply choose a ‘Taxpayer’ in it.

- Select your appropriate state and district.

- Write down your firm’s name.

- Fill out the firm’s PAN number.

- Enter your email & contact number in the suitable sections. As the Time Password will be sent to your given email & contact number.

- Write down the word/number shown in the picture on the screen & simply tap on the ‘Proceed’ button.

Step 5: Enter the received OTP on your given emails or number. Now click on the ‘Proceed’ button.

Step 6: After the completion of the 5th step, now you might be seeing a Temporary Reference Number (TRN) on your display. Simply write it down & keep it safe for future purposes.

Step 7: Now get back to the GST portal and choose ‘Register’ from the ‘Taxpayers’ menu.

Step 8: Just tap on the TRN button.

Step 9: Fill out the Temporary Reference Number & captcha info. Now click to Processed.

Step 10: Again you will be received a One Time Password on your given email & number, simply write down the OTP & tap to ‘Proceed.’

Step 11: Though the page will display the status of your registration. On the right side of the page, you will find an ‘Edit icon’ just tap on it.

Step 12: You will find 10 parts on this page. All required info should be filled in, & all necessary documents should be attached.

- Photographs

- Evidence of business address

- Bank data such as your/business account number, Name of bank, Location of the bank branch & bank IFSC code.

- Authorization form

- The taxpayer’s constitution

Step 13: Get into the ‘Verification’ page and examine the statement form, then submit the form using the following ways;

- Via Electronic Verification Code (EVC). The final OTP will be sent to a given number.

- Via e-Sign technique. The OTP will be sent to the number connected to your AADHAAR.

- While filling out the form for a firm, the applicant should fill the form via Digital Signature Certificate (DSC) method.

Step 14: After the successful completion of a form, you will receive an Application Reference Number (ARN) which will email the given contact number & emails.

Step 15: To check the status of your GST registration, simply visit the GST website & check out the stage of ARN.

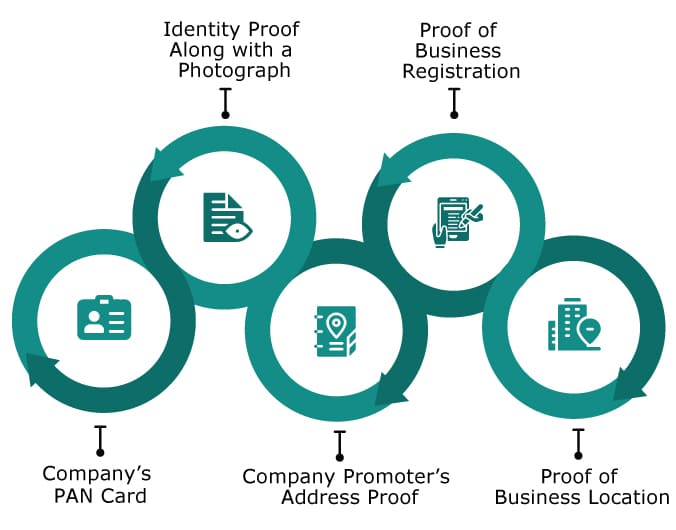

Documents Required For GST Registration

Regular taxpayers registering for GST registration must present the following documentation.

- The company’s PAN Card:

The GSTIN links GST registration to the business’s PAN. As a result, before applying for GST Registration, the business entity must obtain a PAN.

- Identity Proof along with a Photograph:

PAN, passport, driving license, Aadhar , or voter’s identification card can be obtainable as identity proof along with photos. Photographs of the promoters/owners must also be supplied.

- Company Promoter’s Address Proof:

To address evidence, papers such as a passport, driving license, Aadhaar , voters’ identity, and ration card can be provided.

- Proof of Business Registration:

There is no need to submit this paperwork for a sole proprietorship because the proprietor and the entity are almost the same. It must present the partnership deed in the event of a partnership firm. In case you are an LLP or a company, you must submit the MCA incorporation certificate. Other business entities, such as a Society, Faith Denomination, Club, Government Agency, or Body of Persons, are necessary to submit a registration certificate.

- Proof of business location:

It is required to address evidence for all commerce locations integrated into the GST registration application. The following papers can prove your address meant for GST registration.

