Estonia is a nation that is located in the northern part of Europe. The country is one among three Baltic regions, sharing its border with Russia and Latvia. Estonia is regarded as one of the most welcoming and fastest-growing hubs for start-ups all over the world. Estonian capital, the city Tallinn is known as the Silicon Valley of Europe with the highest percentage of startups per capita and an active and economic population that is prone to entrepreneurship.

Estonia has an ecosystem that is equipped with high-tech processes, a worldwide connected online resident community, and a favorable investment environment. The absence of bureaucratic restrictions makes it appealing for entrepreneurs all over the world to select a business for their company registration.

Through this article, we will be discussing the procedure for Estonia company registration, along with the documents required, taxation and advantages.

Eligibility Criteria For Estonia Company Registration

The following requirements to register a company in Estonia:

- Registration and Digital ID: Digital ID is required for the initial step to Estonia company registration.

- Legal address and contact information in Estonia is a must.

- Availability of the chosen company name.

- Requirement for banking: A bank account in Estonia must be established to facilitate financial solutions.

- Capital requirement: A share capital of 2500 euros is required for an LLP. A minimum share capital of 25.000 euros is needed to form a public limited company.

Initial stages of registering a Company in Estonia

To register a company in Estonia all founders must have electronic residency digital ID cards from Estonia as well as Latvian, Belgian or Estonian ID cards as well as Lithuanian as well as Estonian mobile IDs and be individuals who are not public.

If the company’s founder doesn’t possess any of these documents, he has to go to a notary public in Estonia to check the validity of these documents.

This is the process to be an e-resident in Estonia:

- A web-based application: The applicant has to fill out an online form and pay for the application fee which could range from EUR100 to EUR120.

- Picking the appropriate service: If the board of management is not located in Estonia, the management board of the Estonian company is not located in Estonia.

- Online Registration of a company through the e-Business Register: The applicant must decide on the structure of the company and pay the required state fee of EUR265 for company registration in Estonia.

- Application for business banking: The applicant needs to apply for commercial banking through Fintech partners who will handle all financial needs of the business.

- Network worldwide: When you join the community of e-residents, the applicant can access the worldwide network of the e-resident community. This allows them to increase their business’s reach.

