EIN Number in Delaware

Every state has particular rules and regulations pertaining to the business. Obtaining an EIN number in Delaware is one of the things you’ll need to do if you’re launching a business there. Although obtaining an EIN is not required, there are several good reasons why your business should. You can gain a substantial edge by being aware of the fundamental principles governing EIN, including whether your company needs one, how to apply it, and the benefits that come with it.

How to Get an EIN Number in Delaware?

One must have the full knowledge of all the below-mentioned details for filling an EIN number in Delaware:

- Name of the liable party.

- Social Security Number, Individual Taxpayer Identification Number, or previously-issued EIN of the culpable individual

- Name and postal address of the business

- The kind of corporate structure (i.e. corporation, partnership, LLC, trust, estate, etc.)

- Why you should request an EIN?

- The month that your company’s fiscal year ends.

- The anticipated total payroll over the upcoming 12 months.

- when you start making salary payments.

- the main commercial activity that you are involved in. (such as retail, alcoholic beverages, or logistics) and certain business operations (e.g., selling organic food, computer sales, package transfer, and so on).

Who is required to have an EIN number in Delaware?

The needs are primarily based on specific circumstances and actions, contrary to popular belief that only large firms need an EIN. In other words, even if you work for yourself or as a sole proprietor, you need an EIN number in Delaware.

The following businesses require an EIN for tax purposes:

- Delaware companies and any other entity subject to corporate taxes,

- Regardless of the sort of business entity with workers they are.

- Several-member LLCs.

If a sole proprietorship meets the requirements listed below, it must apply for an EIN:

- Having or preparing to have employees in Delaware, whether one or many.

- Creating self-employed retirement programs, such as a Solo 401(k) or Keogh plan.

- Acquiring or considering purchasing an existing firm with the intention of operating it going forward as a single proprietorship.

- Declaring bankruptcy.

- A business bank account is opened (in some banks).

The IRS also mandates EINs for representatives who manage an estate that runs a business after the owner’s passing and for trusts created by estate funds. Users most likely don’t need a Delaware EIN number unless they meet any of the prerequisites mentioned above. However, there are very strong arguments in favor of doing so.

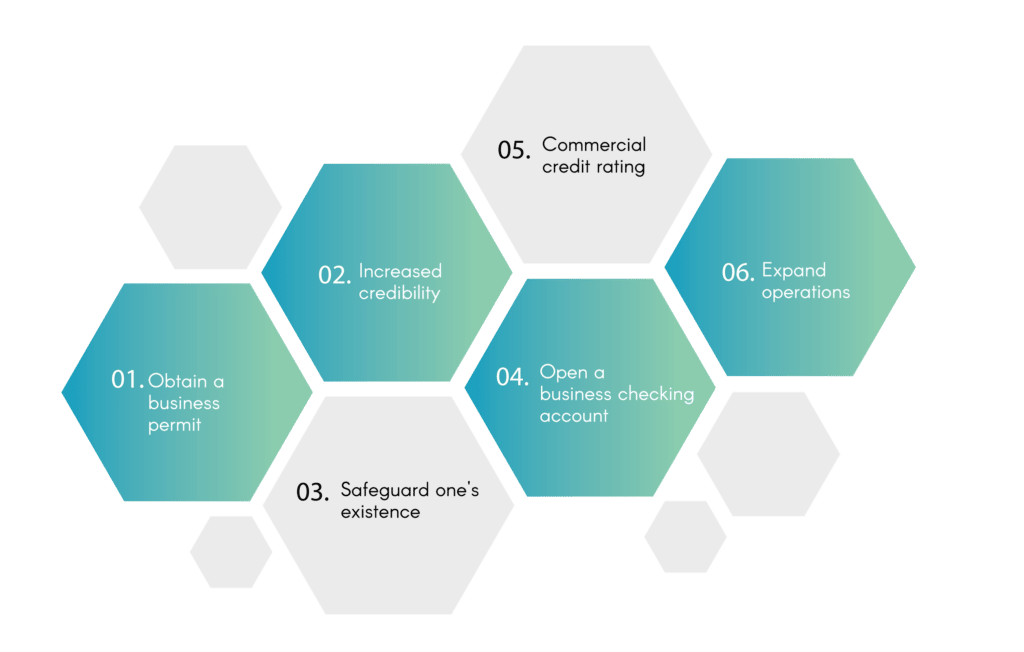

Reasons to have an EIN Number in Delaware

Even while obtaining an EIN number in Delaware isn’t always an entrepreneur’ priority, it can streamline the startup process and simplify life in the long run. You should apply for an Employer Identification Number for the following main reasons:

Obtain a business permit

Depending on the state, an EIN may be required before you can apply for a business license to operate a corporation. Delaware is one of these states.

Increased credibility

EIN number in Delaware makes a firm appear more professional to potential customers, which makes it easier to acquire and maintain client relationships.

In the case of independent contractors and freelancers, having a business tax ID proves to potential employers that you are running a legitimate business rather than a side gig.

Safeguard one’s existence

EIN is a useful tool to secure your identity and assist prevent identity theft. Your risk of identity theft decreases if you don’t have to give customers or vendors your Social Security number (SSN) if you have an EIN number in Delaware, which reduces the likelihood that thieves will steal and obtain your private information.

