Overview: Filing TDS Return Online

TDS on salary refers to the tax that the employer deducts from the employee’s salary when they pay it. The employer deducts your money and deposits it on your behalf with the government.

TDS was created to collect tax directly from income sources. This concept states that a person (deductor), who is liable for making payment of specified nature to another person (deductee), shall deduct tax from the source and remit it into the Central Government’s account.

A credit would be granted to the person whose income tax was deducted at source based on Form 26AS/TDS certificates issued by the deductor.

Online TDS returns can be filed by any employer who has a valid TAN (tax collection and deduction account number). Individuals and businesses must deduct tax at source for any payment made under the I-T Act. The required time frame for depositing the same is met. These payment types are:

- Salary

- Commissions for insurance

- Horse racing wins can bring in income

- Income through “Income on Stocks”

- You can earn income by winning the lottery or solving puzzles.

- Payments for National Saving Scheme and other programs

If the e-TDS was taken from an assessee’s income, they can file an e-TDS return. The assessee must file the return by the due date, or they will be penalized for late filing. These are the categories of assesses that can electronically file their TDS return each quarter:

- Company in India

- Audited accounts of persons u/s44AB

- Individuals who hold an office under the Government

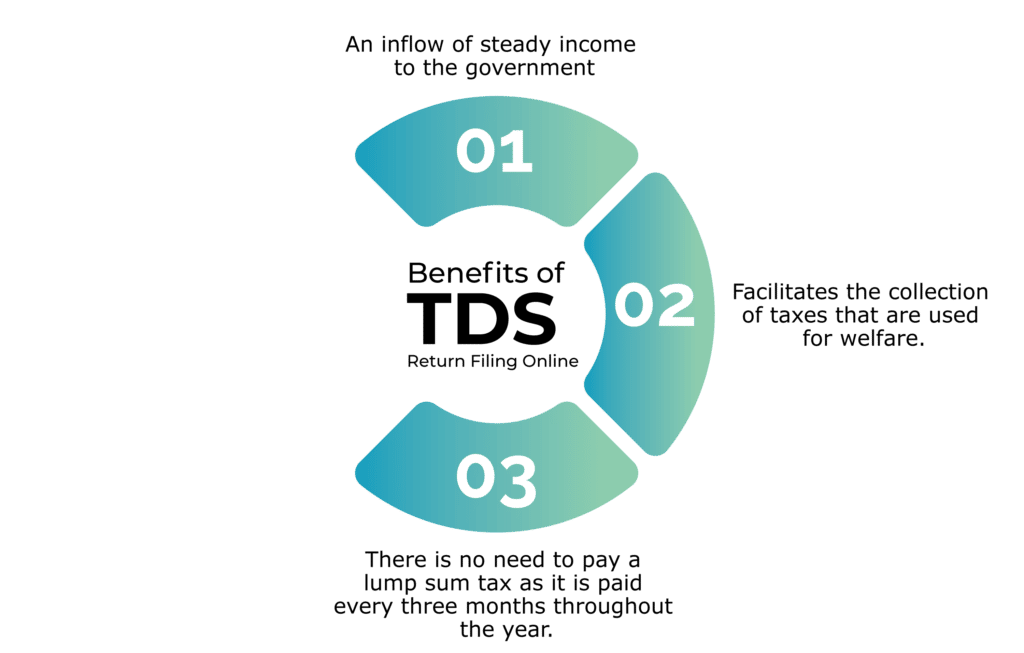

Benefits of TDS Return Filing Online

According to the IT Act of 1961, filing a TDS return is required. It also provides some benefits for individuals or companies. There are a few benefits to submitting a TDS return and getting information about the status of your refund request:

- An inflow of steady income to the government

- Facilitates the collection of taxes that are used for welfare.

- There is no need to pay a lump sum tax as it is paid every three months throughout the year.

What can we do to help you file your TDS return?

Each deductor should present a TDS return to the Income Tax Department of India each quarter. Each detail must be precise and accurate. It can be difficult to keep up with quarterly payments. If you don’t pay on time, you could face a severe penalty.

