Overview: Introduction to LLP Registration in India

The budding entrepreneurs are choosing Limited Liability Partnership (LLP) as the most chosen type of firm. Why? Because it comprises all the advantages one would get from a company, and a separate partnership firm.

In India, the idea of forming an LLP was first introduced in 2008. An LLP comprises all the properties present in a company and a partnership firm. The LLP Act is responsible for its regulation in India. The formation of LLP in India requires at least 2 partners. But there is no fixed number for the maximum number of partners that can exist in an LLP.

There are two partners and both of them should be normal individuals, and at least one partner amongst them must be a native Indian resident. The LLP agreement gives out all the duties and rights of the chosen partners. The partners make sure that all the guidelines and provisions of the LLP Act and agreement are followed properly.

What is Limited Liability Partnership in India?

An LLP is a limited liability partnership in which each member has limited personal responsibility for the firm’s debts or claims. An LLP’s partners are not held liable for the actions of their other partners.

Seperate Legal Entity

Like firms that have an individual legal unit, an LLP also has its legal unit. The partners are not primarily associated with the LLP. Any LLP has the power to either sue or get sued. All the contracts only get signed in the designation of LLP. This increases the trust of several stockholders and provides a confidence boost to the consumers in their firm.

Restricted responsibility of the partners

The responsibility of partners in an LLP depends on the amount of contribution they are making to the company. So, this comes down to the meaning that the partners will pay only the sum of their contribution. Plus, if the company faces any loss, the partners are not responsible for that. If the LLP is on its way to getting dissolved during the wind-up process, only the possessions of an LLP are responsible for reimbursement of its debts. So as the partners don’t have to face any personal obligations they can freely function as dependable businessmen.

Cheap & easy agreement

It is obvious that if you have decided to form an LLP, you would know that it has a low cost in comparison with another type of private or public limited company. Another perk that comes with an LLP is that it has few compliances and requires only 2 official statements per year. Such as a statement of accounts, solvency, and an annual return.

No lowest investment contribution

No set level of minimum capital is needed before establishing an LLP company. An LLP can be incorporated using any amount of investment put in by the partners.

