9 Benefits Of Getting an EIN in USA

An EIN, employer identification number, or a corporate tax ID is a 9-digit number that one utilizes to file taxes for his/her company. An EIN additionally aids in the formation of a corporate entity, the acquisition of a commercial loan, the opening of a corporate bank account, and so much more. Your firm’s EIN is just as significant as your private SSN, Social Security number.

An EIN is simply a tax responsibility for some companies. There are some companies that don’t need to get an EIN, but they have their own compelling reasons for that. It should be noted that getting an EIN is extremely beneficial.

The excellent thing is that obtaining an EIN is cheap and just requires a few minutes. Understand when an employment identification number is essential and when it is voluntary, as well as how to obtain one and the main advantages of doing so.

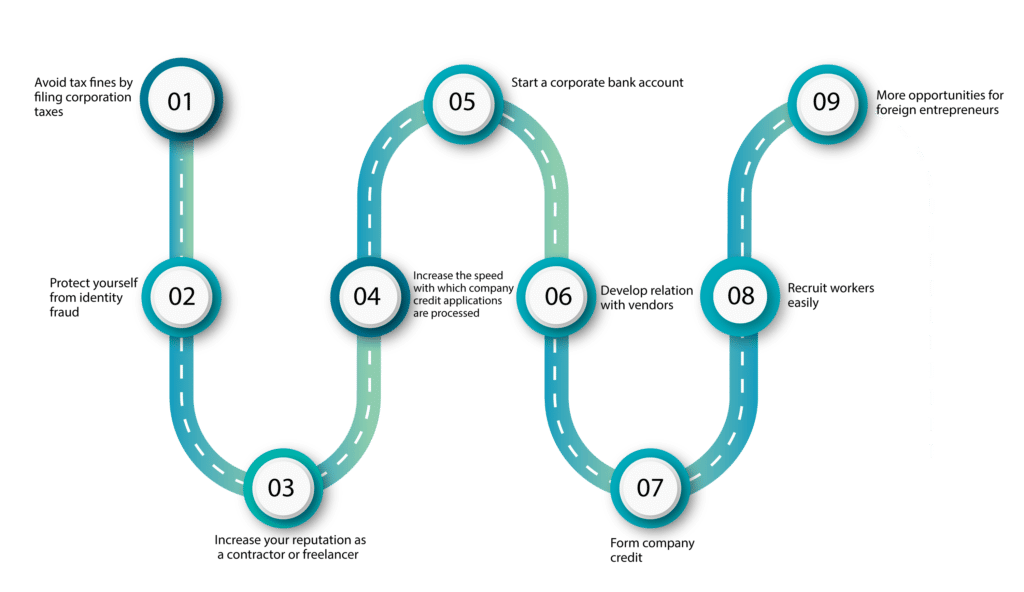

Benefits of Getting an EIN

Even if you aren’t obliged to have one, you might consider acquiring one. Possessing an EIN, generally, lets you isolate your financial affairs and lifestyle from your company in the USA. This is critical for simplifying bookkeeping and accounting as well as limiting responsibility in the situation of a lawsuit. Sometimes, skipping out on an employment identification number now will cost you money and time later.

Even if you aren’t required to obtain an EIN, there are some advantages to doing so:

1. Avoid tax fines by filing corporation taxes

You must fill out special documentation to tell the IRS if one does not have his/her employment identification number by the tax date and were expected to receive one. If one fails to do so, the IRS may reject your submission, and you may be subject to penalties for submitting late.

2. Protect yourself from identity fraud

You could be shocked to hear that obtaining an employee identification number is a useful tool for preventing identity fraud. An EIN is a number that distinguishes your personal and corporate money. You won’t have to give your actual SSN, or Social Security number to customers or vendors if you have an employee identification number. You could instead supply your EIN.

By supplying your employer identification number, you may maintain your SSN, and Social Security numbers more secret, reducing the likelihood of a criminal acquiring them and allowing the use of your money. Although people steal employment identification numbers, the issue isn’t as common as customer identity fraud – at least not yet.

