Incorporate a Delaware Holding Company in 2025

The Delaware Holding company can be described as a specific type of business entity – typically either an LLC or corporation which doesn’t run any ventures, operations, or engage in the trading of services or products. Instead, it’s created to maintain and manage the administration of intangible investment funds or intangible assets of corporations or trusts for business.

Particularly, investments intangibles can include, but aren’t restricted to:

- Notes, bonds, and securities along with other types of credit instruments (including the obligation to repay debts of affiliated corporations).

- Patents, trademarks, and other property that is intangible.

- Similar kinds of intangible assets.

Working of a Delaware Holding Company

You can set up an organization for holding by forming the company and restricting its operations to maintenance and management of tangible assets.

It is also possible to form a holding company to provide financing to companies that are newly established, and then make them your subsidiary. With just one or two subsidiaries, you’ll be able to provide more protection from risk and improve the efficiency of your business operations.

Certain subsidiaries owned by holding companies may operate or trade that are known as operating companies. Other subsidiaries own shares of stock, intellectual property, financial instruments real estate, machinery, vehicles, or anything else worth its weight that is utilized by the operating companies.

Requirements to Incorporate a holding company in Delaware

To start a holding business in Delaware, the first step is to be able to meet the required conditions as listed below:

- No other activities are being conducted, except for the management and maintenance of intangible assets.

- Do not purchase any property that is not essential for the management of assets that are intangible.

- A sustainable amount of capital in order to guarantee the smooth running.

- Maintaining all payments such as filings, payments, and filings necessary.

- Separately maintaining records for bank accounts.

- Tax returns for the year.

Procedure for Incorporation of a Delaware Holding Company

Forming a holding company in Delaware involves two primary steps:

Step 1: Choose the Right Business Structure

Delaware offers several business structures suitable for holding companies, but the two most common are Corporations and Limited Liability Companies (LLCs).

Consider the following factors carefully when selecting the most appropriate structure for your holding company:

- Liability Protection: Both structures offer limited liability, protecting your personal assets.

- Taxation: Evaluate the taxation differences, such as corporate vs. pass-through taxation.

- Asset Protection: Consider your requirements for asset protection and privacy.

- Operational Management: Determine whether your holding company will benefit from the formal management structure of a Corporation or the operational flexibility of an LLC.

Incorporating a holding company can be complex, particularly when managing multiple subsidiaries or operating companies. For detailed information, consult Delaware’s Division of Corporations or a professional incorporation service.

Step 2: File the Required Documents

Once you’ve selected the appropriate business structure, you need to file specific formation documents with the Delaware Division of Corporations:

- Corporations: File a Certificate of Incorporation.

- LLCs: File a Certificate of Formation (not Incorporation, as previously mentioned).

The Delaware Division of Corporations will review the submitted documents to verify compliance with state laws. After approval, you’ll receive an officially stamped Certificate of Incorporation (for Corporations) or a Certificate of Formation (for LLCs), confirming your holding company’s official status.

Uses of a Delaware Holding Company

Holding companies incorporated in Delaware can benefit businesses of all sizes and across all industries. However, they are especially advantageous for enterprises managing multiple divisions or subsidiaries.

Centralizing Multi-Division Businesses with a Delaware Holding Company

Imagine running a company that manufactures and sells a variety of consumer products—such as toothpaste, laundry detergent, vitamins, and more.

Rather than structuring your company as a single corporation with several divisions, you could organize it as a Delaware holding company with multiple subsidiaries. Each product line would operate as its own subsidiary, owned by the holding company. This structure simplifies operational management, enhances administrative efficiency, and makes your business more attractive to potential investors by clearly defining each subsidiary’s role and responsibilities.

Delaware Holding Company for Intellectual Property (IP Holding Company)

Another key use of Delaware holding companies is managing intellectual property (IP). You can utilize a holding company specifically to hold patents, copyrights, trademarks, and other IP assets—keeping them distinct from your operational businesses. This arrangement protects valuable intellectual property from operational risks, lawsuits, creditors, or other liabilities.

