Setting up a company in Belgium is one of the smartest moves for entrepreneurs and investors aiming to tap into the heart of Europe. Known for its strong infrastructure, advantageous location, and business-friendly regulations, Belgium offers seamless access to the European Union’s 450+ million consumers. Whether you’re a startup founder, an SME owner, or a multinational expanding your presence, Belgium provides a flexible and efficient legal framework for business incorporation.

The company registration process in Belgium is straightforward but must be followed carefully to ensure compliance with local laws and regulations. From drafting legal documents and registering with the Crossroads Bank for Enterprises to setting up a bank account and enrolling in VAT, each step plays a vital role in your business journey.

In this guide, we walk you through the step-by-step procedure for company registration in Belgium, including eligibility requirements, types of legal entities, required documents, taxation policies, and the benefits of doing business in Belgium.

Why Should You Register a Company in Belgium?

Belgium’s strategic geographical location at the heart of Europe, along with its multilingual population—French, Dutch, and German-speaking—makes it an ideal test market for launching new products in the European Union.

The country is known for its robust trade performance, consistently ranked as the 12th largest exporter and the 14th largest importer of goods globally.

Belgium also boasts world-class infrastructure, including advanced road networks, high-speed rail, and one of Europe’s busiest ports in Antwerp. This makes it a highly attractive destination for businesses in logistics, distribution, and manufacturing.

Procedure for Company Registration in Belgium

Step 1: Draft the company’s legal documents

The necessary legal documents of the firm have to be prepared, such as the memorandum of association and articles of association. Once the documents are prepared, you must file them with the relevant authorities.

Step 2: Register at a commercial court

In order to start a business in Belgium, you have to apply to register your business with the Crossroad Bank for Enterprises.

Step 3: Set up a bank account and deposit capital

You must set up a bank account where the minimum capital required to operate the business has to be deposited.

Step 4: Notarization of the deed of incorporation

The deed of incorporation and the by-laws should be drafted and signed in the existence of a notary, who will verify this paperwork and enroll the incorporation deed. And after the submission of the deed, the firm’s identifying information is provided to the Crossroads Bank for Enterprises. Following that, the deed of incorporation is published in the Belgian Official Gazette. Your firm is assigned a corporation number by the CBE.

Step 5: Find the company’s VAT number

Then you must enroll for VAT and also acquire the tax id number.

Step 6: Join social security to register

After that, you must enroll in Social Security.

Step 7: Arrange workplace insurance

Arrange for the necessary workplace insurance

Step 8: Engage payroll agency

After completing the enrollment process in Belgium, workers are required to begin the operation. Belgian workers are well-trained, and businesses seeking staff members can find applicants on hiring websites or through hiring agencies.

Set up professional cards and work permit

Obtain the required permits and licenses required for operating your firm in Belgium.

