Board Of Directors Definition

The Board of directors is the group of people who are elected individuals, having the responsibility of representing the objectives of a firm in support of the firm’s stakeholders. This corporate body makes up the top-most layer of hierarchy and puts its concern on ensuring that the firm is proficiently achieving its targets.

The main duty of the board of directors is to hold a company and keep it on its toes even during a tough situation. Other duties of the board of directors are financial decision-making, the company’s complete management, policy establishment, and law compliance.

Structure of Board of Directors

The structure of a Board of Directors varies by company size, type, and jurisdiction but typically includes:

1. Chairman

The highest authority in the BOD, responsible for leading board meetings and ensuring effective governance. Often, the chairman is also the CEO in some organizations.

2. Managing Director

Oversees the company’s day-to-day operations and executes the board’s strategic decisions.

3. Executive Directors

Company employees who handle internal operations, marketing, finance, and business development. They represent the company’s executive interests on the board.

4. Non-Executive Directors

External advisors who provide independent perspectives and unbiased decision-making. They ensure transparency and accountability.

5. Other Key Positions

- Chief Financial Officer (CFO)

- Vice Presidents (VPs)

- Zonal Heads

- Audit and Compliance Chiefs

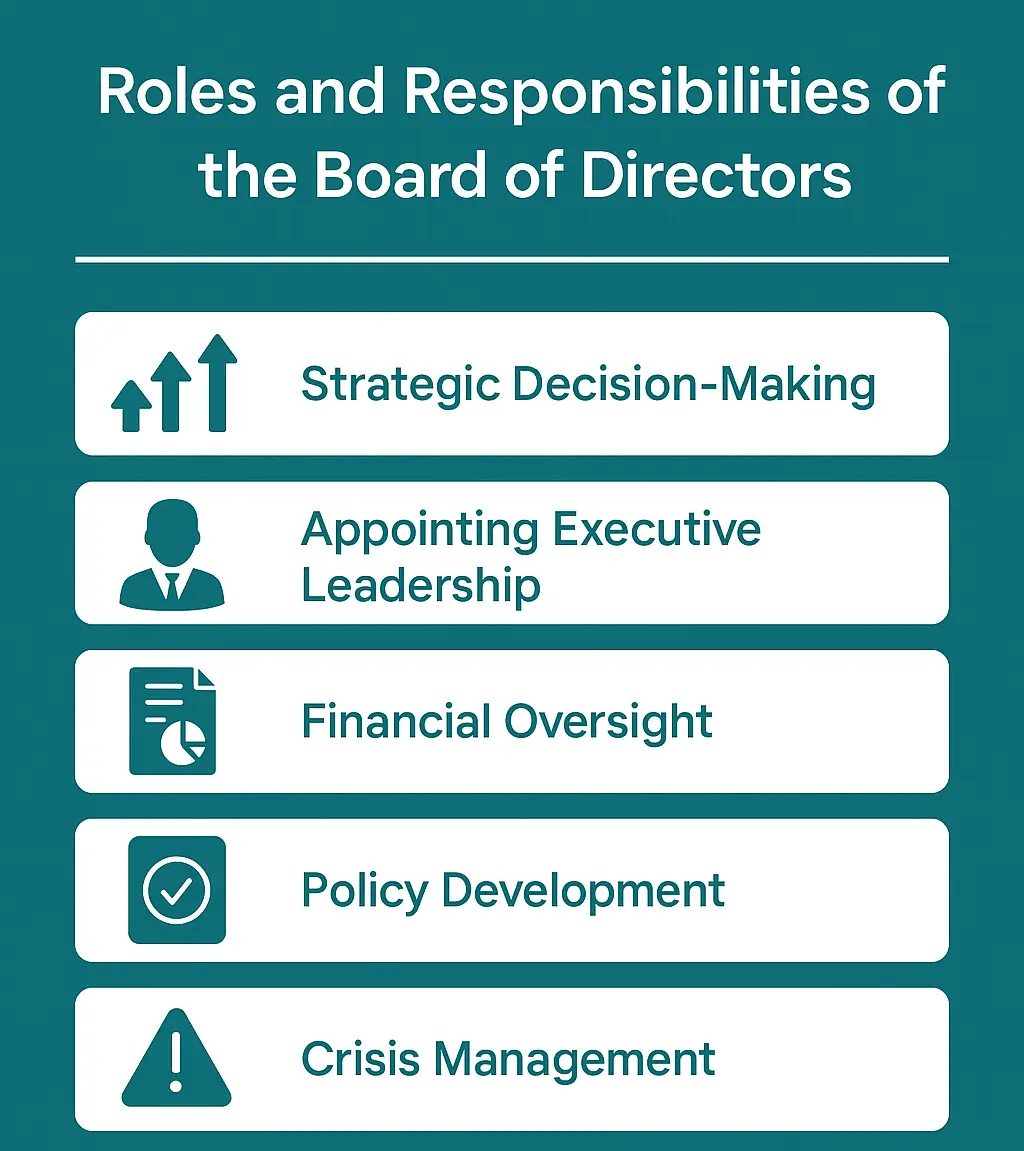

Roles and Responsibilities of the Board of Directors

The Board of Directors plays a vital role in corporate governance. Their key responsibilities include:

- Strategic Decision-Making: Approving company strategies, mergers, acquisitions, and key business initiatives.

- Appointing Executive Leadership: Hiring, evaluating, and, if necessary, removing the CEO and senior executives.

- Financial Oversight: Approving budgets, monitoring financial performance, and determining dividend payouts.

- Policy Development: Establishing corporate policies and ensuring legal compliance.

- Crisis Management: Guiding the company through financial or reputational crises.

Aspects of the Board of Directors

Tenure:

A director’s term on the board typically ranges from 5 to 10 years, depending on the company. A special resolution may be required to grant tenure extensions.

Board members are often compensated with an annual salary and stock grants. According to a 2017 survey, 50% of large U.S. corporations paid board members more than $300,000. Additionally, members may receive extra compensation for attending meetings.

Liability:

As a corporation is a separate legal entity, its directors are generally not personally accountable for its obligations. However, they can be held liable for losses caused by their actions or negligence.

- Sources for Director Information:

- Official websites of public companies.

- A company’s Incumbency Certificate, which lists key organizational roles.

- The “About Us” section on the company’s website.