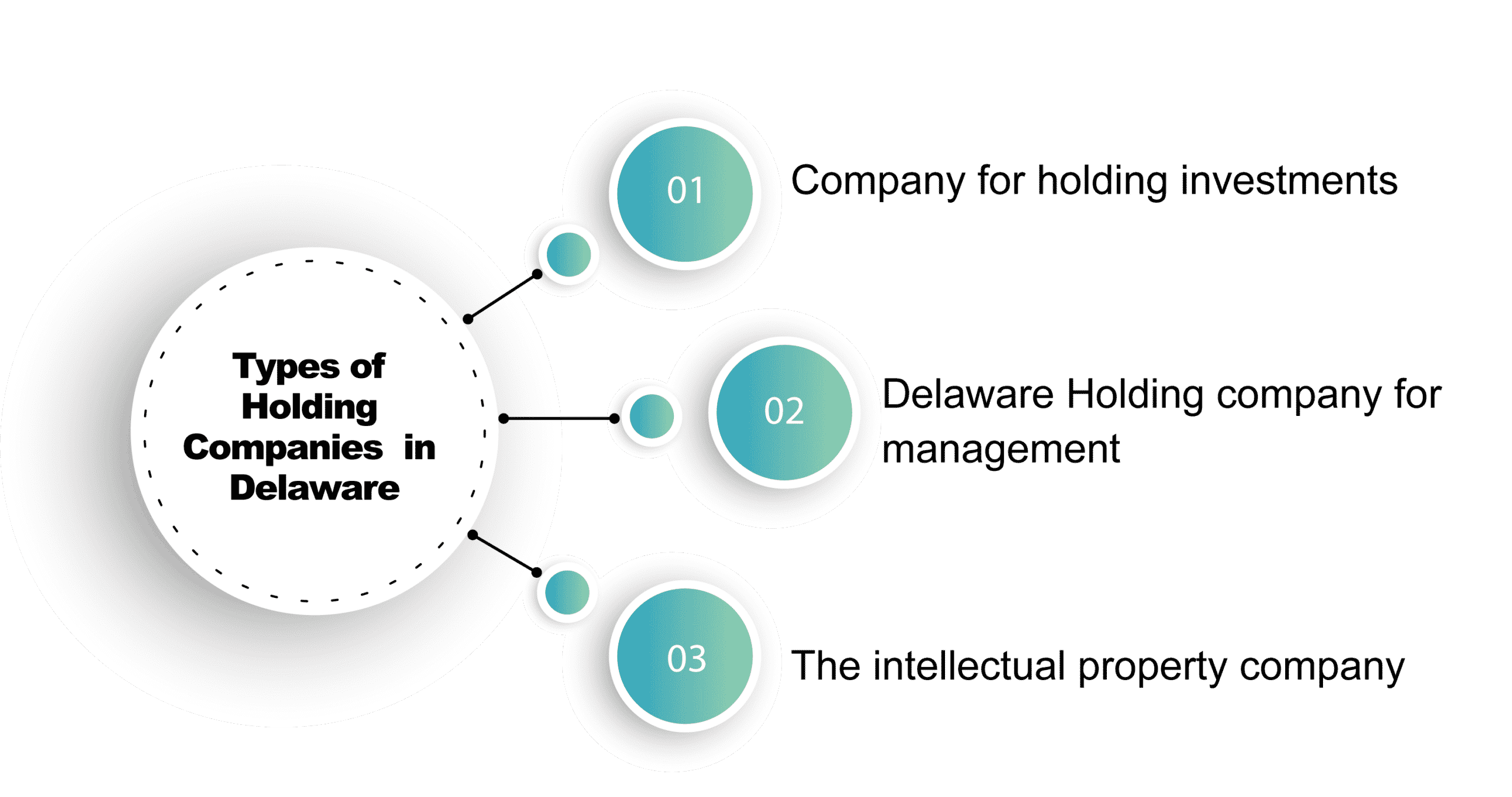

Types of Holding Companies in Delaware

The most popular kinds of holding companies that are found in Delaware include management holding, investment holding, and holding intellectual property.

- Company for holding investments It exists for the sole purpose of holding investments as well as holding shares in other companies. The earnings from an investment holding firm come from dividends, interests, as well as a capital gain.