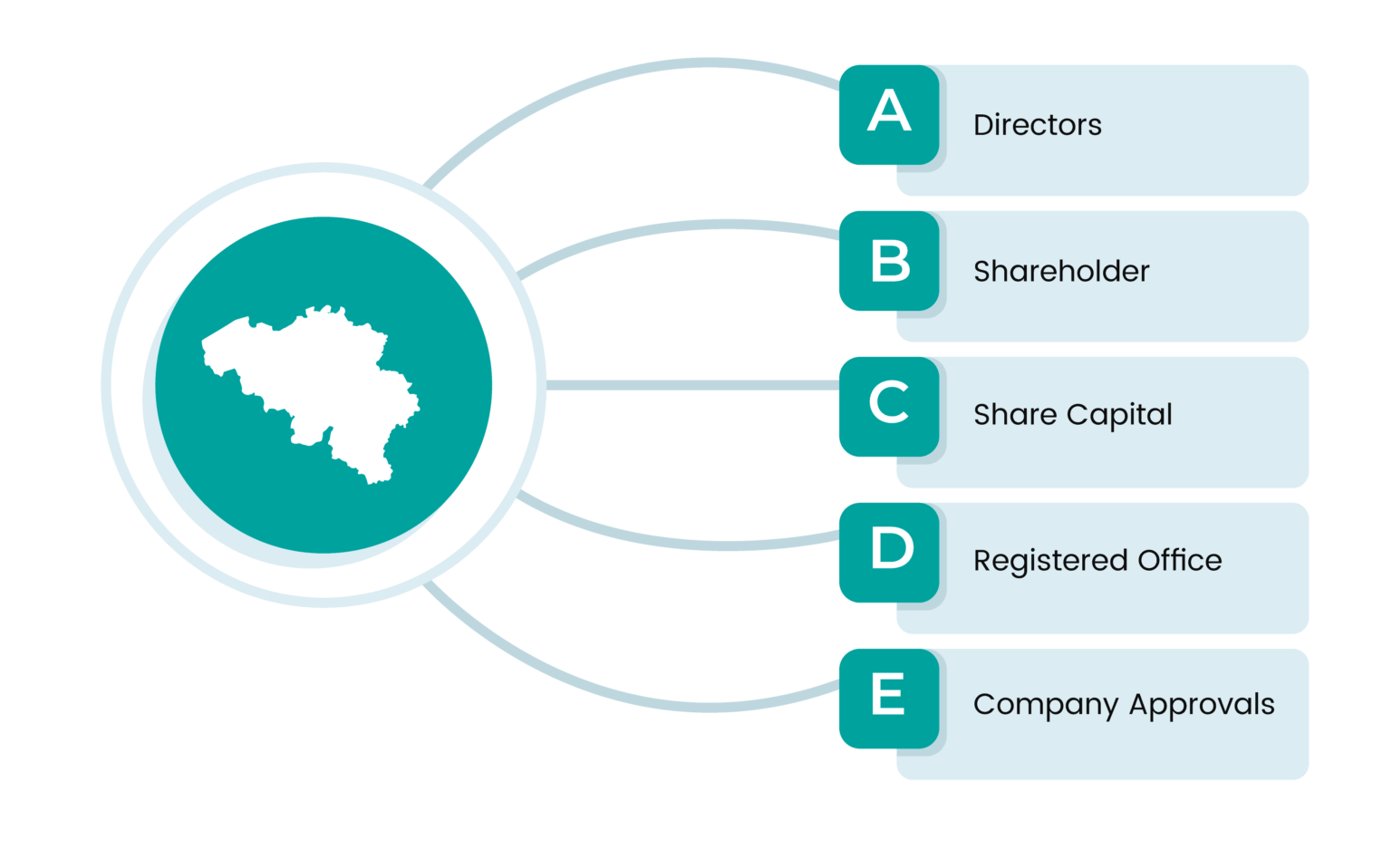

Eligibility criteria for Company Registration in Belgium

The eligibility criteria for company registration in Belgium are as follows:

Directors

One director from any nationality is needed. The Director of a Belgium company registration can be a Belgium citizen or a foreign citizen.

Shareholder

At least one shareholder is all that is needed for company registration in Belgium.

Share Capital

The minimum share capital required for a public limited company is at least 61,500 euros and for a private limited company is 18,500 euros.

Registered Office

Your business requires an official office in Belgium and must be provided for company registration in Belgium.

Company Secretary

It is not a legal obligation for the Belgium business to have an executive secretary.

Documents Required for Company Formation in Belgium

For Belgium company registration, you need these documents:

- The Name of the Company

- The director’s full name, birth date, address, nationality, and full name.

- Copy of the director’s professional/educational qualification

- The capital amount and how many shares were purchased by each member.

- A financial plan will include details on how the initial investment, capital stock, will meet the requirements of the business for the first two years.