IT departments determine the rate of TDS based on expenses they have recognized. The prescribed rate of deduction can vary. It can be difficult to remember the threshold limit when making payments.

Before you file your TDS Return on Time, here are some things to keep in mind

TDS returns can be filed online for anyone who has had their TDS reduced. You must prepare your return within the timeframe. Individuals who are considered regular defaulters in India can face a severe penalty. It is important to submit e-TDS returns within the time frame.

It is crucial that the deductor deposits the TDS subtracted to the relevant government department with all the details.

Below are the deadlines for the deposit of the amount by the deductor and the time limit within which the deductee must file for a TDS refund. To avoid a penalty, you must adhere to the schedule.

Online TDS returns must be filed by every person who has submitted the TDS deduction. The quarterly submissions should be made by the deductor to the Income Tax department.

You can choose from different forms depending on the changes in the TDS deductions. In the statement, the PAN details of the deductor and deductee should be included. The statement should include information about TDS Challan and tax details, among other important information.

The statement/ TDS Return is an online TDS return that summarizes all transactions with quarterly TDS payments. This statement ought to be submitted to the division for income tax by the deductor.

TDS returns must be submitted by all deductors. It includes details about TDS deductions and deposits made. It should contain the PAN card information of both the deductees as well as details about the deductor and taxpayer, as well, as information about TDS Challan and any additional information that may be required.

Validation of TDS Returns

Below is the procedure for validating the TDS Returns

- First, you must include all relevant information in the file.

- Once you have filled in the details, you must update them on the portal’s validation utility tool.

- This tool is available free of cost online at the NSDL site.

- The File Validation Utility (FVU), will report any errors in the file.

- Before the file is sent through the verification process again, you must make the necessary changes.

Criteria for filing a TDS Return

Employers and organizations that have a Tax Deduction and Collection Account Number can file TDS returns. TDS must be filed to claim the income tax act-exempt payments below.

- Salary payment

- Any winnings from lotteries or puzzles.

- Commissions for insurance

- Any income generated from Income on Securities

- Horse racing wins can generate income.

- Pay-outs made to the National Savings Scheme or any similar scheme

Revisions to TDS Returns

Online TDS returns will not reflect any errors due to incorrect challan details or incorrect PAN details. A revised TDS return is required in such instances.

Two files are required to file a revised TDS return. One is the consolidated file that contains details about the quarter’s deductions, and one is the justification file which contains information on the errors in the return.

Time for filing TDS Return

If you have paid more than the tax amount due online, you can claim a TDS refund. The amount of time it takes to refund depends on whether the income tax returns were filed before or after the due date.

If the returns were filed in time, you will get the refund within 3 to 6 months. Online TDS returns can be late or fail to file. Individuals or companies will face two types of penalties.

- Late filing fees- U/s 234E and 234E

- Penalty for non-filing – U/s 271 H

Deadlines for online TDS Return Submission

TDS returns are due within the same timeframe as tax payments. Although the TDS return can be filed online it must be submitted by a certain date each quarter.

- To file a TDS, Return it online, you will need to have the following documents

- To file the TDS returns, you must submit the following documents.

- TAN details

- PAN details

- Last TDS filing details, if applicable

- The filing period of TDS

- Date of incorporation

- Name of the entity – Proprietorship/ Partnership/ Company/ LLP

Conclusion

TDS was created to collect tax directly from income sources. This concept states that a person is liable for making a payment of specified nature to another person.

So, if you wish to know more about the filling process of TDS return, then we are ODINT Consultancy, here to help you out in each & every step of yours.

FAQ’s

TDS Return is a quarterly statement to the Income Tax Department. Each deductor must file the TDS returns on time.

TDS returns must be filed by all assesses who fall within the tax slab prescribed by the Income Tax Department

TDS certificates have to be granted by an individual who is deducting TDS to the assessee from those earnings TDS was reduced while doing any pay.