Other Required Documents:

- Your bank account statement & one canceled cheque

- Confirmation of incorporation or firm registration Digital Signature Director’s or Promoter’s ID, address proof, and pictures

- Letter of Authorisation or Authorised Signatory Board Resolution.

GST Registration Via Authentication of Aadhaar

Using your Aadhaar card anyone or new enterprises may acquire their GST registration. The procedure is simple and fast. The current procedure got onto work on August 21, 2020. Here is the required method for opting for Aadhaar authentication:

- At the time of GST registration, you’ll have the choice of using Aadhaar authentication.

- A simple tap on the ‘YES.’ & you will receive the authentication link on your given email & contact number.

- Click on the authentication link.

- Write down your Aadhaar number & tap to ‘Validate’ it.

- As all your data has been examined, an OTP will be sent to your contact number & email.

- Just write down the OTP to complete the transaction. In the next 3 working days, you will have your GST registration.

Check the Status of GST Registration

- Visit the official GST.

- Get onto the ‘Services, area ‘ then click onto the ‘Registration,’ and then ‘Track down the Status of your GST application.’

- Pin down your ARN number along with the given Captcha code & simply tap onto the SEARCH button.

- You will find the status of your GST registration;

- Liable status

- Temporary status

- Pending confirmation status

- Verification against mistake status

- Departed status

Download the GST Registration Certificate.

The method for obtaining the GST Registration Certificate is as follows:

Step 1: visit the GST website, I.e. https://www.gst.gov.in/.

Step 2: Choose to ‘Login.’

Step 3: Put down your GST registration login and password. Tap to log in.

Step 4: Now select the ‘Services.’ & then choose the ‘User Services.’

Step 5: Tap onto the ‘View option/Download option to get the Certificates.’

Step 6: Just Tap on the Download’ button & the registration certificate will contain info about your entire tax transactions.

The Benefits of GST Registration

The following are the fundamental benefits of GST registration:

- Multi-National Firms can have big projects.

- Commodities can be bought and sold online.

- Commodities can be bought/sell in the entire country.

- As a GST registration is a legitimate entity registration, it works out as legitimate documentation.

- An input tax credit is usable when buying products or services.

- Via GSTIN you can create your current bank account.

- It helps you in building your firm’s brand value.

Penalties for Late Registration Under GST

It is a criminal violation if you do not pay your tax or pay less, then you will be fined 10% of the amount you own. However, the minimum fine for this is Rs.10,000.

Apart from this, if you try to misuse or trying to dodge the tax, then the fine is 100%, of the mandatory tax amount.

Exemption From GST Registration

People and Businesses inscribed below are omitted from GST registration:

- Firms that do the supplies of a product/service which do the reverse payment.

- Firms that create non-GST/non-taxable allowances.

- Factories of immune/nil-rated products.

- Companies that come under the exemption threshold.

- Agriculturists.

Conclusion

If you are running a business or looking to start your new firm, it is good to register your firm under the GST & have a GSTIN number. It will provide you with an enormous benefit to your brand & keep you safe from all the criminal offenses.

To know more about the GST registration process we are ODINT Consultancy, here to help you out in each & every step of yours.

FAQ’s

You will be charged zero rupees for the registration of the GST via an online portal.

CEIDG is a business book of entries with info on self-employed entrepreneurs. Any sole trader must register in CEIDG.

There is no such price for the GST registration, Eventually, this GST registration process is quite a time taking. To fasten up the work you can hire a CA, who will charge you a fee as per their pricing.

Absolutely yes, you may let down your GST number.

The CBIC authority submitted the Quarterly Return Filing and Monthly Payment of Taxes proposal under Goods and Services Tax (GST) to help small industries owners whose turnover is minor than Rs.5 Cr.

All traders whose annual turnover is more than ₹ 20 lakh will have to register under the GST.

The state levies road tax, toll tax and, environmental tax, and it has not been brought under GST.

Contraceptives, milk, vaccines, organic manure, earthen pots, beehives, live animals except for horses, maps, books, bulletins, magazines, non-judicial seals, kites, and pooja props are exempted from GST.