- Delaware Holding company for management manages the activities of any subsidiary. This kind of holding company is prevalent in Delaware since it can help companies reduce their liability and lower taxes.

- The intellectual property company owns trademarks, patents, and other forms of intellectual property. These holdings are used to earn revenue through licensing and other forms of royalty payments.

Advantages and Disadvantages of Delaware Holding company

Advantages:

1. Tax exemption

The Delaware holding company can be a powerful tool to protect your income that is passive from taxation by the state and save your business significant sums of state funds each year.

In the Delaware corporate tax law, the corporate entities of Delaware that are restricted to the administration of intangible assets owned by businesses trusts, or corporations that are registered as investment companies as per the Investment Company Act 1940 are not taxed.

The distribution and collection of the earnings derived from such investment funds or from tangible assets that are physically located outside of this State are also exempted.

2. Asset Protection

The holding company can offer great security. In the case of an asset being held in the hands of the holding firm, it’s likely to be beyond any creditors’ reach should the business be insolvent.

This is crucially important when your business is relatively new and has a greater chance of disruption. Furthermore, the holding company may license the property and assets rights to any future trading companies, ensuring continuity.

3. Easy access to funding and financing

A holding company usually has a stronger financial position and can take out loans with a lower interest rate than operating companies and subsidiary companies.

If you are in highly risky industries such as insurance, cryptocurrency, and construction, Delaware holding corporations can assist you to secure financing from investors. They are more likely to lend money to a set of companies that have different businesses, as opposed to any one business that has a similar risk profile.

4. Low administrative costs

If the holding company has the entire portfolio of assets, it can simplify management and help save lots of dollars. Furthermore, it will be easier to permit the transfer of property rights and assets when the company is being sold.

From a commercial perspective, it may be sensible to retain the intellectual property rights even after the sale of the business and give an appropriate license for the next owner to earn an ongoing revenue (without any ongoing effort).

Disadvantages:

There are some disadvantages when using a holding company and its subsidiaries, such as the following:

1. Management incompetence

Since your Delaware holding company controls many types of assets, you might not have sufficient information about each property or asset owned through your organization. This means that the general management of your company could suffer and you may not be able to make educated decisions on the most efficient way to utilize your resources, and how to respond to market trends and competition.

2. More complex

The holding structure of a company could create more complexity for your business, particularly in financial reporting because you may need to combine the accounts of the subsidiaries.

This could make it difficult for creditors and investors to comprehend your company’s financial health and performance. It is possible that you will need to employ additional staff, like lawyers and accountants, to assist you in complying with the regulations and overseeing your business.

3. Management challenges

With multiple companies to manage and manage, the use of holding companies adds a layer of complexity that’s not evident in the single-entity model, making the task of managing and monitoring the entire organization more challenging.

It can be difficult to achieve the ideal balance between autonomy and control in your subsidiary companies. Although decentralization could lead to an absence of coordination between your businesses, however, too much centralization could hinder the development of new ideas.

Conclusion

A holding company isn’t involved in any other activities, besides managing and maintaining the intangible assets. In addition to owning assets, the holding company could be used to coordinate the operations of several subsidiaries. The most common kinds of holding companies that are found in Delaware include management, investment, and intellectual holding.

Benefits of holding companies include the exemption from taxes, asset security, easy financing, and low administrative expense. The process of incorporation consists of two steps: deciding on a business structure and filing documents with the authority responsible for the incorporation.

FAQ’s

Delaware General Corporation Law Delaware General Corporation Law is the most beneficial to both businesses and shareholders. Delaware is known for its long track record of being a business-friendly state, as well as its law on corporate matters is continually adapting to the changing needs of businesses in the modern age.

Delaware, Nevada, and Wyoming permit businesses to be incorporated as holding companies.

The ideal state in which to start a holding company would be Wyoming and the most suitable state for the establishment of a Fortune 500 company in Delaware.

The term “S-corp” (S corporation) is a form of federal tax identification, not an official business structure. This means that you cannot simply choose the option of incorporating your business into an S corporation – you have to first declare it an LLC or a company and comply with the guidelines of the Internal Revenue Service (IRS) to be eligible for the status of S-corp.