Limited Liability Company in Ireland

The legal structure of the business is the first thing an entrepreneur would consider when starting a business in Ireland. In Ireland, the Limited Liability Company, often known as a Private Company Limited by Shares (LTD) is among the most prevalent form of organizational structure for private as well as corporate business endeavors.

The limited liability company in Ireland is a distinct legal entity. The main advantage of forming a limited liability company in Ireland is the limited liability granted to the firm’s stockholders, which implies that its administrators and stockholders are typically solely responsible for the value that they invest in the company.

The Ireland Companies Act of 2014 does not place any limitations on the kind of operations LLC corporations can engage in as long as those operations are legitimate.

Prerequisites for a limited liability company in Ireland

To form a limited liability company in Ireland, you must meet the following requirements:

- There should be one director at a minimum who will be in charge of overseeing the business operations.

- The chosen director must be a member of the European Economic Area.

- In the event that there is only one director, then the business must hire a different company secretary. However, if the firm has more than one director, then one of them may also serve as the secretary.

- There must be an actual operating workplace in Ireland.

Documents needed to establish a limited liability company in Ireland

The following documents are essential in order to establish a limited liability company in Ireland:

- Information on the proposed business’s directors, stockholders, and the secretary of the corporation.

- Signed approval from stockholders and directors.

- Subscribers and information about the stocks issued.

- Company’s MOA & AOA.

- Disclosure of the capitalization of the issued and authorized shares and the payment made.

- Details of the registered office address.

- Nature of the business operations.

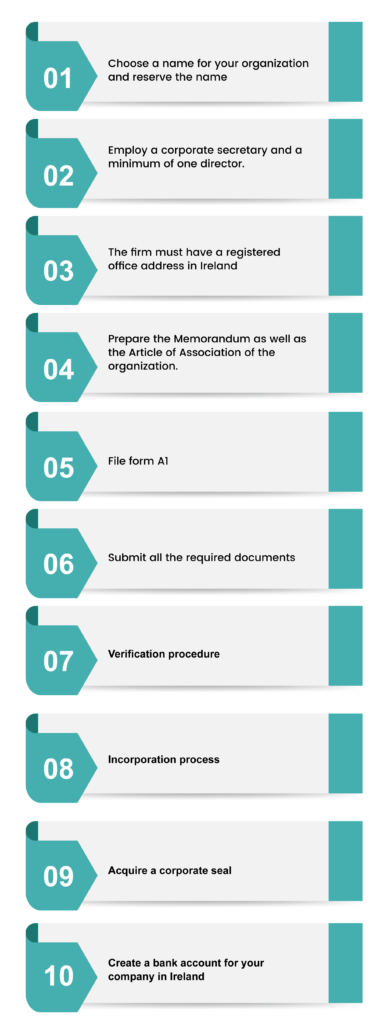

Procedure for establishing a limited liability company in Ireland

- Choose a name for your organization and reserve the name: It is important to choose a name that is distinct and unique from the names of any existing firm registered with the CRO. Once the name has been decided it should be filed with the companies registration office. The overall expense of reservation is €25. The chosen name can be reserved for a period of twenty-eight days.

- Employ a corporate secretary and a minimum of one director: The first thing while establishing a limited liability company in Ireland is to choose a minimum of one director who would be in charge of managing the business. Every Irish business must employ a minimum of one director who is a member of the EEA. Along with that, it is necessary to employ a corporate secretary whose primary responsibility is to submit annualized reports.

- The firm must have a registered office address in Ireland: The formal, official location of the business is the corporation registration address. It must have an Irish physical location that is frequently checked. The registered address is the place where essential notices and mails are sent.

- Prepare the Memorandum of Association (MOA) as well as the Article of Association (AOA) of the organization: It is important to get the AOA and MOA of the organization ready before filing the form for registering a limited liability company in Ireland. Along with the Articles of Association, all the necessary documents must also be prepared. Our experts at ODINT Consulting can help you prepare the required documents.

- File form A1: Form A1 must be submitted to the companies registration office. It includes a statement about the purpose for which the business has been created and indicates that the Companies Act’s criteria have been fulfilled.

- Submit all the required documents- All the required documents such as the corporation’s name, legal office, secretary and members’ contact information, and their permission to serve in those roles, and share information must be submitted to the CRO along with Form A1.

- Verification procedure: The officials would then verify the firm and the submitted documents. Once the authorities have verified the materials’ legitimacy, they would approve the business registration form.

- Incorporation process: Once the registration form is approved by the authorities of the companies registration office, the limited liability company in Ireland will be incorporated.

- Acquire a corporate seal: Once the business has been authorized and established, it is essential to acquire a corporate seal. The seal must have the corporate’s name imprinted upon it and would be utilized to seal the documents.

- Create a bank account for your company in Ireland: The following step is to create a bank account for your company in Ireland. In Ireland, opening a bank account often necessitates at least one in-person interview. Additionally, it will require certain corporate records, such as a copy of the A1 application, the corporate structure documents, and the original incorporation certificate.

Read More: Advantages of a company in Ireland

Conclusion

The following article briefly described the limited liability company in Ireland. The incorporation of an LLC in Ireland is simple. If you want to form a limited liability corporation in Ireland, you can consult our experts at odint Consultancy. Our experts will guide you through the incorporation process.

FAQ’s

Limited Liability Company, often known as a Private Company Limited by Shares (LTD) is a distinct legal entity and is among the most prevalent form of organizational structure for private as well as corporate business endeavors. it has limited liability granted to the firm’s stockholders, which implies that its administrators and stockholders are typically solely responsible for the value that they invest in the company.

Companies Registration Office

- Information on the proposed business’s directors, stockholders, and the secretary of the corporation.

- Signed approval from stockholders and directors.

- Subscribers and information about the stocks issued.

- Company’s MOA & AOA.

- Disclosure of the capitalization of the issued and authorized shares and the payment made.

- Details of the registered office address.

- Nature of the business operations.

- Decide on a name for your business and reserve the name

- Employ a corporate secretary and a minimum of one director.

- The firm must have a registered office address in Ireland

- Prepare the Memorandum as well as the Article of Association of the firm

- File form A1

- Submit all the required documents

- Verification procedure

- Incorporation process

- Acquire a corporate seal

- Create a business bank account in Ireland