In modern times the requirement for a Chief Financial Officer has increased. The need for a CFO can be mostly seen in medium to large size firms. Successful firms today see the CFO role as more of an asset than an expenditure.

So now the question stands what has increased the need for a Chief Financial Officer in this modern world?

Keep reading this article to know what is exactly a CFO, the roles and responsibilities, the current demand of a CFO in recent times and how you can become a Chief Financial Officer.

Chief Financial Officer (CFO)

Chief Financial Officer is the highest-ranking position as a financial expert in an organization and is in charge of the company’s finances.

CFO is a position at a job that is purely involved in the department of finance. The CFO is the firm’s top executive.

Establishing a leading finance and accounting group, ensuring incomes and expenditures stay in harmony, overseeing FP&A operations, making mergers and acquisitions suggestions, acquiring financing, working with department managers to analyze financial information and design funding levels, attesting to the reliability of documents, and consulting with company forum of directors and the CEO on numerous strategic approaches are all the duties of a CFO.

The most valuable CFOs are innovators who build the future by collaborating directly with upper executives and aren’t afraid to make specific recommendations. They also determine technology direction, particularly in fintech, and offer suggestions based on their financial and business experience on anything from distribution chain to marketing.

Eligibility To Be Chief Financial Officer(CFO)

Some of the degree qualifications and skill sets that can make any individual eligible to be a Chief Financial Officer are as follow:

- A CFO must have a degree in accounting or finance, as well as advanced business education, such as an MBA.

- A Chief Financial Officer must also have prior expertise in analysing data in order to offer financial and organisational planning suggestions.

- Workers in this position must be able to foresee and provide a strategic vision to the business based on both internal and external data, as well as provide advice on industry-specific difficulties and possibilities.

- In order to be eligible for a CFO, one must have both hard and soft skills. Hard skills include: data analysis, budgeting, and GAAP and soft skills include: management and leadership skills, great communications, ability to negotiate and many more.

- A Chief Financial Officer must have a thorough understanding of financial innovation, including its evolving nature, potential choices, and implementations, as well as how to make financially wise choices about IT investments and infrastructural facilities, also how to interact with and enlighten employees to ensure broad implementation across the organisation.

Work Of A Chief Financial Officer

The Chief Financial Officer serves as a strategic advisor to the CEO and oversees the company’s monetary activities, including being accountable for the finance and business experts that conduct operations of the company.

The work of a CFO is divided into several categories they are as follows:

Liquidity:

The liquidity section ensures that the firm is performing its financial commitments efficiently and has adequate cash flows. Treasury groups are usually on the lookout for the company’s net profit. The Finance department is well-versed in handling the organisation’s financial condition and monetary reserves, which include current liabilities, outstanding, and stocks.

Reporting:

Reporting is one part of the job which is extremely exhaustive and time taking for the CFO. In this process, the company’s financial specialists collaborate to prepare all of the company’s financial reports for shareholders, employees, lenders, governments, and regulatory agencies.

Investment Return:

One of the most essential functions of a Chief Financial Officer is to assist the organisation in achieving its financial objectives. A corporation can get the maximum risk-adjusted return on equity and return on investment with the help of a CFO. A Chief Financial Officer must be able to recognise the firm’s core elements and how to convert those critical elements into financial variables. This is when the CFO’s financial planning and evaluation team steps in to assist him.

Ability to predict accurately:

Their capacity to correctly predict expected future outcomes is a crucial aspect of their worth to an organisation. This involves financial prediction and modelling depending on the internal factors that may affect income and expenditure, as well as the firm’s prior performance. The CFO’s job is to interpret the numerous functional estimates in order to generate financial targets for the CEO and investors.

Internal aspects comprise sales patterns, labour and HR-related expenses, prices of raw materials, and more, while external data sources could include investment potential costs, market growth shifts, rising competitors in the market, and technological advancements.

Responsibilities Of A Chief Financial Officer

The CFO’s responsibilities have extended and grown into diversified roles with the exceptional requirement to become more precise and faster as firms have changed due to their complicated and diffused framework.

