One of the biggest problems with business-facing bureaucracies everywhere is duplication of information. What if you had one platform that could share your signatures and corporate identity to different government agencies without you having to refill cumbersome forms every time? That’s what the Singapore CorpPass does for you.

Setting up a digital identifier like the CorpPass can help you breeze through the payment of taxes, filing reports to the Registrar, and much more. Moreover, once you’ve registered for a CorpPass, you can concentrate on doing the business activity you love best.

This article will be going to let you know about registering the Singapore CorpPass and streamlining corporate compliances.

CorpPass Essentials

The CorpPass is the Singapore government’s virtual identity management software that exclusively authenticates and authorizes transactions between businesses and the government.

Ideally, such transactions are handled by specialists such as accountants, cashiers, etc. For the purpose of delegating a company owner’s signing authority, the CorpPass allows you to assign CorpPass administrators and CorpPass users with access to completing those transactions.

CorpPass Uses

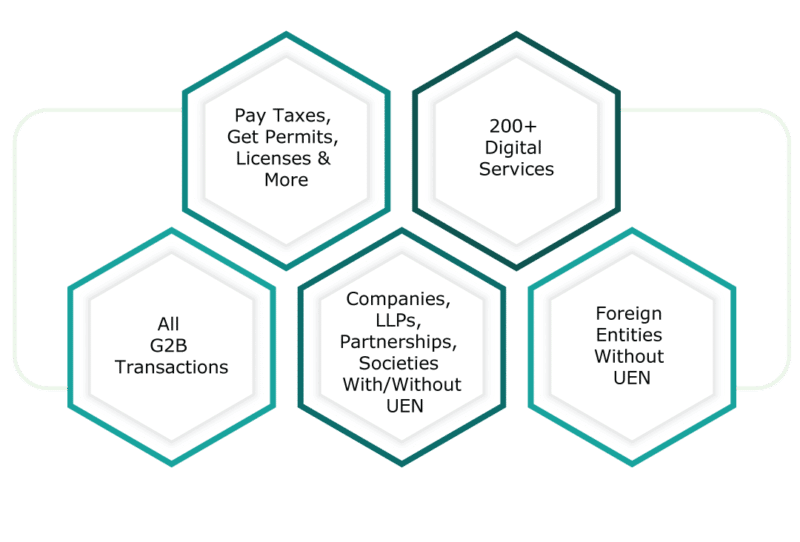

You can use a CorpPass to:

- Pay Taxes, Get Permits, Licenses & more

- 200+ Digital Services

- All G2B Transactions

How to Register in CorpPass?

- Collect all documents needed for registration.

- Visit the CorpPass website and navigate to ‘Register as a CorpPass Admin’.

- Set CorpPass logins, fill-in details of admins, sub-admins, and users.

- Select the online services your company needs for its business.

- Link those online services with the user accounts for your organization.

Documents Required for CorpPass Registration

For Local Entities:

- Your entity UEN

- Personal Details of CorpPass Admins: complete names, email addresses, NRIC, PR, SingPass login

- Personal Details of CorpPass Registered Officers (ROs): complete names, email addresses, NRIC, PR, SingPass login For Foreign Entities:

- Registered Business Particulars

- Admin login details for your CorpPass

CorpPass Registration: Step-by-Step

The process of Corppass registration is given below:

Appoint the Registered Officer

Appoint a person as the registered official of your firm. The Corppass administrator that RO assigns will set up and maintain user accounts for your company. The RO can decide to act as the Corppass administrator. The present limit for CorpPas admin account is 2 per organization.

Log in with a SingPass

Currently, foreign and local users both need UENs. Local entities that are without UENs are not eligible for CorpPass registration. You can apply for a UEN with the corresponding government agency. Of course, if you are a Registered Officer, you can become the CorpPass admin yourself.

CorpPass Admin creates further user accounts

CorpPass admins can set up numerous CorpPass accounts based on available functions.

Note: The CorpPass Sub-Admin role has a restriction of 10 people at the most, who will be authorized by the CorpPass Admin. There is no maximum number of CorpPass Users.

You can further choose the rights you want to assign to each user.

CorpPass for Sole Proprietors, GST-Registered Businesses, and Grouped Applicants

Sole proprietors, group registered companies, and companies with IRAS divisional registration who come under the ambit of the GST must set up a different GST CorpPass admin account linked with their GST registration numbers.