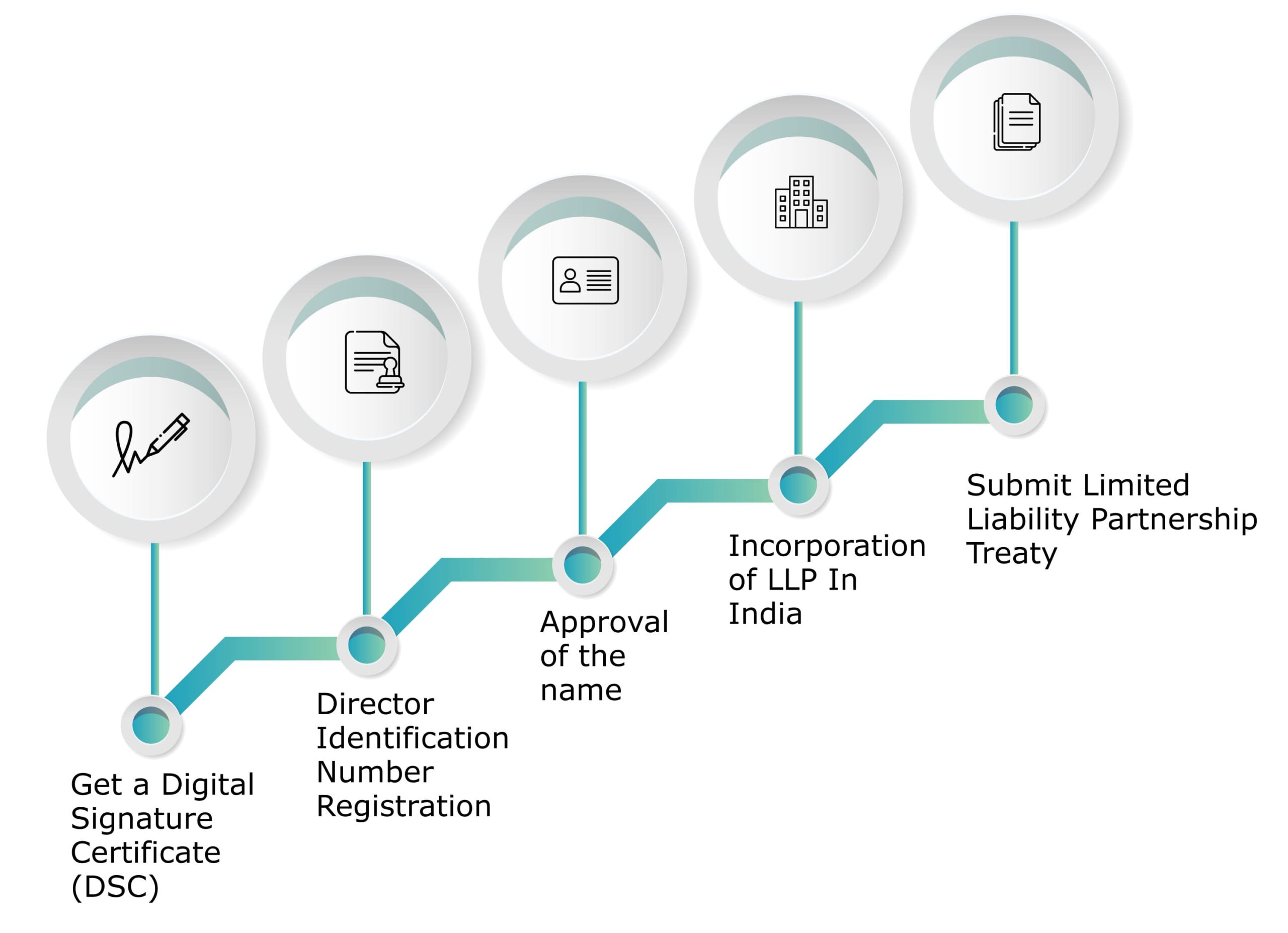

Process To Register LLP In India

1st Step: Get a Digital Signature Certificate (DSC)

Before getting started with the process of registration, get the e-signatures of the official LLP partners. This is because it is a compulsory requirement that all the documents LLP should be digitally signed and uploaded online. After doing that, the partner can obtain his/her e-signed certificate.

The price of DSC differs based on the certification agency. You must also achieve DSC class 3 classification. When you register a Limited Liability Partnership with ODINT Consulting, you can get up to two DINs for free, and you won’t have to register for them individually.

2nd Step: Director Identification Number Registration

All authorized associates or those who wish to be authorized associates of the prospective LLP must register for a Director Identification Number. To successfully issue a DIR number, you must complete the issuing of DIR-3.

All the e-copies of your paperwork, like, PAN card and Aadhar card should be adjoined with the application. The paperwork must be approved by a full-time firm secretary CEO/ Director / CFO /the Managing Director of the established business where the applicant will be elected as a director.

3rd Step: Approval of the name

The third step is to get the name of the LLP reserved. The LLP RUN, which is the abbreviation for LLP- Reserve Unique Name, comes under this technique. Once you have selected the name, it is then sent to the Central Registration Centre. It is to be ensured before confirming the name in the application that you take the help of the free name option that is present on the MCA portal.

Related to the user’s search parameters entered, the software will generate a list of established businesses with very similar names. Using this, you can pick some of the most unique names. You should pay attention to the fact that your LLP name should be catchy, attractive, and should appear appealing to Central Government. Also ensure that your chosen LLP name is unique, and is distinct from any kind of trademark, LLP, or body corporation. Then only the registrar will give you the permit to use that name.

The application RUN-LLP must be supported by fees listed in Annexure ‘A,’ which the registrar may accept or refuse. Once you get the application, you have 15 days in which you can send it back to correct any sort of mistakes in it. You can also send in two different names for LLP as suggestions.

4th Step: Incorporation of LLP in India

- There is a specific form that is used for the establishment process, i.e., the Form for incorporation of Limited Liability Partnership, FiLLiP. This form is shared with the registrar. The registrar has the state’s authority in which the LLP’s official office is present. This form is a type of combined form.

- The fees according to Annexure A must be submitted

- If any one of the partners doesn’t have a DIN or DPIN, then using these forms the partner can apply for allocation of DPIN.

- Only 2 people can send in an allotment application.

- The FiLLiP form can help applicants in sending a reservation application.

- If your chosen name is approved by the government, then this reserved and selected name shall be picked as the planned LLP name.

- Suppose your chosen name gets the approval, then this permitted name will get filed as the final LLP name.

5th Step: Submit Limited Liability Partnership Treaty

The mutual rights and obligations of the associates, as well as the Limited Liability Partnership and its associates, are governed by the LLP contract.

- Via the MCA portal, submit your Form 3. The whole process will remain online.

- After your LLP incorporation gets completed, within one month, you should submit Form 3.

- Stamp Paper must be used to publish the LLP Contract. Stamp Paper has a varied value in each state.

Our experts at OnDemand International can assist you to apply for a limited liability partnership in India.

Documents Required to Form LLP In India

1. Paperwork needed by partners

- Passport: Foreigners and Non – resident Indians must present their passports as a condition of claiming a partnership in an Indian Limited liability partnership. All the NRIs or the citizens of a foreign nation should get their passports apostilled or certified. They can do this with the help of the respective authorities in their native land. If not that, you can contact the Indian Ambassador in that country. He/she can certify your documents.

- Associate Address Evidence: Partner can provide any one of the following documents: voter’s ID, driver’s license, passport, or Aadhar Card. The partner’s details like his name, etc, on the proof of address and the PAN card, must be identical. Suppose a situation arises where there is an error in either your name, your parent’s name or in your DOB, you will have to correct it before submitting it to the RoC.