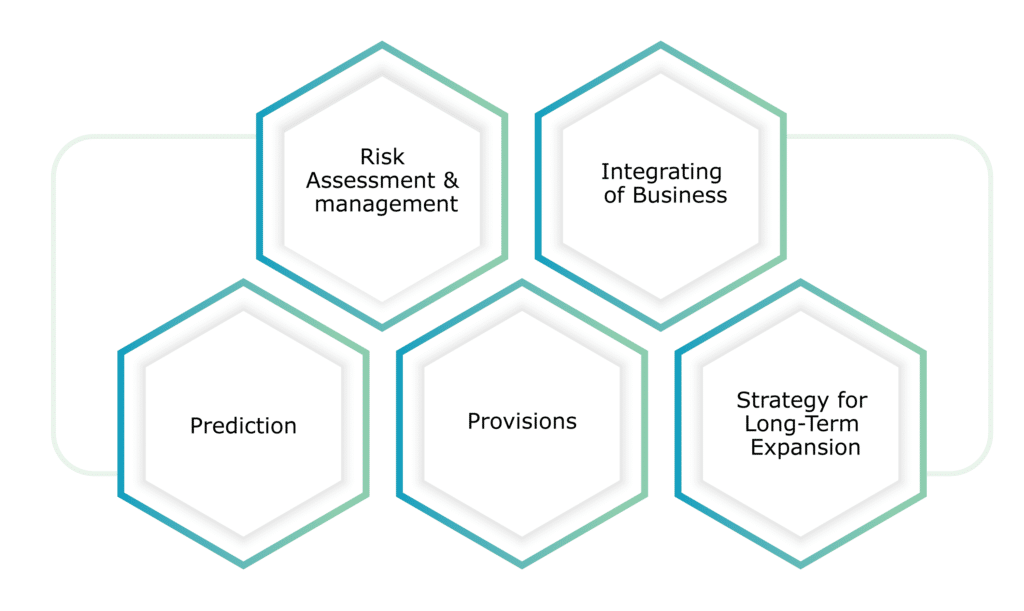

However, a CFO’s tasks and responsibilities differ depending on the business they are in. A successful Chief Financial Officer must succeed in each of the following disciplines.

- Risk assessment and management: Danger is an inevitable reality. Businesses deal with it occasionally.

- Integrating of Business: CFOs and other corporate leaders are frequently caught between ineffective and competing ambitions. The shortfall, loss of production, high costs, and dissatisfaction result from the lack of coordination or imbalance. The Chief Financial Officer is one of the executives who have the clearest vision of the company and is best positioned to guarantee that the business plan, financial analysis, and budgeting are completely integrated into all aspects of business activities. Rigid CFOs can never be tolerated in any firm. They must be adaptable because it is their responsibility to formulate and build regulations and procedures as well as manage the business earnings.

- Prediction: A CFO should always be willing to take chances and should be adaptive to changing circumstances, including the willingness to question conventional wisdom when required.

- Provisions: A smart CFO understands that his scope of operations is broad. If a Chief Financial Officer wants his or her company to compete globally, he or she must be proficient in different scenarios and predictions, as well as predictive modelling and stress testing.

- Strategy for Long-Term Expansion: Fiercely competitive rivalry has a significant impact on any company’s growth. Intense competition from both current and emerging competitors in the market has made attaining long-term development a top priority. Modern CFOs have no problems defying the old paradigm of number crunching in order to become a vital advantage and add actual benefits to the firm.

Qualities Of A Chief Financial Officer

The expertise of a brilliant CFO distinguishes him or her in the industry. A Chief Financial Officer will have both elevated operational and financial knowledge. They’ll also be well-versed in forward-thinking methods, modelling, management, and other areas.

A CFO must have the following characteristics:

- Strong Management: A terrific CFO should have solid financial capabilities as well as outstanding leadership capabilities. Many financial experts are known for their smooth attitude. A Chief Financial Officer ought to be capable of leading both the financial and operational teams. A strong CFO should be able to create data-driven specific recommendations and execute those plans.

- Forward-thinking Approach: A forward-thinking approach is one of the most important characteristics of a successful CFO. Records management is the responsibility of accountants, bookkeepers, and controllers. They keep the accounts tidy and correct while creating progress reports. They also assist in the creation of budgets based on statistics, but their functions are backwards-looking. A CFO specialises in protracted strategy. A prediction is one of a CFO’s most effective tools.

- Extensive Financial Management Experience: Several CFOs join the organisation having been elevated from Controllers to Chief Financial Officer in an old role. This rise, however, does not always accompany a change in experience, training, or mentoring. Your CFO would have gained this high-level financial experience over time if they made this change years ago.

- Connections of High-Quality: A foundation of high-quality contacts is another attribute that exceptional CFOs bring to the game. Connections can have a massive effect on a company’s performance in the financial world. This is true in a variety of scenarios, including financing, investment, and enhancing supplier relations and agreements.

Conclusion

In recent times a CFO is responsible for more than just the company’s finances. They are truly creative figures who are the masters of strategy, business, and people management. Working across inter-and intra-organizational barriers has become a requirement of their employment. A Chief Financial Officer’s job is extremely demanding and comprehensive, but it can also be highly gratifying. No one knows how the role of the CFO will change in the coming future, but it is more likely to expand. Because a Chief Financial Officer handles multiple functions, it is preferable to engage with a company that provides CFO services rather than employing a CFO.

FAQ’s

Making your way up to the post of chief financial officer often requires 10 to 15 years of experience in the sector. A mid-size firm’s chief financial officer will have at least 10 years of working experience, and in some situations, much more. To get this position, you might have to take a stance outside of your current employer.

A career as a chief financial officer can begin with a range of methods. You’ll have a benefit working in corporate treasuries because you’ll be in charge of revenue management and financial expenditures.