3. Increase your reputation as a contractor or freelancer

Even missing one customer can create a meaningful financial impact for entrepreneurs and contract workers. You would like to make every effort to establish yourself as a reputable company owner. Whenever you sign on a customer, you’ll need to offer them either an SSN, Social Security number, or an Employer Identification Number (EIN) so that they may issue you a 1099 income tax return.

4. Increase the speed with which company credit applications are processed

If you do have an employee identification number, you can speed things up related to the business loan applications. A huge chunk of lenders doesn’t need it. If you have verified business permission or license, you can take up this loan.

The drawback is that several lenders demand that candidates have a corporate bank account with a minimum number of deposits. It is to verify that you possess a location where you can collect loan capital and make repayments on a regular basis. An EIN is frequently required to open a corporate bank account.

5. Start a corporate bank account

There are some banks that let sole proprietors without an employee identification number start a corporate bank account, but the other financial institutions have stricter provisions. For example, the Bank of America savings and checking accounts need evidence of your employee identification number to generate a corporate bank account.

There are some other papers that you’ll have to provide with your Employee identification number to start a corporate savings or checking account. This comprises your company formation date, site of your company, personal details about the founder/owner, and official company name. As soon as you start a corporate bank account, ensure that the only funds being deposited or transacted in/out of the account are for commercial purposes.

6. Develop relationships with vendors

If you’re someone who owns a small business, it would be tough to complete all the duties on your own while starting a company. You’ll have to be dependent on suppliers, partnerships, and vendors with other companies to meet your goals. With the help of an EIN, you can make these 3rd parties join you easily.

Why so?

As these parties may wish to verify your company credit before starting trade with you. The wholesale distributors usually need an EIN verification before they start commerce with a retailer. Possessing an EIN gives an idea that your company is credible, and that you are a responsible individual who will submit the payments on time.

7. Form company credit

An employee identification number is essential to form a company credit history. Company credit history is just like your individual credit history, but in it, you evaluate your firm’s bill payment history, and commercial responsibility, instead of evaluating your own commercial habits.

8. Recruit workers easily

If your firm already has workers or you are about you hire some, then you will require an EIN. Even if you don’t have any immediate thoughts on hiring workers, getting an EIN would be feasible if you think you may hire people in the long term. Yes, predicting the future would be tough, but if you want to grow your firm to the point where you necessarily need employees, applying for an EIN wouldn’t hurt. Having an EIN helps you create a payroll structure when you recruit someone and causes no delays in the recruitment process.

9. More opportunities for foreign entrepreneurs

Possessing an EIN can be great for establishing a firm if you’re a foreign entrepreneur and without an SSN. International citizens can get their EIN by reaching out to the IRS. Once you get an EIN, you can apply for a company credit card or even start a corporate bank account before getting an SSN. This provides foreign citizens a kind of headway before they start their firm and also adds up competitiveness if they wish to shift quickly.

If you wish to start a firm and you’re not a US citizen and don’t have an SSN, it is best that you claim an EIN. International citizens can claim their EIN by reaching out to the IRS. It becomes really simple to issue a business credit card or start a corporate bank account using an EIN. This will give you an idea of how to launch a business, and might also give you a competitive edge if you wish to grow fast.

Conclusion

Employee Identification Number or EIN is a 9-digit number that helps individuals in filing taxes for their business. Apart from being inexpensive, it’s also very simple to obtain. Here in this article, we discussed the main advantages of obtaining an EIN. We hope we were successful in our attempts, and you have understood why is an EIN number essential. In case of questions or assistance, please reach out to us at ODINT Consulting.

FAQ’s

EIN number is a unique code of 9 digits that is filed by the Internal Revenue Service and is essentially used to file employment taxes. Another name for a SIN number is the federal tax ID number.

There are some major areas where getting an EIN number is a perk. Some of them are, when starting a business bank account, for foreign businessmen, in case of identity theft, in maintaining relations with suppliers, etc.

Firms need an EIN number to submit their federal taxes digitally, issue their yearly tax return, and file tax papers and payroll to their vendors. So, if your firm has to pay taxes, get an EIN number.