Security and maintenance of accounts is the responsibility of the Admin.

What is a UEN?

A Unique Entity Number is an identifier associated with and issued to

companies, LLPs, Representative Offices, or societies in Singapore. Only

UEN-issuance agencies (ACRA, ROS) are authorized to grant UENs.

GST Registration with the CorpPass

Step 1: Set up Account for GST CorpPass admin

Download and fill up the suitable IRAS forms to assign the admin for the type of business entity you have. Save the document as a PDF, and mail this to the IRAS with the correct option on the myTax website. The mail must be delivered to the IRAS at least five days before applying.

Step 2: Set up GST CorpPass Users

Set up CorpPass user accounts by logging in as the Admin. The previously used EASY accounts stopped being updated after 2018. You will receive new a link to modify authentication details on your email.

Step 3: Select your GST e-Services and Delegate them to CorpPass users

You can designate different users to different e-services on the myTax portal so that account security is maintained.

User Categories of Singapore CorpPass

There are five types of CorpPass account roles for employees who are active in conducting transactions with the government on behalf of their business entity:

1. Registered Officer (RO): The person whose name appears as the ultimate beneficiary or owner in the ACRA company register and the corresponding UEN identifier. The RO can assign rights to the Corppass users including the Admin. You may also express to be a Corppass Admin to transact on condition of your commodity, without expecting any permissions. The private whose phrase is officially enrolled with ACRA and Associated/ enrolled to the commodity he/she is incorporated will be accountable for nominating 2 Admins and ratifying the CorpPass Admin charge.

2. CorpPass Administrator: This is someone that the RO designates to create CorpPass Accounts and manages their permissions, including their access to specific digital services. For micro-entities, RO’s can allocate themselves as a CorpPass if necessary.

3. CorpPass Sub-Administrator account (CorpPass Sub-Admin): used by the CorpPass Admin to assist manage CorpPass summaries and their admission to online services on structure of their being the Sub-Admins are merely appointed by the CorpPass Administrator. Appointing someone to be a Sub-Admin does not expect the permission of RO.

4. CorpPass Enquiry Database account: A CorpPass summary assembled by the CorpPass Admin or Sub-Admin of the being Also borrowed to administer marketings with the Government’s digital employment and impression elements of their CorpPass format.

5. CorpPass User account: A CorpPass article established by the CorpPass Admin to deal with government digital employment and its agreements. CorpPass User Accounts will have a unique CorpPass ID from the others,There is currently no limit for the CorpPass Users for every entity.

Advantages Of Singapore CorpPass

A CorpPass can be used by authorized employees to:

- Assign roles & responsibilities to employees conducting business with

the Singapore government. - Pay corporate taxes.

- Register for the GST.

- Obtain tax reference number for holding companies.

- Obtain income tax reference numbers.

Apply for permits. - Pay license fees

- Obtain government grants for startups (eg. from Enterprise Singapore).

- Deal with the Singapore Accountant General’s office to curate public buildings, etc.

- Authorize your accountants & service providers to conduct government transactions on your behalf (thus adding an extra layer of security to your SingPass – which is needed for non-corporate services with the government)

- Pay customs duties.

- Sell goods or services to the Singapore government via the GeBIZ

portal. - Perform G2B transactions.

Conclusion

Corpass is an all-in-one-pane authentication and authorization for service, which is widely regarded as the most secure method of login that big corporations use when they are conducting business on the internet.

Corppass enables people working in an organization to conduct online business with numerous governmental bodies and is preferred by a variety of government agencies at this moment.

FAQ’s

While a SingPass allows you to authenticate user logins to various government services, a CorpPass allows you to authorize other users/employees to conduct G2B transactions on behalf of the company or other entity.

In this manner, the CorpPass adds a layer of corporate security for all your digital transactions.

All Singapore-registered businesses must obtain a CorpPass to pay employee taxes, corporate taxes, license fees, stamp duties, and so on.

Yes, Branch & Representative Offices of Foreign firms in Singapore must also apply for and obtain a CorpPass.

A CorpPass admin or administrator is the person whom the owner, partner, the director or Corporate Secretary may be assigned to conduct any corporate transaction with a government agency. An organization with a Unique Entity Number (UEN) may have at most 2 CorpPass admins.

An owner, partner, Director, or Corporate Secretary of a company can manage, approve, reject, or remove CorpPass admins. Smaller companies may appoint the owner as a CorpPass admin.