- Business journals, news articles, and financial publications.

- Corporate directories and business listings.

Disqualification of a Board of director

A director may be temporarily suspended or permanently disqualified for the following reasons:

- Misuse of company resources or funds for personal gain.

- Fraudulent activities or misconduct.

- Continuing business operations after the company has become insolvent or bankrupt.

- Failure to maintain accurate business accounts or publish financial records.

- Failure to submit company tax filings.

- Conducting business despite the company’s inability to meet financial obligations.

International Structure of a Board of Directors

Beyond the USA, the structure of a BOD is more diverse. The organization is often broken into 2 principal boards:

- Supervisory

- Executive

Workers and stockholders select the members of the executive board, which is composed of firm insiders. The board of executives is usually chaired by the firm’s CEO or a senior officer. The panel is usually in charge of managing the day-to-day processes of the firm.

Whenever working with the corporation, the advisory board is concerned with a wider spectrum of problems and functions similarly to a conventional U.S. board. The panel’s chair changes from time to time, but it is always somebody other than the CEO.

Also Read: Officers of a Corporation

CEO vs. Board of Directors: Key Differences

The Chief Executive Officer (CEO) and the Board of Directors (BOD) play distinct but interconnected roles in a company’s governance structure.

|

Aspect |

CEO |

Board of Directors |

|

Position |

Top executive officer |

Governing and oversight body |

|

Role |

Manages daily business operations |

Sets corporate strategy and oversees management |

|

Authority |

Executes board-approved strategies |

Appoints, supervises, and can remove the CEO |

|

Accountability |

Accountable to the Board of Directors |

Accountable to shareholders |

|

Focus |

Short to mid-term business performance |

Long-term company vision and governance |

|

Decision-Making |

Operational decisions |

High-level strategic decisions |

Conclusion

So, incorporated with elected people who work as agents for a firm, a BOD acts like a substitute for stakeholders. The non-profit firms, profit entities, and also some government organizations have a group of BODs.

The board of directors can differ from firm to firm, and from the nation in which the firm is operating. Every corporation sends out provisions for the board as per the state corporation commission rules. Usually, the boards can have up to 30 members, but huge complex public firms may have more than 30 members.

FAQ’s

Shareholders typically elect board members during the company’s annual general meeting (AGM).

The board ensures the company’s long-term success by overseeing management, making strategic decisions, and protecting shareholder interests.

Yes. Directors can be removed for misconduct, mismanagement, or violating fiduciary duties.

No, it is not mandatory but is highly recommended for better governance and credibility.