- ID Proof of Partners/PAN Card: When starting with the LLP registration in India, all associates must produce their PAN. Your PAN card holds immense importance as it acts as the first source of your identity.

- Image: Associates should also offer a passport-size picture with a white background, ideally.

- Associates’ Residency Proof: A recent bank account statement, and monthly bills of phone, mobile, electricity, or gas bill must be presented as residence proof. The bank statement or the bill should fall within a time period of 2-3 months. It should also match the partner’s identity present on his/her PAN card.

If you are an NRI or a foreign citizen, you will have to give proof of your residence. The proof of residence may include, a bank statement, driver’s license, any document registered through the government with your address, or simply your residential permit.

Suppose your documents are in any other language apart from English, you should also provide a certified translated copy of the same.

2. LLP Paperwork

- Digital Signature Certificate: Because all paperwork and requests will be validated through an online portal, by the authorized representative, one of the chosen partners must also choose a DSC.

- Evidence of Registered Business Address: On applying or within 1 month of formation, evidence of business address must be given. If in any case, your registered office address is rented, the owner of the place will have to himself sign a contract and give a letter of no-objection. Once the landlord submits the no-objection letter, the applicant can utilize the LLP business location, and tag it as a “registered business”.

Furthermore, any service bill, such as telephone bill, electricity, or gas, must be provided. The bill must include the exact location of the property as well as the identity of the proprietor, and it must be less than two months old.

Features of an LLP in India

- LLP is a form of business structure that combines the freedom of a partnership with the advantages of a firm’s restricted liability.

- An LLP can keep functioning even if one or more partners pass away, become bankrupt, or resign.

- It is a distinct legal organization from its partners.

- In an LLP, each partner’s responsibility is limited to the amount of their investment.

- No requirement exists for minimal capital investment.

- One of its partners must be an Indian citizen at a minimum.

Disadvantages of LLP Registration in India

Penalty on non-compliance

The level of compliance that a limited liability partnership (LLP) must adhere to is minimal. However, the LLP will be subject to a significant penalty if these compliances are not fulfilled promptly. Regardless of the lack of activity during the year, limited liability partnerships (LLPs) must submit annual returns to the Ministry of Corporate Affairs (MCA). The failure of the LLP to file the returns will result in the imposition of a significant penalty.

Dissolution and winding-up of LLP

The minimum number of participants necessary to establish an LLP is two. The LLP will be dissolved after six months in which the minimum number of partners falls below two. Dissolution may result from the LLP’s inability to remit its debts.

Challenges in Obtaining Capital

Unlike a corporation, the LLP does not have the notion of equity or shareholders. As shareholders, angel investors and venture capitalists are not permitted to invest in the LLP. This is because shareholders are required to assume all the responsibilities of a partner and must therefore become partners in the LLP. Venture capitalists and angel investors therefore prefer to invest in corporations over LLPs, which hinders the ability of LLPs to raise capital.

Conclusion

In India, limited liability partnerships have elements of both corporations and partnerships. LLPs are a sort of company structure that are established and operated according to an agreement. The LLP is a distinct legal organization, and is accountable to the greatest capacity of its assets, but the partners’ responsibility is only as much as their agreed-upon investment in the LLP. The LLP can keep functioning even if some of the partners resign. It has the legal authority to make agreements and possess assets in its own name. In India, forming an LLP can be advantageous since it offers flexibility without establishing burdensome legal or administrative restrictions.

If you are looking to form a business globally, contact our specialists at OnDemand International to assist you with the business registration process and with gathering the necessary paperwork.

FAQ’s

A Limited liability partnership can have any number of partners, including individuals and corporations. Juveniles, individuals of unsoundness of mind, and insolvents who have not been dismissed cannot be associates in a Limited liability partnership.

Yes, a Limited partnership must be registered with the Ministry of Corporate Affairs (MCA). To be legally enforceable, an LLP should be registered under the Limited Liability Partnership (LLP) Act.

A Limited liability partnership does not have any directors. A limited liability partnership (LLP) does not need to designate executives or have directors. An LLP’s company is managed by its associates. The LLP’s operational and commercial decisions are made by the associates. As a result, an LLP must always have at least two associates.

- It is a distinct legal organization from its partners.

- In an LLP, each partner’s responsibility is limited to the amount of their investment.

- No requirement exists for a minimal capital investment.

- One of its partners must be an Indian citizen at a minimum.

- LLP is subject to fewer rules and requirements.

In an LLP, every member is accountable for their own conduct, therefore if one person is prosecuted, the other members won’t be held liable for that member’s activities.

An LLP can keep functioning even if one or more partners pass away, become bankrupt, or resign.

A minimum of two Authorized Partners, all of whom must be persons, must be present in any LLP, and a minimum of one of them must be an Indian citizen.