- Names and addresses of shareholders as well as a copy of ID/passport

- Proof of Residency and copy of the passport of the Director(s)/Shareholder(s)

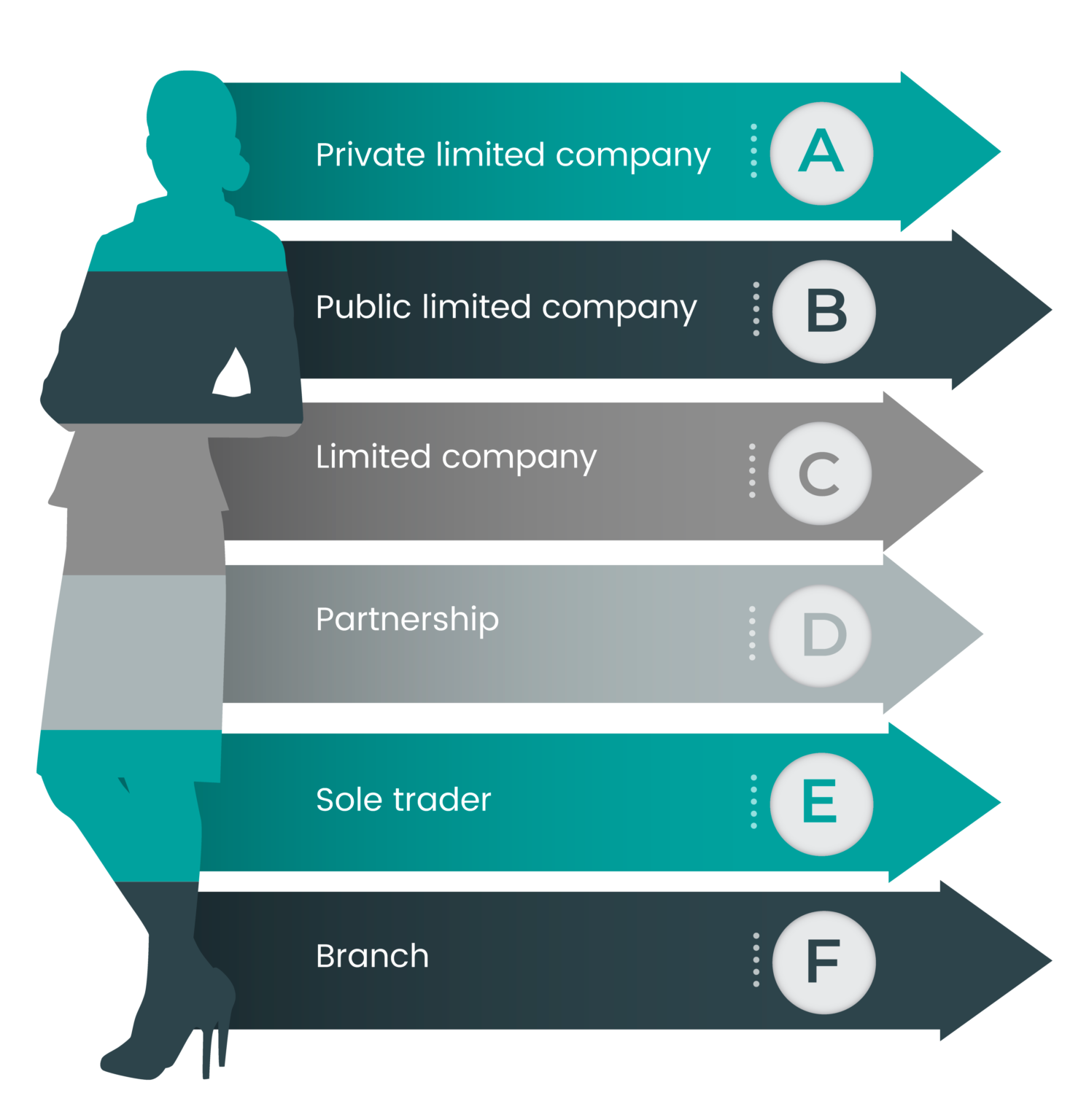

Types of business entities for Belgium company registration

These are various types of business structures of company registration in Belgium.

Private limited company

This kind of structure is used to create small-sized businesses, provided an initial 18550 shares of capital dollars is paid. It is split into shares, and at minimum 20% of each share needs to be paid before incorporation.

Two shareholders are needed to set the type of organization, regardless of nationality or place of residence. The liability of shareholders is limited to the amount they contributed.