Procedure for Registering a Company in Estonia

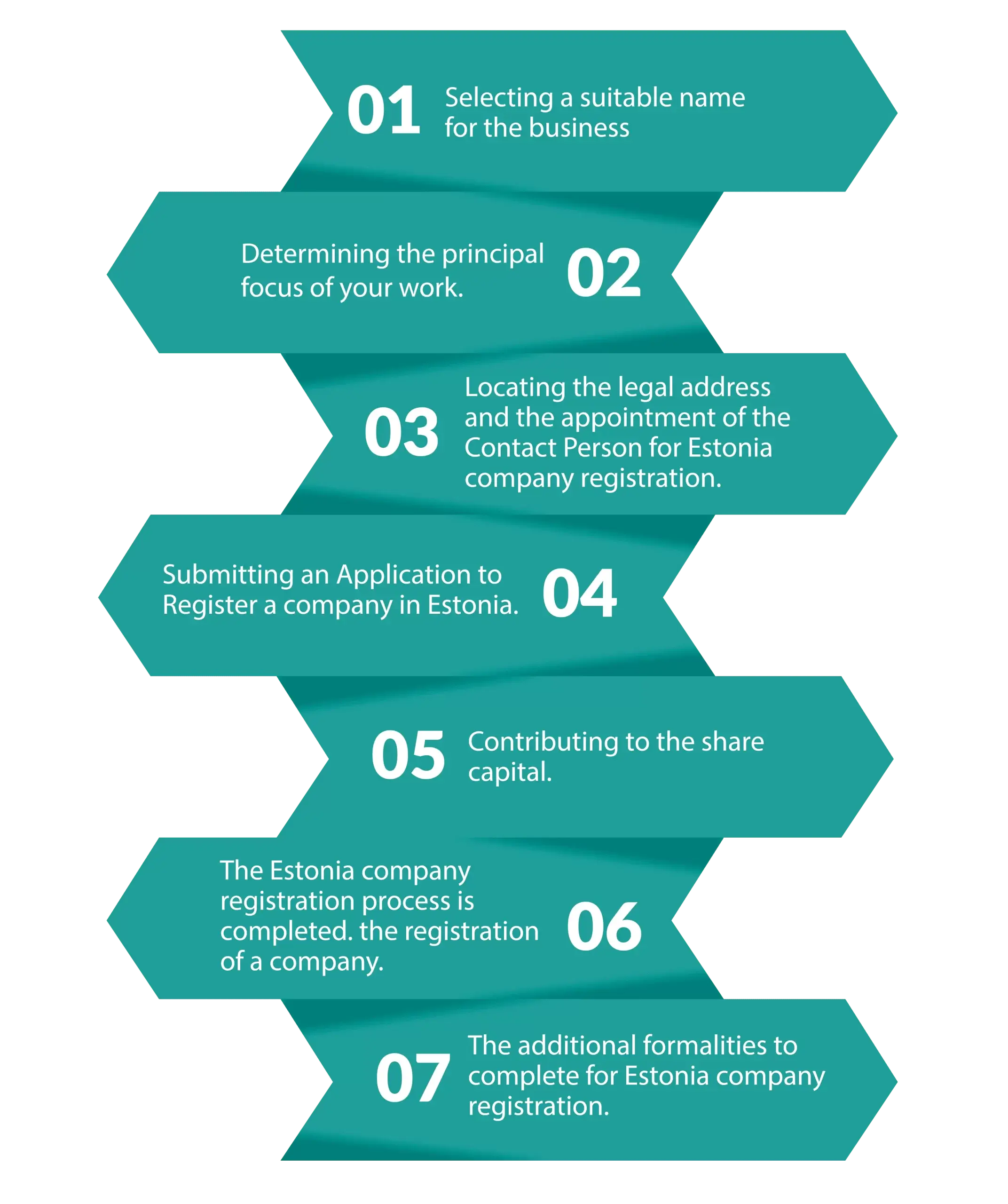

To complete the process of company registration in Estonia, one should follow the process that is outlined below:

- Selecting a suitable name for the business.

- Determining the principal focus of your work.

- Locating the legal address and the appointment of the Contact Person for Estonia company registration.

- Submitting an application to register a company in Estonia.

- Contributing to the share capital.

- Additional formalities to complete for Estonia company registration.

Step 1: Selecting a Suitable Name for the Business

The first step in registering a company in Estonia is to choose a name for the business. The name must be written in Latin characters and not contain special characters.

It’s also important that the chosen name is unique and doesn’t conflict with any existing business names in Estonia.

Step 2: Deciding on the Main Field of Activity

Once the brand name is decided, the company applicant needs to select the main field of activity for the business. This is done by choosing an EMTAK code, which is the Estonian classification of economic activities.

This code helps define the business’s primary scope of operations, although the company can engage in multiple commercial activities for revenue generation.

Step 3: Finding a Legal Address and Appointing Local Personnel

The business must have a legal address in Estonia, which can be used for official communication and annual filings.

While Estonia doesn’t require the company to have a resident executive director, there must be a local contact person who can handle communication with Estonian authorities on behalf of the business.

Step 4: Applying to Register the Company

The next step is to submit an online application to register the company through the Estonian e-Business Register.

The process involves preparing and signing the necessary documents, paying the state fees, and submitting the application. The registration fee for Estonia company registration is EUR 265.

Step 5: Contributing to the Share Capital

For the company to be registered, a share capital contribution is required. The founders can transfer the share capital either to the company’s business bank account or a depository account. However, founders may postpone the actual contribution until a later time.

Step 6: Complete the Required Company Registration Formalities

After submitting the application, the business owner must wait for the court’s decision. The court typically processes the application in a few days, and the decision is usually communicated via email.

If the company does not yet have a business bank account in the European Economic Area (EEA), the business owner will need to obtain an EU IBAN account.

Read More: Start a Business in Estonia from India

Post-registration Requirements

After the company is registered, there are several formalities that must be completed:

- Legal Documentation: The company needs to draft legal documents such as shareholder agreements, employment contracts, and confidentiality agreements.

- Tax Administration and Accounting: The business must comply with Estonia’s tax and accounting requirements.

- Licensing: Depending on the type of business activity, certain licenses or permits may be required.

- VAT Registration: If the annual turnover of the business exceeds EUR 40,000 from commercial activities in Estonia, the company must register for VAT.

Documents Required for Company Registration in Estonia

Documents needed to register a company in Estonia:

- Information on the Founders

- Memorandum of Association

- Articles of Association

- Board Resolution (if applicable)

- Certificate of Payment of Share Capital

- Bank Certificate Confirming the Deposit of Share Capital.

Types of Business Entity in Estonia

Once the applicant has made an application for an e-residency permit, the applicant receives their digital ID, and becomes eligible to begin a company in Estonia.

When starting any business in Estonia it is important to decide a legal structure to run the business. The Commercial Code of Estonia provides the following types of companies to residents of the country.

They are in the following order:

- Private Limited Company

- Public Limited Company

- Sole Proprietorship

- General Partnership

- Limited Partnership

- Commercial Association

- Branch Office

1. Private Limited Company

Private limited companies (OU) are by far the most popular type of business entity used by those who are e-residents to establish their business in Estonia. E-residents can register approximately 21,000 businesses in Estonia and over 99 percent of them were established within private limited corporations.

A shareholder in a private limited corporation is not individually responsible for the firm’s debts. An OÜ must have a minimum share capital requirement of €0.01 per shareholder.