Open a business checking account

Some banks demand an EIN and a Delaware Operating Agreement in addition to the necessary business licenses to prove your right to conduct business locally in order to create a business bank account. For instance, all types of firms must provide Bank of America with verification of their EIN.

Commercial credit rating

In comparison to not having any credit score at all, having a solid business credit score might make it much easier for you to be authorized for loans and lines of credit. This is so that lenders will know that you are a trustworthy business owner who will likely pay back your loans on time.

Expand operations

By offering a special identity that can be used to monitor and control corporate operations. Additionally, EIN enables companies to seek tax breaks and other advantages that might help them save money and expand their services.

EIN Number in Delaware before or after incorporation

Every business needs to be incorporated before getting an EIN from the IRS. If you incorporate your firm before submitting an EIN application, be sure to enter the exact legal name of your company, since the name of the eligible business entity must be entered exactly as it appears on the incorporating documents. In addition, the IRS will ask you for the date the firm was founded when you apply for an Employer Identification Number with them.

An EIN can be obtained prior to incorporation, but it is only good for your sole proprietorship-based current business. A new one would need to be obtained if you subsequently decide to scale up to an LLC or corporation. Before requesting an EIN number in Delaware, the majority of business owners frequently incorporate their enterprise or establish their LLC at the state level. This is a result of federal applications being often validated against state databases. Consequently, owners who apply for an EIN without appropriately completing their state file will be turned down.

Procedure to get an EIN Number in Delaware

If a firm wants to apply for an EIN number in Delaware, they have to go through the following steps:

- The application process for an EIN is quite straightforward, but you need to establish your company first. For instance, create your corporation before requesting an EIN if you intend to conduct business in Delaware as a corporation.

- You have the option of submitting your application via fax, mail, internet, or by using an independent service.

- To apply online, complete the SS-4 form on the IRS website, submit it, and then watch for a confirmation letter to arrive.

- Download and print the SS-4 form from the IRS website to submit your application by fax or mail. Once the form is finished, you may either send it to the address indicated or fax it to the number provided.

- If you are submitting an application on behalf of a corporation, please provide a copy of your articles of incorporation.

- If you’re employing an independent provider, give them the necessary details and sign an authorization form allowing them to act on your behalf.

- One thing which needs to be remembered, If you apply online or by fax, you should get your Delaware EIN number in 4 business days; if you apply by mail, it will take around 2 weeks.

- Once you have your EIN, keep it safe because you’ll need it for tax filing and other crucial business considerations.

Reasons your EIN application might be rejected

Getting an EIN number in Delaware is a difficult procedure but most of the time, the IRS will accept your request for an EIN, but there are a few circumstances in which it can be rejected. Your EIN application could be rejected for a variety of reasons, including:

- The Social Security number is not valid.

- Typographical typos or problems in your application, such as omissions of data or typos (e.g., listing a different physical address than that of your company or mispronounced name)

- Do not file for a new EIN if you already have one (for instance, if you were previously a sole proprietor and just converted to an LLC). Instead, complete a form to discover your current EIN.

Conclusion

To make sure your application is successful, be sure that prior to beginning the application procedure, gather the necessary data. If you have not already done so, incorporate your business in Delaware. Select the approach you’ll take to request your EIN number in Delaware (online, fax, mail, or independent service) Also allow the independent service you’re using to act on your behalf if you’re utilizing one and awaits for the IRS’s letter of affirmation.

FAQ’s

In Delaware, there are the following ongoing charges and tax obligations:

- Franchise tax and yearly report. Companies must submit an Annual Franchise Tax Report to Delaware. For businesses, the deadline is March 1. The franchise tax is computed using the number of shares and par value, and the yearly report cost is $50. The quantity of the Annual Franchise Tax Report could rise if there are more than 5,000 shares.

- Taxes. Visit Business Owner’s Toolkit or the State of Delaware for comprehensive information on state taxes for Delaware corporations.

- The number for federal tax identification (EIN). For corporations that will employ people, an EIN is necessary. Additionally, in order to open a business bank account, the majority of institutions demand an EIN.

- Identification number for state taxes. An official state tax identification number is not necessary for Delaware.

One must pay a charge in order for us to process your request for a federal tax ID number. Most firms can anticipate spending between $149 and $250 depending on the service they choose, while the precise cost will vary depending on the application’s processing time and a few other variables. The quicker you receive your tax ID, the more money you may anticipate paying for the service.

The expense of a service that can acquire a business owner a tax ID number quickly shouldn’t be an issue for business owners who need to start making money as soon as possible.

Before your company can lawfully start operating, it could need a federal tax ID number. Alternatively known as an EIN, this number is also used to identify employers. Every organization with more than one member and every organization that employs workers must have this nine-digit unique identifier. Additionally, if you want to create a business bank account, seek business credit or loans, or apply for any licenses or permissions for your firm, you’ll need one of these documents.

Your preferred application process, in particular, will determine how long it takes for you to receive your federal EIN number.

Delaware’s qualifications for corporate directors are as follows:

Minimum amount. A minimum of one director is required for corporations.

necessities for residence. The location of the directors’ residence is not specified in Delaware law.

age restrictions. There are no age restrictions in Delaware.

to be mentioned in the certificate of incorporation It is not necessary to provide director names and addresses in the certificate of incorporation.