Public limited company

The minimum share capital required for this type of business is at least 61,500 EUR which can be paid by at least two shareholders. The company may be founded either by individuals or legal entities regardless of the place of residence or citizenship they possess. The liability remains restricted for shareholders.

Limited company

Three members at least must agree to create this kind of organization in Belgium and they must have at least 18,500 EUR. A minimum of 6,200 EUR is required to be paid before the incorporation of the Belgian firm, and the remaining is deposited within five years of incorporation. There is a different kind of cooperative that has unlimited liability.

Partnership

The company is founded by at least two founders who are the sole owners of the business and both are responsible for the obligations and debts of the company. There is no minimum amount of deposit required upon incorporation, and management is backed with the help of shareholders.

It is crucial to remember that in a general partnership, the responsibility of the shareholders is not limited. When a partnership is limited the general partner is the person who is accountable for the business and who will take care of the management, while the limited partners will contribute the financial resources but will not be able to participate directly in managing the company.

Sole trader

This is the simplest form of type of business and is also the one that carries full responsibility, just like in the case of a general partnership. The business is operated by a single person and there isn’t any separation between his property and the assets of the company. It is a good choice for consultancy work or offering other services.

Branch

The branch of the parent firm is engaged in similar business activities in Belgium. In tax matters, it is treated the identical way as a resident entity and must adhere to the local rules of management. The branch must also be certified by the Crossroads Bank of Enterprises before it can begin business operations.

Advantages of company registration in Belgium

- International investors are granted the same privileges as citizens when it comes to corporation creation.

- It is simple to establish a business in Belgium because it only requires one stockholder and no local directors.

- Belgium is an EU member, so it benefits from no trade constraints and easy access to EU clients.

- Belgium has world-class infrastructure and transportation systems.

- Belgium is one of the world’s leading exporters.

- Belgian workers are among the most productive in the EU.

- Double taxation treaties have been signed with more than 80 countries.

Cost to register a company in Belgium

- The notary fees are calculated by the share capital of the company and will be greater in the case of an SPRL when compared with an SA.

- The publication fee will be charged to the time that they are paid when the Articles of Association are published in the Belgian Official Journal; around 250 euros.

- The registration fee for a company is due at the time of registration at the Crossroad Bank, with an average fee of around 70 euros.

- The VAT registration fee typically ranges from 50 to 50 euros for tax registration for the business.

Taxation of companies in Belgium

- Businesses in Belgium must adhere to the regulations of the Income Tax Code and the additional laws and decrees that are appropriate. The tax authorities of Belgium are created at the local, regional, and federal levels.

- The taxes that companies pay include taxes for companies include corporation income tax, pay tax for payrolls, transfer tax, insurance premium tax, value-added tax, and the value-added. The amount of corporate income tax is an effective rate of 25 percent. The general VAT rate is 21%.

- Tax on branches has the same value; however, when it comes to withholding taxes on dividends, foreign companies operating in Belgium are affected by a reduced rate or total exemption by an agreement on double taxation.

Conclusion

Belgium has an ideal business environment as well as an excellent connection to markets around the European Union. The country offers a very high quality of life and an incredibly welcoming, multicultural, and advantageous business climate. The investors who register a company in Belgium are also able to have access to a highly skilled workforce of the country and million of consumers from the European Union.

Incorporating a company in Belgium is not a difficult process if the proper steps are taken. Contact OnDemand International for help with company registration in Belgium. Our specialists will guide you through the process and ensure that your applications are not turned down.

FAQ’s

Yes, foreigners can fully own and operate a business in Belgium. There are no restrictions on foreign ownership, and international investors enjoy the same rights and benefits as local entrepreneurs.

- For a Private Limited Company (BV/SRL): Minimum capital is €18,500.

- For a Public Limited Company (SA/NV): Minimum capital is €61,500.

- For a Partnership or Sole Proprietorship: There is no minimum capital requirement.

No, residency is not mandatory. You can register and manage a company in Belgium as a non-resident, though having a local registered office is required.

Yes, certain business structures—such as a BV/SRL or SA/NV—require a notarial deed of incorporation. The notary authenticates key documents and registers the deed with the authorities.