These are the advantages of the private limited company for residents of Estonia as the company entity for their business:

- Simple registration process

- Share capital low minimum

- Directorship number of the founder

- Financial liability

The business has the option to register voluntarily for VAT or apply for VAT registration when the annual turnover that is tax deductible exceeds EUR 40,000.

2. Public Limited Company (AS)

An AS is a public-liability company (AS) is a type of business entity that can provide its securities to the general public as well as foreign investors. Shareholders of these entities are liable only for the amount of their share contribution to the business.

A public limited company must have a minimum share capital of 25,000 euros.

3. Sole Proprietorship (FIE)

The concept of a sole proprietorship isn’t an extremely common type of business entity that is used by firms in Estonia and also by electronic residents.

The reason for this is that sole proprietorships are not considered to be distinct legal entities within the meaning of the law.

4. General Partnership

These kinds of businesses aren’t common for e-residents, despite an easy and quick process to establish. These entities can be created electronically through the e-residency card, or by an intermediary service provider using the Power of Attorney.

5. Limited Partnership

A minimum of one general member and one limited member should be registered using a shared business name to form a Limited Partnership.

The limited member has limited responsibility to the firm capped at his contribution whereas a general member has unlimited accountability for the firm’s debts.

6. Commercial Association (Uhistu)

If the objective of the business is to promote the interest of the members via joint economic activity and the vehicle for business of commercial associations does not have a minimum capital requirement for shares when creating a commercial organization in Estonia.

It is necessary to have a minimum of two founders to establish an association commercial.

7. Branch Office

Imagine a foreign corporation would like to continue to sell goods and services to the Estonian market under its name. In that scenario, you have the option to incorporate the company as a branch office. It is important to note that a branch does not constitute an independent business entity that is distinct from the parent company.

Tax Structure For a Company in Estonia

All businesses which are registered with Estonia must be liable for corporate tax.

Taxes like the following are applicable:

- Corporate Tax to be paid for in Estonia amounts to 20% of profits distributed. However, a lower net efficient rate of 14% is in effect in the event of normal dividends.

- The rate of the Branch Tax is 20% in Estonia.

- The tax on capital gains can be paid at a 20% rate.

- The standard tax rate for VAT is 20 percent. A lower rate of 9 percent applies to certain items. Some items are taxed at 0%, and there are some items for which exemptions have been made available.

Advantages of Registering a Company in Estonia

The following are some benefits of registering a company in Estonia:

Tax Benefits

Estonia provides a unique method of taxation for company registration in Estonia. One of the advantages that are part of Estonian fiscal system is that the profits made by the business aren’t subject to taxation at the moment of earning.

Full Online Registration Process

One of the biggest advantages for entrepreneurs when company registration in Estonia is the complete online registration and administration process provided by the Estonian government.

Benefits of a single EU market

Estonia is also part of a single European Union market, which gives the Estonian businesses with registered name accessibility to the largest economies in the world.

The members and their citizens enjoy the advantages of traveling throughout the bloc and reaping the economic benefits with no obstacles.

Conducive business environment

Estonia has always performed very well in the ease-to-do-business indexes (such as the World Bank’s Ease of Doing Business Report) as one of the most favored nations worldwide, offering the right conditions for business to flourish and grow.

Estonia is also ranked as the best jurisdiction having the most efficient tax system of the OECD countries.

Conclusion

When choosing a location to establish your business there are a lot of things to think about. Estonia offers an appropriate amount of resources, which makes it an excellent choice for people whose businesses are in a blueprint phase. Estonia has low taxes and is an international digital leader and is simple to conduct business in.

Additionally, Company registration in Estonia allows the establishment of a legally-enforceable entity within the EU which makes it much easier for you to start a business.

If you want to register a company in Estonia, contact our business formation experts from OnDemand International. Our business formation specialists can help you register a company in Estonia without having to go through any difficult processes because they have experience in business establishment across the globe.

FAQ’s

The cost of state registration for incorporation of a company within Estonia costs EUR265. The fee is payable by Estonia’s e-Business Registry of Estonia at the time of the online registration of the company.

It usually takes 3 to 5 weeks to create a business in Estonia.

There isn’t a requirement to choose the position of resident director. The only requirement is to choose a local service provider to manage correspondence on behalf of the business.

The company registration process through Estonia Business Registry can be completed online, without the need to physically be in the office. The founders of the company must have their Estonian E-resident ID at the time of company registration.

The Estonia Public Limited Company (AS) should be registered with at least one founding member and at least 3 persons of the supervisory board when it is time to register

The minimum share capital needed in a private-liability corporation (OU) for Estonia amounts to EUR2,500. The capital required for the registration of a public limited corporation (AS) can be as high as EUR 25,000.

The most effective option for registration of a company in Estonia would be a Private Limited Company (OU) since this form of business offers the advantage of limiting liability for the founders equal to the shares of capital that are invested in the company. The tax structure is advantageous for foreign investors as compared to sole proprietorship businesses.